As Bitcoin is more and more built-in into the economic system, traders are recognizing the significance of scalability. Bitcoin traders are significantly within the potential of this digital asset to rework not solely retail institutions and private funds but in addition the goings-on of huge establishments. From the monetary to expertise sector, Bitcoin is a novel area that’s poised to rework how funds are moved. There are crucial issues institutional traders should make concerning their community infrastructure earlier than supporting large-scale Bitcoin. Learn to put together with the next insights that permit for safety, pace, scalability, and effectiveness within the institutional Bitcoin commerce.

Why Institutional Bitcoin Buyers Want Optimum Networks

The rise of Bitcoin is akin to the early Web days. The pace at which society is adopting Bitcoin is asking for environment friendly and efficient upgrades in community infrastructure. Monetary safety is of utmost significance, and the pace at which information could be transferred is paramount for the efficient integration of Bitcoin into giant establishments. Optimum community efficiency supplies institutional Bitcoin traders with the next advantages:

Enhanced transaction pace;Boosted safety;Extra sustainable power utilization;The power to accommodate large-scale Bitcoin operations.

Upgrading your community infrastructure is a strategic necessity when trying to maneuver into the large-scale Bitcoin house. The Bitcoin market is exclusive in its volatility, and a quick, steady community connection is crucial to maintain up. Bitcoin can vastly diversify your institutional funding portfolio, however you should concentrate on the necessities to take action on a bigger and even world scale.

Community Stability

As an institutional investor, you seemingly already work on a longtime community. Giant firms sometimes have their very own servers to maintain their community steady and dealing always. That is essential for operations to run easily, and that features investments in Bitcoin.

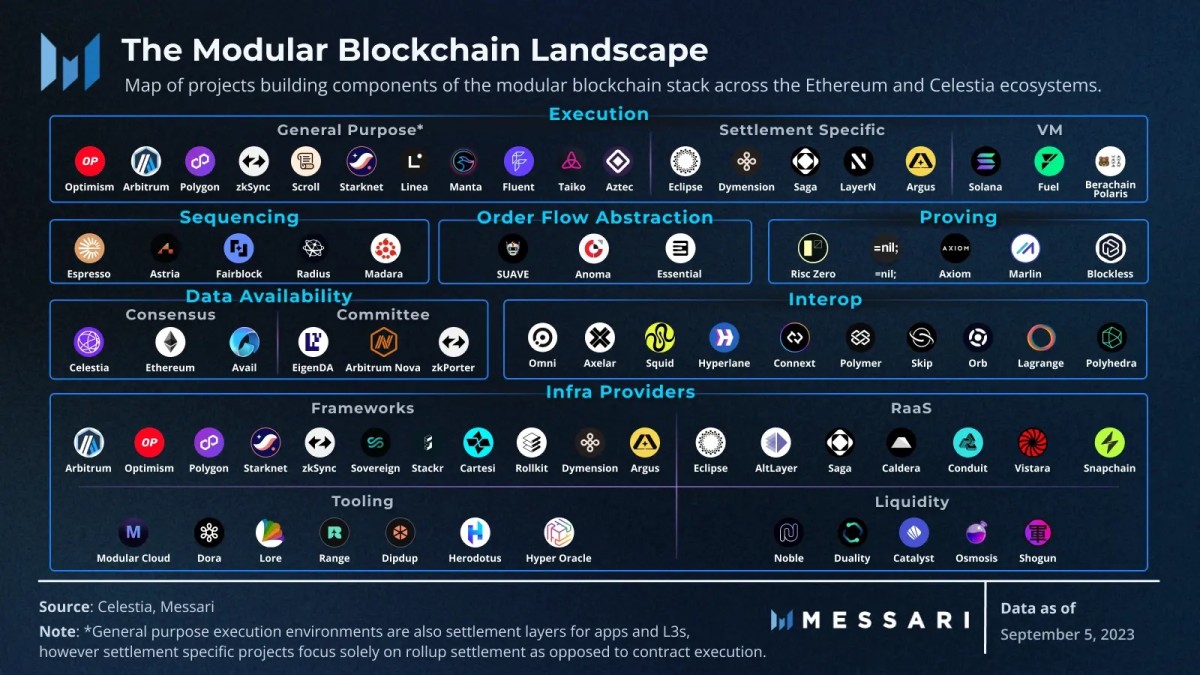

Blockchain infrastructure requires a sure stage of community stability because of the giant quantities of transactional information that’s saved throughout a number of databases in a distributed ledger. Bitcoin makes use of blockchain expertise to make sure it’s nearly inconceivable for the information to be hacked or corrupted. To ensure your community is steady sufficient to switch information between nodes, you should have:

Scalable blockchain software program, like IBM Blockchain;Dependable inside servers or exterior servers, just like the Canton Community;Enough {hardware}, like strong graphics playing cards and CPUs;Secure, quick web connection.

You’ll seemingly have a number of gadgets throughout a community speaking with one another , so it’s crucial to have steady enterprise web. Your bandwidth ought to have the ability to accommodate giant quantities of information being transferred and saved on inside and exterior servers always.

Holding an Eye on Efficiency Metrics

When choosing an web service supplier (ISP), {hardware}, and software program package deal in your institutional Bitcoin investing, verify on key efficiency metrics like packet loss and jitter. Packet loss is when some elements of transferred information don’t make it to the receiving finish. Giant quantities of information are extra simply transferred throughout networks when damaged down into items, or packets. Nonetheless, a few of these packets could be misplaced or corrupted in case your {hardware} is inadequate, software program has bugs, or your ISP’s community is clogged.

You can even expertise jitter or the method of a number of the packets coming at a delay. For Bitcoin funding, this can be a deal-breaker. You want dependable, steady networks that don’t crash. You’ll be able to remedy this by upgrading your {hardware}, internet hosting your networks onsite, or partnering with a strong ISP with low packet loss and jitter occurrences.

Vitality Consumption

Institutional Bitcoin is just not solely taxing by way of information load, however it is usually energy-intensive. Customers are more and more eager on companies’ commitments to sustainability, so discovering various power sources for Bitcoin mining and funding is usually a strategic transfer. By using energy-conscious strikes like photo voltaic, you’ll be able to take pleasure in:

Decrease power prices and higher earnings; Fixed entry to plentiful energy sources with out Bitcoin funding interruption;Independence from the principle power grid, permitting you to be self-sufficient and have a leg up on the competitors.

The potential of solar energy to revolutionize Bitcoin mining and buying and selling is palpable. It’s at present being optimized to harness extra photovoltaic energy with much less photo voltaic waste. As soon as these points are resolved, utilizing photo voltaic for Bitcoin transactions is poised to be the easiest way to cut back carbon emissions and decrease your dependence on the power grid. This will present establishments with the resilience and stability wanted to foster long-term Bitcoin viability.

Cloud-Primarily based Options

In case you are trying to accomplice with exterior community options for institutional Bitcoin funding, be sure to vet the corporate totally. Cloud-based options could be much less energy-intensive and expensive than organising your personal safe networks on-premises. Nonetheless, they should be simply as safe to ensure that Bitcoin funding to stay protected and scalable. As an example, Google Cloud and Voltage partnered to create world Lighting Community options. Because of this they’re providing low-cost, cloud-based providers which can be scalable and capable of transmit information globally. Options like this set the usual for respected cloud-based Bitcoin switch.

Emphasize Pace, Safety, and Scalability

A steady community must also be a speedy community. Your ISP ought to match your expectations with regards to high-traffic web speeds. Working with safe companions or internet hosting servers onsite is the easiest way to maintain institutional Bitcoin funding transactions protected and safe. Giant-scale investments require a stage of scalability that the Bitcoin trade is just starting to expertise. Make sure that to vet each third-party establishment that you just work with, and brush up on {hardware} and software program necessities frequently. This can make institutional Bitcoin funding a breeze as you progress ahead into the way forward for finance.

It is a visitor put up by Miles Oliver. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.