The beneath is an excerpt from a current version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

This week’s matters

Monumental SEC failureBitcoin ETF multipleGerman financial updateTaiwan elections and China response

SEC’s 2FA Failure

Bitcoin is a good trainer. Many people have discovered a lot, from learning and following Bitcoin over time, not nearly cash however about life. As soon as once more, Bitcoin offers us with a teachable second within the hack of the SEC’s X/Twitter account. First, even if you’re a normie in favor of closely regulated markets, this occasion ought to open your eyes to the truth that the regulators have grown right into a systemic danger themselves. They’re a danger to the buyers they’re supposed to guard. The SEC is even in a battle on the Supreme Courtroom battle over their in-house semi-judicial system.

Secondly, this scandal occurred as a result of the SEC didn’t use 2FA, months after warning everybody about using 2FA. This stunning incompetence would possibly wake many on the market and unfold using 2FA — one thing lengthy overdue.

The entire injury primarily based on the SEC’s failure was $30 billion wiped from the market cap with $90 million price of open positions liquidated. In fact, the SEC didn’t apologize for his or her failure and can doubtless be going through authorized penalties. Spicy take, this bitcoin-inspired scandal would possibly outcome not solely in us getting the ETFs accepted, but in addition the SEC getting taken down a peg.

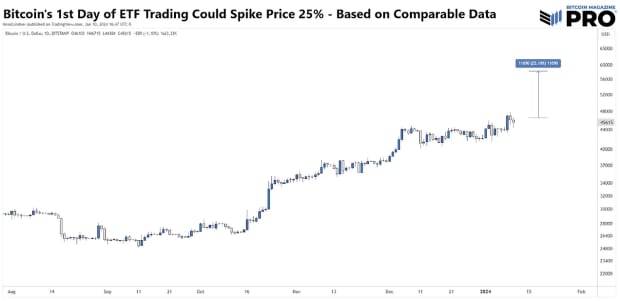

Bitcoin Market Cap A number of of Inflows

Estimates of inflows on the bitcoin ETF’s first days of buying and selling are anticipated to be huge. Issuers have publicly said they’re seeding their funds with $312.9 million thus far. These are commitments by non-public gamers to instantly create shares to seed liquidity. This doesn’t embody different cash from common buying and selling.

The payment buildings submitted this week by issuers have clauses for introductory intervals primarily based on the influx of belongings beneath administration. For instance, ARK is providing a 0.0% administration payment for the primary 6 months or till $1 billion in AUM. Invesco is providing 0.0% for six months or $5 billion AUM. This implies they anticipate these time intervals and AUM to be a sensible expectation. If we add up all these particular charges reductions, we arrive at $13 billion of anticipated AUM development within the first 6-12 months from 5 issuers alone. That doesn’t imply inflows precisely as a result of bitcoin purchased earlier will recognize including to AUM.

Supply: @JSeyff

The seeding funds are small potatoes in comparison with the full $25 trillion AUM of the issuers. If 1% have been to return into the bitcoin ETFs over the primary 12 months, that’s $250 billion.

Again in 2021, close to the ATH, Financial institution of America put out a research that bitcoin had a 118x multiplier on influx to market cap appreciation. So, for each $1 million in recent shopping for, the market cap would improve by $118 million. That multiplier depends on many various elements, like velocity of influx, variety of out there bitcoin on exchanges, and block reward. Financial institution of America made their estimate when there have been 2.7 million BTC on exchanges, right this moment there are only one.8 million — or 607,000 when contemplating the most important US exchanges Coinbase, Gemini and Kraken solely. In different phrases, the multiplier may very well be better than 118x this time.

The biggest single ETF launch in historical past noticed $2 billion of inflows. The bitcoin ETF occasion guarantees to be larger than that as a result of it’s a group of 11 ETFs and is a brand new asset class. $2 billion is subsequently conservative, however we’ll use it for our functions right here. $2 billion occasions 118 means $236 billion market appreciation on day one. The market cap at time of writing is $900 billion, that means the primary day transfer may very well be ~25%, taking us to $58,000.

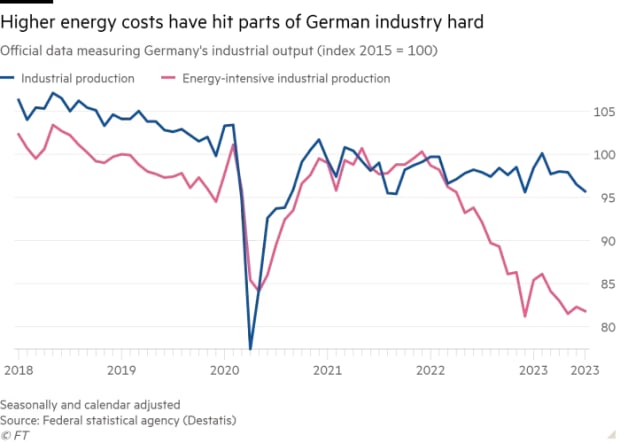

German De-industrialization

Individuals assume it may’t occur, that’s why it’s occurring. Some Germans are starting to know the impact of deglobalization on their financial mannequin, and the impact that communist local weather insurance policies can have on heavy trade. Massive corporations like BASF, Linde, and Volkswagen all have plans to maneuver out of Germany. Power-intensive industrial manufacturing is being hit the worst. 2024 goes to be a large recessionary 12 months around the globe.

Supply: Monetary Occasions

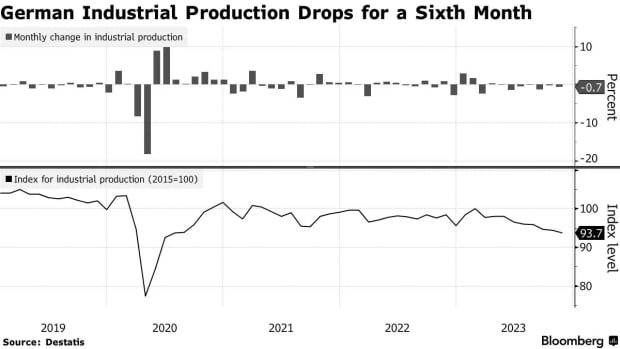

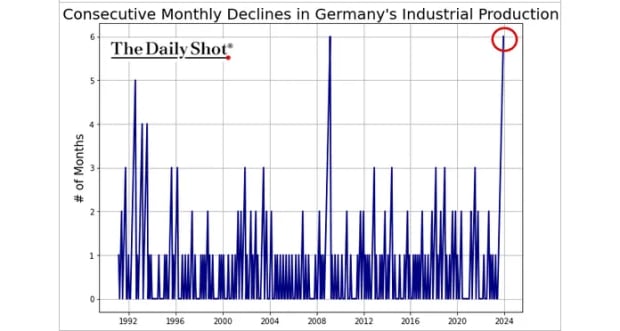

The most recent quantity for November confirmed the sixth straight month of commercial manufacturing, the worst stretch for the reason that Nice Monetary Disaster.

Supply: Bloomberg

Supply: @SoberLook

Taiwan Elections and China’s Financial Catastrophe

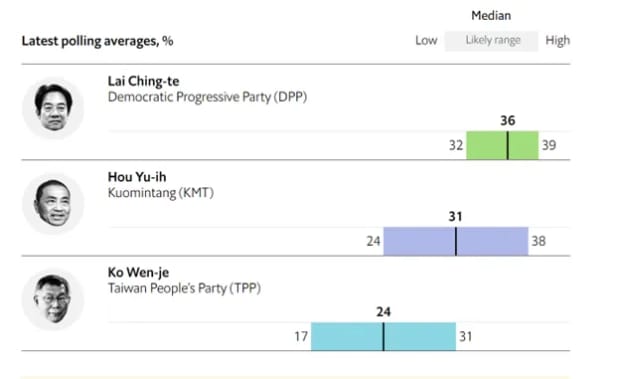

Probably the most consequential elections this 12 months is occurring Saturday in Taiwan. Because it stands, it’s a three-way race for president with the extra anti-China Democratic Progressive Get together, Lai Ching-te, because the front-runner. He’s pleasant to the US and shall be a thorn within the aspect of the CCP. Actually, China has invested closely in stopping him and spreading propaganda inside Taiwan. Regardless of this, the anti-China candidate remains to be favored.

Supply: NHK Japan Broadcasting Company

Supply: Fulcrum Asset Administration

This election has world penalties as you’ll be able to think about. In an article yesterday on Bloomberg, they highlighted the likelihood that the election of Lai could lead on on to battle with China and probably price the worldwide economic system $10 trillion.

That is additionally occurring because the Chinese language economic system is falling aside. Their blue-chip inventory market CSI 300, just lately hit 5-year lows, standing in stark distinction to the US inventory markets rallying to close ATHs.

Supply: Yahoo Finance

Final however not least, the overseas direct funding (FDI) numbers for 2023 have come out and they’re a complete catastrophe. Cash is fleeing China on the quickest tempo in fashionable historical past. All that is to say that the election in Taiwan and the financial pressures in China might transfer the world nearer to battle over Taiwan.

Supply: @Geo_papic