One might observe that onchain buying and selling appears to be trending in the direction of higher sophistication. What had been as soon as bespoke strategies in automation have gotten more and more mainstream, and market demand for these utilities is saturating.

A pioneering new expertise from Bancor, Carbon DeFi, empowers merchants to carry out maneuvers with confidence and ease which can be prohibited by standard AMM and concentrated AMM designs, setting a brand new normal for what a buying and selling platform can obtain, and unlocking new prospects for what you may accomplish this bull run. Carbon DeFi is engineered with a personalised view of entry to DeFi as a core precept, which offers an unparalleled stage of management, tailor-made particularly to satisfy the person calls for of its customers.

Carbon DeFi is an island unto itself; it’s a distinctive characteristic among the many suite of different DeFi primitives with a reputable declare to being amongst a really quick checklist of indispensable instruments for critical onchain buying and selling. To substantiate this, the sections beneath current an in depth overview of the separate parts from which the superior energy of Carbon DeFi emerges.

Superior Order Sorts and Novel CapabilitiesAdjustability FeaturesBuilt in Execution BotBacktesting SimulatorAdvanced Exercise TrackerThe Know-how on the Core

Superior Order Sorts and Novel Capabilities

Previous to discussing the superior orderbook-like options of Carbon DeFi, it is very important observe that technique makers don’t incur any gasoline or buying and selling charges upon order execution. Paying the gasoline is unique to the act of technique creation or modification, which implies that the technique can commerce many instances with out incurring any additional prices.

It must also be emphasised that Carbon DeFi’s order varieties are a pure expression of its good contracts, which had been intentionally designed to remove dependency on exterior third events comparable to oracles, hooks, and keepers, thus eliminating widespread assault vectors together with oracle manipulation and different main safety considerations in DeFi. Carbon DeFi has additionally undergone three intensive audits previous to launch.

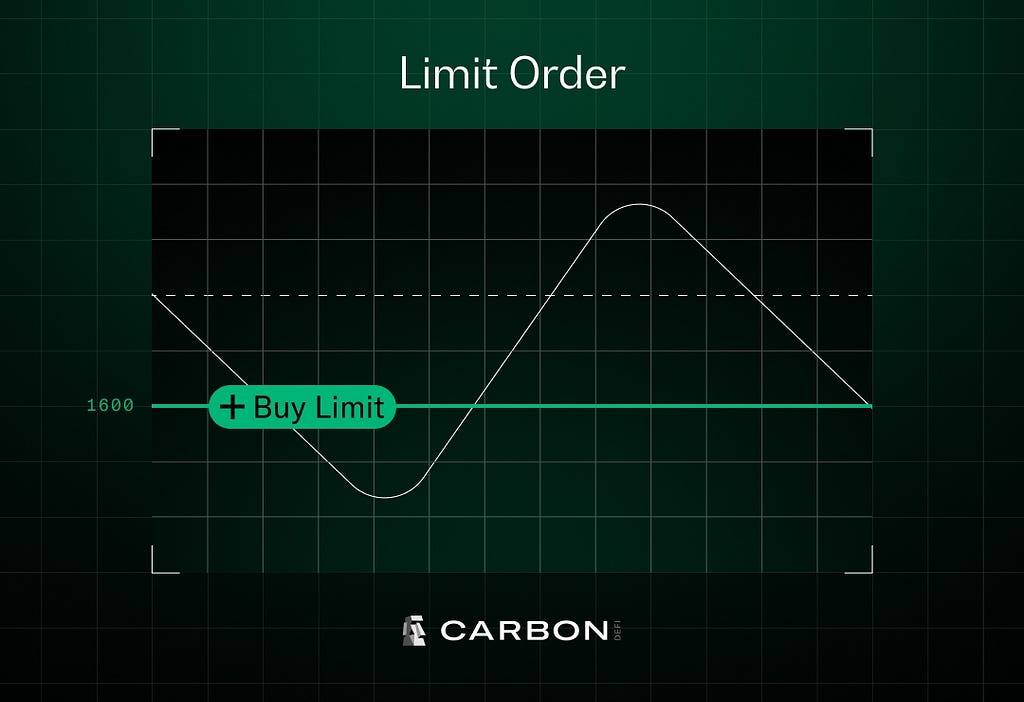

Restrict Orders: Precision at Its Most interesting

Carbon DeFi revives the essence of conventional buying and selling behaviors with native Restrict Orders. This characteristic permits merchants to set actual purchase or promote costs, mirroring the performance present in centralized exchanges, with out sacrificing the decentralization ethos. The important thing benefit right here is the elimination of buying and selling and gasoline charges on crammed orders, offering a cheap resolution for strategic placement inside the market. This characteristic ought to really feel acquainted each in its presentation and operation to anybody who has used restrict orders on their most well-liked CEX.

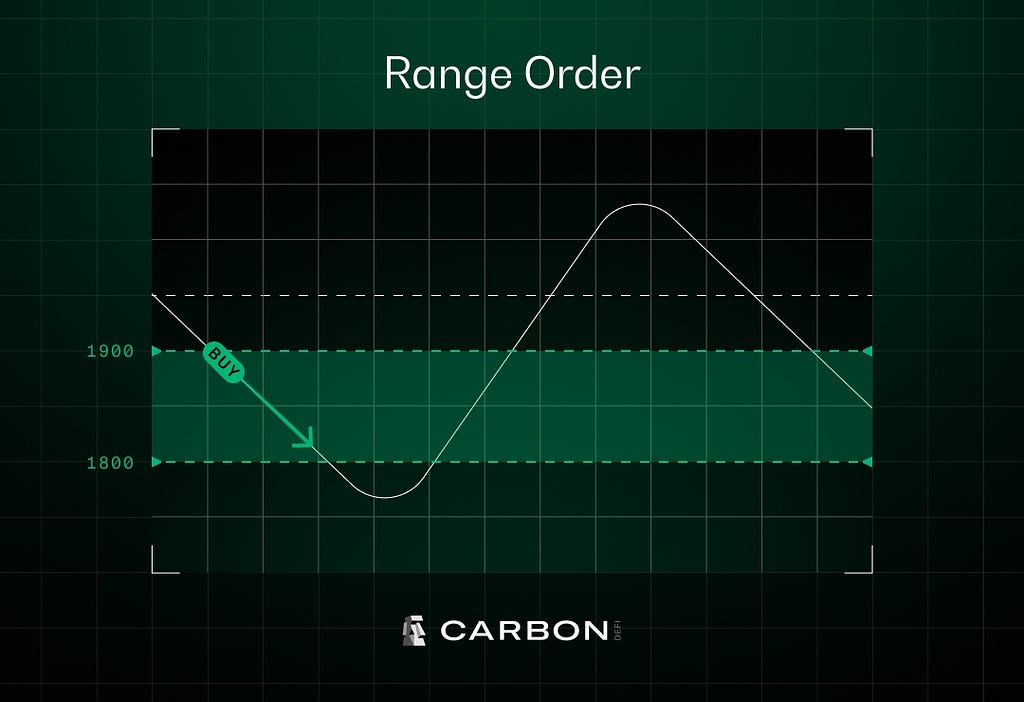

Vary Orders: Scale In/Out

Carbon DeFi introduces Vary Orders, an unique characteristic that units Carbon DeFi aside. Vary Orders permits merchants to enumerate an unlimited assortment of discrete restrict orders over a given value interval, which is a mainstay habits of scaling-in and -out of positions close to technical assist and resistance ranges, respectively. For instance, a dealer can set an order to promote Ethereum (ETH) starting at $4,500 and finishing at $4,700. For 1 ETH, that’s equal to one million million million discrete restrict orders on a standard order e book. This stage of fantastic construction is good for capitalizing on unsure market fluctuations, supporting a tailor-made technique that conventional order varieties can not compete with.

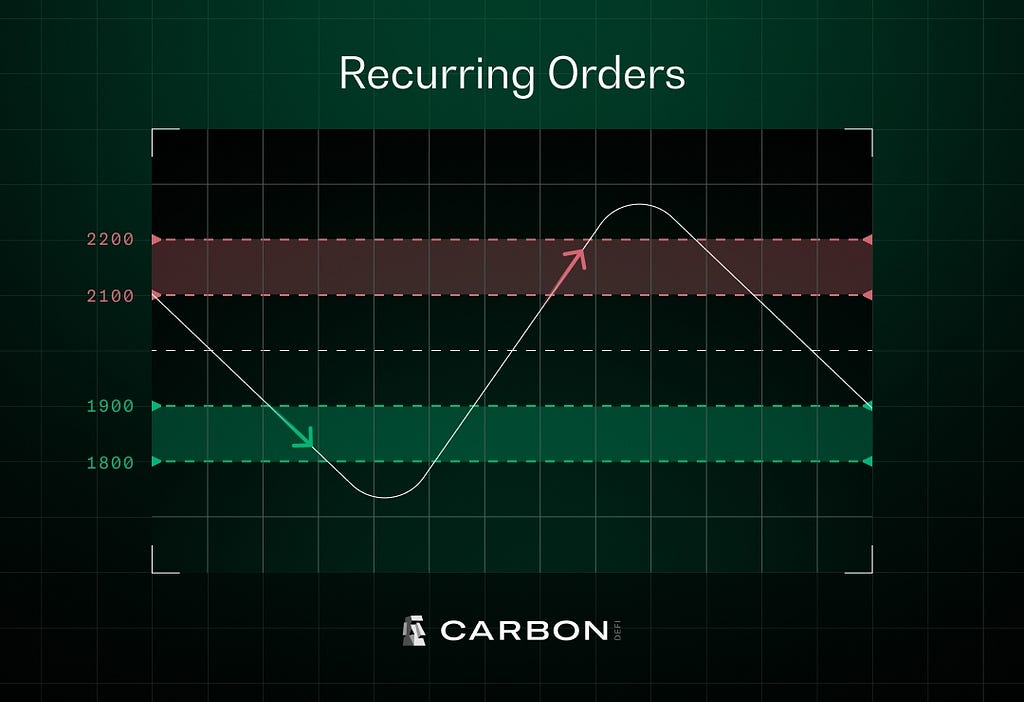

Recurring Orders: Automated Fading Methods

Carbon DeFi embraces buying and selling automation tendencies with Recurring Orders, an revolutionary characteristic that capitalizes on market volatility by seamlessly connecting a purchase order and a promote order, “fading” between them (utilizing the widespread vernacular) As soon as an order is crammed, the acquired tokens robotically fund the other order. This course of creates a perpetual cycle of shopping for low and promoting excessive at user-defined ranges, mimicking the actions of a buying and selling bot or grid buying and selling system. This cyclic course of results in the buildup of tokens and the compounding of income, simplifying what would usually be a fancy guide buying and selling operation. Linked order varieties are customizable; you may hyperlink limit-limit, range-limit, limit-range, or range-range orders to align with your personal expectations of the oncoming market.

Along with linked orders and rotating liquidity, Carbon DeFi’s automated recurring orders supply one other distinctive skill. As a result of makers have zero obligation to fund each orders of their technique, they achieve the power to solely fund one order, successfully making a restrict order with funds they don’t but have.

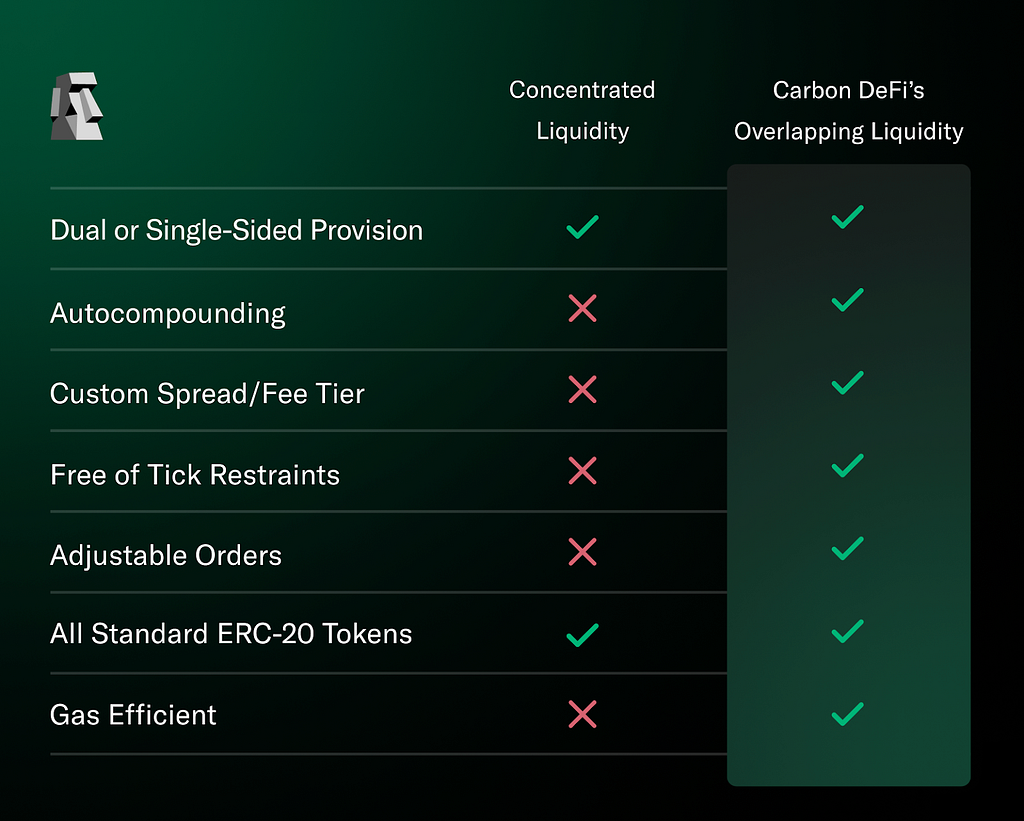

Overlapping Liquidity: The Brief-Straddle (or Brief-Gamma) Concentrated AMM Place

A particular association of linked vary orders, Overlapping Liquidity is the most recent addition to Carbon DeFi’s suite of order varieties, and represents a next-gen, particular person concentrated liquidity place. Carbon DeFi permits merchants to create overlapping liquidity methods inside any value vary in a gas-efficient method, and in contrast to conventional concentrated liquidity fashions, Carbon DeFi makers are usually not constrained by preset “payment tiers”. Overlapping Liquidity empowers merchants to decide on their very own, arbitrary unfold (aka payment tier).

Ease of Adjustability

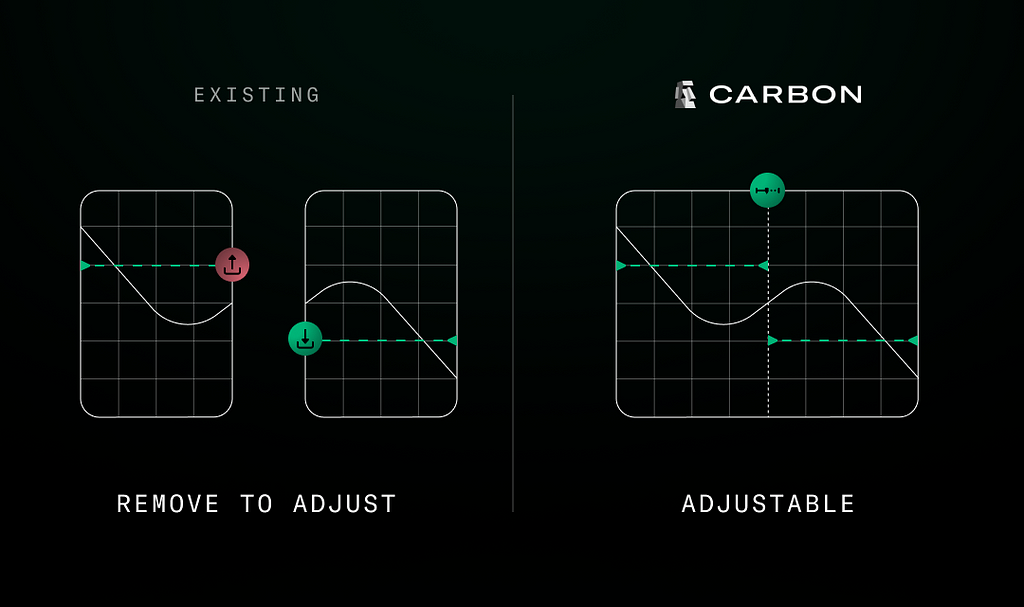

Carbon DeFi elevates onchain buying and selling with its distinctive adaptability, permitting merchants to shortly fine-tune methods in response to market shifts or alternatives. The mix of Carbon DeFi applied sciences, an intuitive interface, and versatile order varieties streamlines changes, enhancing agility and potential success within the decentralized finance panorama.

Modify Pricing

Modify pricing permits makers to shortly alter the costs they select to purchase and promote their tokens, with out having to cancel orders, withdraw funds, redeposit funds, or create new orders.

Modify Place Measurement: Add and Withdraw Funds

Funds could also be added to, or withdrawn from a technique at any level, with out sacrificing the technique object within the good contract. Due to this fact, methods are reusable.

Partially withdraw or withdraw in full, with out sacrificing the good contract components of the technique contained in the system. Withdrawing, slightly than deleting, offers makers the chance to return to their technique later, modify their place measurement and value targets, with out paying the gasoline for creating a brand new technique from scratch.

Pause

Pausing buying and selling means tokens inside the respective recurring restrict order are not out there for takers to commerce in opposition to.

Unpause

Reactivate buying and selling on the maker’s desired value factors.

This stage of adaptability is a uncommon attribute within the decentralized finance area, and a precious one, on condition that market situations can shift dramatically in moments.

Environment friendly Execution: A Buying and selling Bot/DEX Hybrid

The Arb Quick Lane, additionally developed by Bancor, is an open-sourced, permissionless, arbitrage framework woven into the material of Carbon DeFi. It acts as a bridge between the markets being made on Carbon DeFi, and your complete liquidity base of the chain it’s deployed on, wherever it might be. This association ensures well timed order execution for makers on Carbon DeFi whereas additionally offering a singular avenue for market individuals to have interaction with DeFi in a way akin to passive mining operations.

The merge of Carbon DeFi and the Arb Quick Lane Protocol underscores a hybrid method to onchain market making programs, from which emerges one thing that really resembles a standard “buying and selling bot”. This qualifies Carbon DeFi as a singular and highly effective device within the DeFi area, combining customized buying and selling technique capabilities with novel order varieties, improved order execution, and automatic market arbitrage.

Simulator: Technique Backtesting

https://medium.com/media/ac9ebd44347134c8bac249f9ff6890d6/href

The Carbon DeFi Simulator emerges as a vital device for merchants searching for an neutral perception into buying and selling alternatives, significantly in opposition to unique token pairs. The simulator permits customers to analyze historic market knowledge and examine value charts for tokens with some other token performing as numeraire (in distinction to widespread USD, ETH and BTC denominations). Furthermore, the simulator permits customers to measure the efficiency of Carbon DeFi methods executed in opposition to the chart of their selecting. The last word goal of the simulator is to supply customers with the means to develop an instinct for Carbon DeFi’s options, and translate their learnings from examination of the historic knowledge to creating an lively place. The seamless integration of the simulator inside Carbon DeFi’s interface ensures a fluid transition from technique testing to execution, facilitating a streamlined and knowledgeable buying and selling expertise.

The simulator stands out with its customizable inputs, catering to a various vary of buying and selling methods and preferences. Customers can choose from varied order varieties, together with “Recurring Orders” and “Overlapping Liquidity,” set exact value targets, and allocate budgets with flexibility. Upon finishing a simulation, merchants achieve entry to detailed analytics, together with dynamic charts, a abstract of efficiency, and a downloadable Commerce Historical past Log, providing deep insights into the mechanics of Carbon DeFi and its interactions with the market.

https://medium.com/media/7fcfc4ed63029092ec6890715186805c/href

Superior Exercise Tracker

The most recent characteristic in Carbon DeFi’s UI was simply launched with the rollout of Buying and selling Exercise, the place customers can dive deep into the buying and selling exercise linked to their methods together with a chook’s eye view of the buying and selling actions system-wide, all up to date in actual time each 30 seconds.

Carbon DeFi customers have quick access to an in depth show of every part they should know concerning the efficiency and buying and selling historical past of:

A Particular StrategyAll Your StrategiesSystem-Huge Methods

Previous to this characteristic launch, accumulating such knowledge meant navigating by means of the complexities of good contracts or relying on dune queries for insights — a necessity nonetheless current in different DEXes, significantly AMMs. With the mixing of technique exercise into the Carbon DeFi consumer interface, accessing this data has change into effortlessly easy and environment friendly.

The Know-how on the Core: A Bancor Innovation

Carbon DeFi is powered by a wholly new expertise developed by Bancor, which ought to come as no shock to anybody aware of the historical past of the mission.

Bancor has all the time been on the forefront of DeFi innovation, starting in 2017 with the invention of bonding curves, pool tokens, and the AMM — which nonetheless stay extensively used throughout the trade.

2017: Fixed Product

In 2017 Bancor revolutionized the world of decentralized finance (DeFi) by introducing the primary AMM with Fixed Product expertise. This innovation empowered liquidity suppliers to supply tokens throughout your complete value spectrum, guaranteeing liquidity at each value level, particularly helpful for brand new tokens.

2020: Concentrated Liquidity

Constructing upon their groundbreaking work, in 2020 Bancor launched Concentrated Liquidity, then known as Amplified Liquidity. This expertise addressed perceived shortcomings of the fixed product mannequin, decreasing value slippage relative to the out there liquidity, by inserting bounds on the value ranges the place buying and selling is supported.

2022: Carbon DeFi– Uneven Liquidity and Adjustable Bonding Curves

Quick ahead to 2022, Bancor’s trailblazing spirit continues with the introduction of Carbon DeFi, powered by their newest invention, Novel Invariant Perform and Uneven Liquidity Swimming pools, now known as Uneven Liquidity and Adjustable Bonding Curves. Uneven Liquidity makes use of two separate adjustable curves, one for purchasing and one for promoting, reshaping the DeFi panorama as soon as once more.

2023: The Arb Quick Lane Protocol

First introduced in March 2023, this first-of-its-kind permissionless arbitrage bot was developed to permit any consumer to carry out arbitrage between the Bancor ecosystem and exterior exchanges, with 50% of the commerce rewarded to the caller. The Arb Quick Lane has since obtained important upgrades and has change into an integral element to the environment friendly order execution of Carbon DeFi and all third social gathering deployments.

Carbon DeFi: The Pinnacle Platform for Onchain Merchants

With its complete suite of superior order varieties, hybrid DEX/Bot structure, and Backtesting Simulator, Carbon DeFi stands because the epitome of innovation and buying and selling sophistication within the DeFi area. From the precision of Restrict Orders to the strategic flexibility of Vary and Recurring Orders, and the extent of management provided to Overlapping Liquidity methods, Carbon DeFi equips merchants with the instruments they should navigate the unstable crypto markets successfully. It’s greater than a platform; it’s a gateway to maximizing buying and selling potential, making Carbon DeFi the final word device for classy merchants aiming to remain forward within the fast-evolving world of decentralized finance.

Wanting Forward

2024 has kicked off with outstanding momentum, propelled by the growth of Bancor applied sciences on a number of networks, together with:

Bancor Deployments of the Arb Quick Lane Protocol

BaseFantomMantle

Licensed Third Get together Deployments of Carbon DeFi’s Good Contracts

Mantle by VelocimeterBase by VelocimeterFantom by Velocimeter

That is just the start, as a slew of deployments are on the horizon, together with anticipated launches on Arbitrum, Linea, Blast, Sei, Canto, Scroll, Metis, Motion, Shardeum, and BSC. This expansive progress not solely showcases Bancor’s unwavering dedication to innovation but additionally alerts a transformative section for the DeFi ecosystem.

Seeking to the longer term, the potential for Bancor, Carbon DeFi, and the Arb Quick Lane Buying and selling bot to reshape the panorama of onchain buying and selling is boundless. With every new integration and deployment, merchants are geared up with extra highly effective instruments and wider entry to markets, guaranteeing that the perfect is but to return. Keep tuned, because the journey forward will likely be full of groundbreaking developments that can proceed to raise the buying and selling expertise for everybody concerned.

https://medium.com/media/ea96242313f98ff7b7fb3f70a4922c2b/href

What Each Dealer Should Know About Coming into the Bull Run was initially printed in Bancor on Medium, the place persons are persevering with the dialog by highlighting and responding to this story.