The next is a visitor publish from Shane Neagle.

No matter an asset’s fundamentals, its worth is ruled by one underlying characteristic – market liquidity. Is it simple for the broader public to promote or purchase this asset?

If the reply is sure, then the asset receives excessive buying and selling quantity. When that occurs, executing trades at various value ranges is less complicated. In flip, a suggestions loop is created – extra strong value discovery boosts investor confidence, which boosts extra market participation.

Since Bitcoin launched in 2009, it has relied on crypto exchanges to ascertain and lengthen its market depth. The better it turned to commerce Bitcoin worldwide, the simpler it turned for the BTC value to rise.

By the identical token, when fiat-to-crypto rails comparable to Mt. Gox or FTX fail, the BTC value suffers tremendously. These are just a few obstacles to Bitcoin’s path to legitimization and adoption.

Nonetheless, when the Securities and Alternate Fee (SEC) authorized 11 spot-traded Bitcoin exchange-traded funds (ETFs) in January 2024, Bitcoin gained a brand new layer of liquidity.

It is a liquidity milestone and a brand new layer of credibility for Bitcoin. Getting into the world of regulated exchanges, alongside shares, ran the steam out of naysayers who questioned Bitcoin’s standing as a decentralized digital gold.

However how does this new market dynamic play out in the long term?

The Democratization of Bitcoin By ETFs

From the get-go, Bitcoin’s novelty has been its weak point and energy. On the one hand, it’s a financial revolution to carry wealth in a single’s head after which be capable of switch that wealth borderless.

Bitcoin miners can switch it with out permission, and anybody with web entry can grow to be a miner. No different asset has that property. Even gold, with its comparatively restricted provide proof against inflation, could be simply confiscated because it occurred in 1933 beneath Government Order 6102.

Which means Bitcoin is an inherently democratizing wealth car. However with self-custody comes nice duty and house for error. Glassnode information exhibits that round 2.5 million bitcoins have grow to be inaccessible as a result of misplaced seed phrases that may regenerate entry to the Bitcoin mainnet.

That is 13.2% of Bitcoin’s 21 million BTC fastened provide. In impact, self-custody induces anxiousness amongst each retail and institutional traders. Would fund managers interact in Bitcoin allocation with such danger?

However Bitcoin ETFs modified this dynamic fully. Traders seeking to hedge towards forex debasement can now delegate the custody to giant funding companies. And so they, from BlackRock and Constancy to VanEck, delegate it to chosen crypto exchanges like Coinbase.

Though this reduces Bitcoin’s self-custody characteristic, it boosts investor confidence. On the identical time, miners, through proof-of-work, nonetheless make Bitcoin a decentralized asset, no matter how a lot BTC is hoarded inside ETFs. And Bitcoin stays each a digital asset and a tough asset grounded in computing energy (hashrate) and vitality.

Bitcoin ETFs Reshaping Market Dynamics and Investor Confidence

Since January eleventh, Bitcoin ETFs opened the capital floodgates to deepen Bitcoin’s market depth, leading to a $240 billion cumulative quantity. This substantial inflow of capital has additionally shifted the break-even value for a lot of traders, influencing their methods and expectations about future profitability.

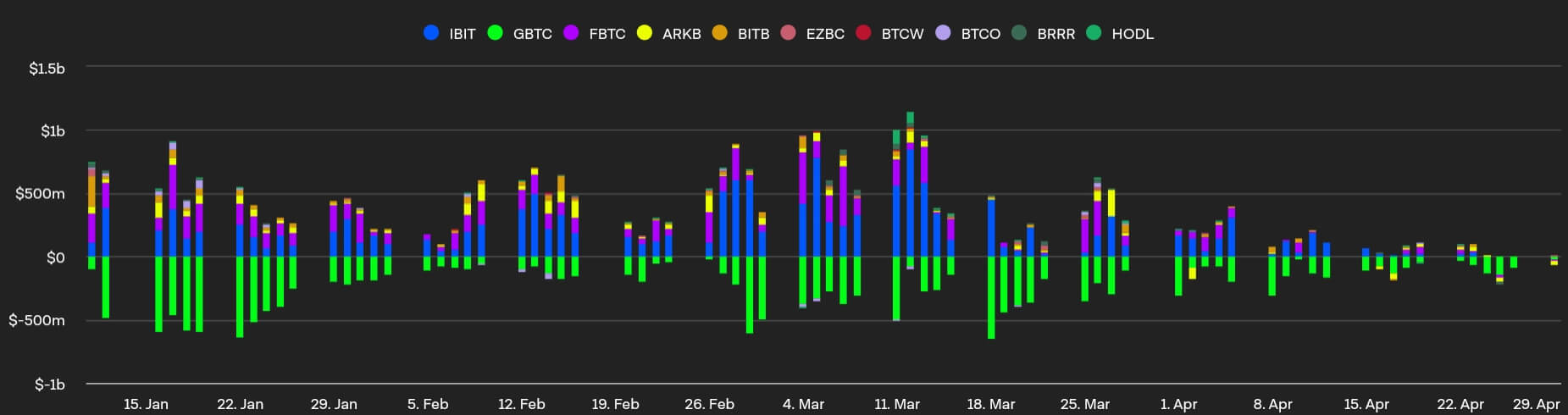

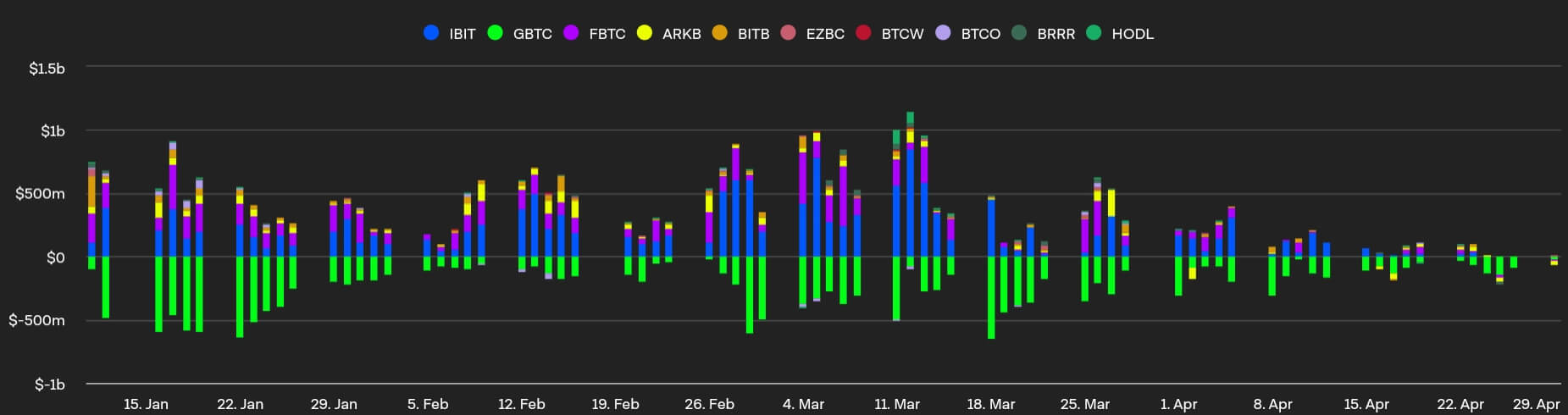

But, regardless of the launch being broadly profitable in exceeding expectations, adverse outflows have gained floor as Bitcoin ETF hype subsided.

As of April thirtieth, Bitcoin ETF flows netted adverse $162 million, marking the fifth consecutive day adverse outflows. For the primary time, Ark’s ARKB outflow (yellow) outpaced GBTC (inexperienced), at adverse $31 million vs $25 million respectively.

Contemplating this was after Bitcoin’s 4th halving, which diminished Bitcoin’s inflation charge to 0.85%, it’s secure to say that macroeconomic and geopolitical considerations quickly overshadowed Bitcoin’s fundamentals and deepened market depth.

This was much more evident when the Hong Kong Inventory Alternate’s opening of Bitcoin ETFs did not ship. Regardless of opening capital entry to Hong Kong traders, the amount accounted for under $11 million ($2.5 million in Ether ETFs), in comparison with the anticipated $100 million.

In brief, Hong Kong’s crypto ETF debut was practically 60x lower than within the US. Though Chinese language residents with registered HK companies might take part, mainland Chinese language traders are nonetheless prohibited.

Likewise, considering that the New York Inventory Alternate (NYSE) is roughly 5 instances bigger than HKSE, it’s not probably that HKSE’s Bitcoin/Ether ETFs are going to exceed $1 billion flows within the first two years, in keeping with Bloomberg ETF analyst Eric Balchunas.

Future Outlook and Potential Challenges

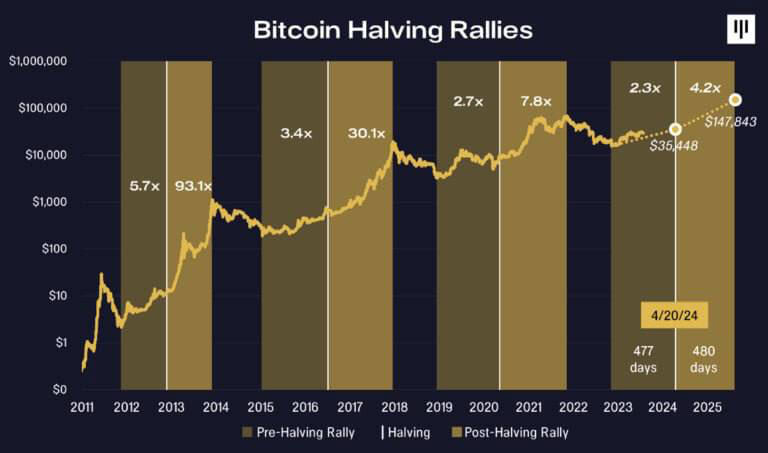

Throughout the Bitcoin ETF liquidity extravaganza, BTC value probed the above-$70k threshold a number of instances, reaching the brand new all-time excessive of $73.7k mid-March.

Nonetheless, miners and holders took that chance to erect a promoting strain and reap positive aspects. With spirits now subdued to the $60k vary, traders may have better alternatives to purchase discounted Bitcoin.

Not solely is Bitcoin’s inflation charge at 0.85% after the fourth halving, vs. the Fed’s USD goal of two%, however over 93% of BTC provide has already been mined. The mined BTC influx turned from ~900 BTC each day to ~450 BTC each day.

This interprets to better Bitcoin shortage, and what’s scarce tends to grow to be extra invaluable, particularly after legitimizing Bitcoin investing on an institutional degree via Bitcoin ETFs. A lot in order that Bybit’s evaluation forecasts provide shock on exchanges by the tip of 2024. Alex Greene, Blockchain Insights senior analyst mentioned:

“The surge in institutional curiosity has stabilized and drastically elevated demand for Bitcoin. This improve will probably exacerbate the scarcity and push costs greater after the halving.”

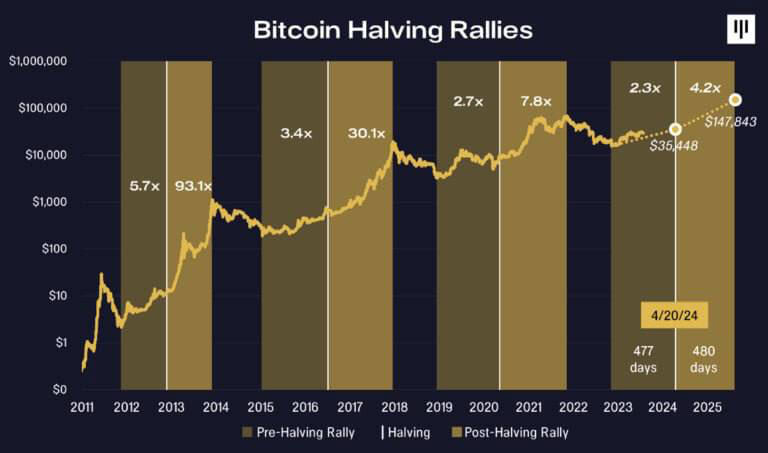

After earlier halvings within the absence of the Bitcoin ETF surroundings, Bitcoin value leveled as much as 7.8x positive aspects inside 480 days. Though a better Bitcoin market cap makes such positive aspects much less probably, a number of appreciation boosts stay on the desk.

Nonetheless, market volatility continues to be to be anticipated within the meantime. With Binance state of affairs resolved, alongside abandoning the string of crypto bankruptcies throughout 2022, the primary FUD supply stays the federal government.

Regardless of Tom Emmer’s efforts, because the GOP majority whip, even self-custody wallets could possibly be focused as cash transmitters. The FBI hinted at this route just lately with the warning towards utilizing “unregistered crypto cash transmitting providers”.

Likewise, this 12 months, the Federal Reserve’s course on rates of interest might suppress the urge for food for risk-on property like Bitcoin. Nonetheless, the notion of Bitcoin and the market surrounding it has by no means been extra mature and secure.

If the regulatory regime adjustments course, small companies might even ditch options like bill financing and transfer to a BTC ETF-supported system.

Conclusion

After years of Bitcoin ETF rejections for spot-trading, these funding automobiles erected brand-new liquidity bridges. Even suppressed by Barry Silbert’s Grayscale (GBTC), they’ve confirmed nice institutional demand for an appreciating commodity.

With the fourth Bitcoin halving behind, elevated shortage and allocations from fund managers at the moment are a certainty. Furthermore, the prevailing sentiment is that fiat currencies will perpetually be devalued so long as central banking exists.

In any case, how might governments hold funding themselves regardless of large funds deficits?

This makes Bitcoin all of the extra compelling in the long term after holders take within the earnings from new ATH factors. Between these peaks and valleys, Bitcoin’s backside will probably hold rising within the deeper institutional waters.

Talked about on this article