Earlier than the introduction of the Ordinals protocol, Bitcoin was largely thought to be a ‘boring’ blockchain. Since its inception in 2009, the pioneer blockchain has targeted on serving as a peer-to-peer system for worth change, aligning with the authentic imaginative and prescient of its creator, Satoshi Nakatomo. Improvements on the community have been largely directed in direction of that singular objective. This unidimensional focus, although interesting to hardcore lovers, ran the chance of not resonating with the broader plenty. And that was ‘partly’ what occurred.

The unique emphasis on the digital foreign money being a “retailer of worth” discovered traction amongst devoted followers however struggled to realize widespread attraction. In consequence, different blockchains emerged, pushed by the necessity for quicker and extra versatile options. Ethereum emerged as probably the most profitable options to Bitcoin, because it replicated its basis however went past being only a peer-to-peer money system. Ethereum allowed for decentralized purposes (dApps), which enabled the creation of assorted cryptocurrencies on its community, fostering high-quality decentralized monetary providers, revolutionizing the gaming business with the arrival of “play-to-earn,” and introducing NFTs as a brand new type of digital artwork.

Past Ethereum, various progressive blockchains surfaced, providing a broader spectrum of providers that Bitcoin lacked. Consequently, Bitcoin lagged behind as newer blockchains secured main partnerships with business leaders within the artwork, sports activities, and automotive sectors.

Nevertheless, this pattern of Bitcoin being left behind modified with the introduction of the Ordinals protocol. Ordinals drove innovation straight on the Bitcoin chain and paved the way in which for the creation of BRC-20 tokens and Bitcoin NFTs, which on the facet challenged the presumption of many on the time that NFTs have been lifeless. The protocol breathed life into the OG blockchain and, for the primary time in a very long time, confirmed that Bitcoin might be greater than only a peer-to-peer worth switch blockchain.

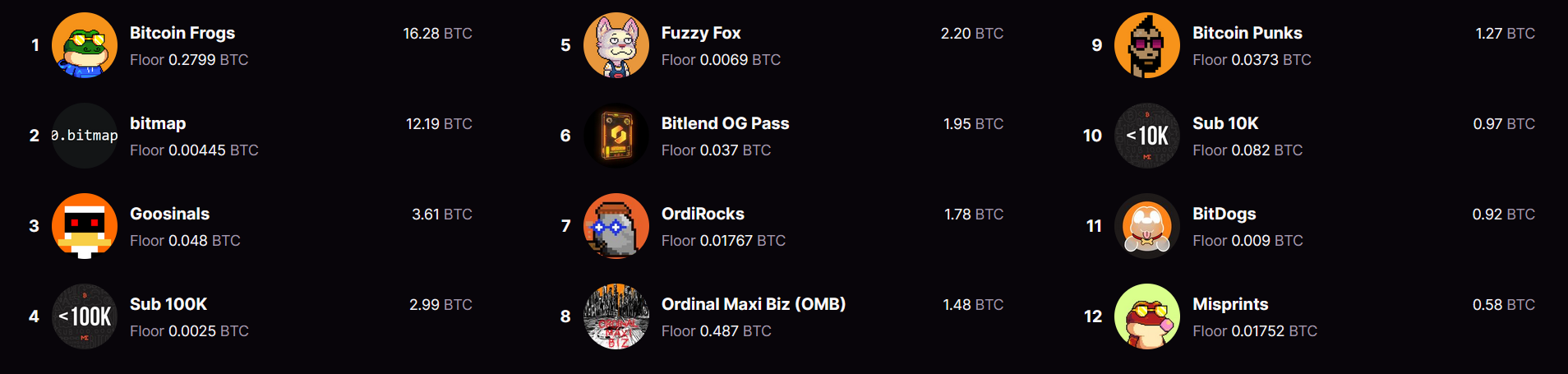

Ordinals Market

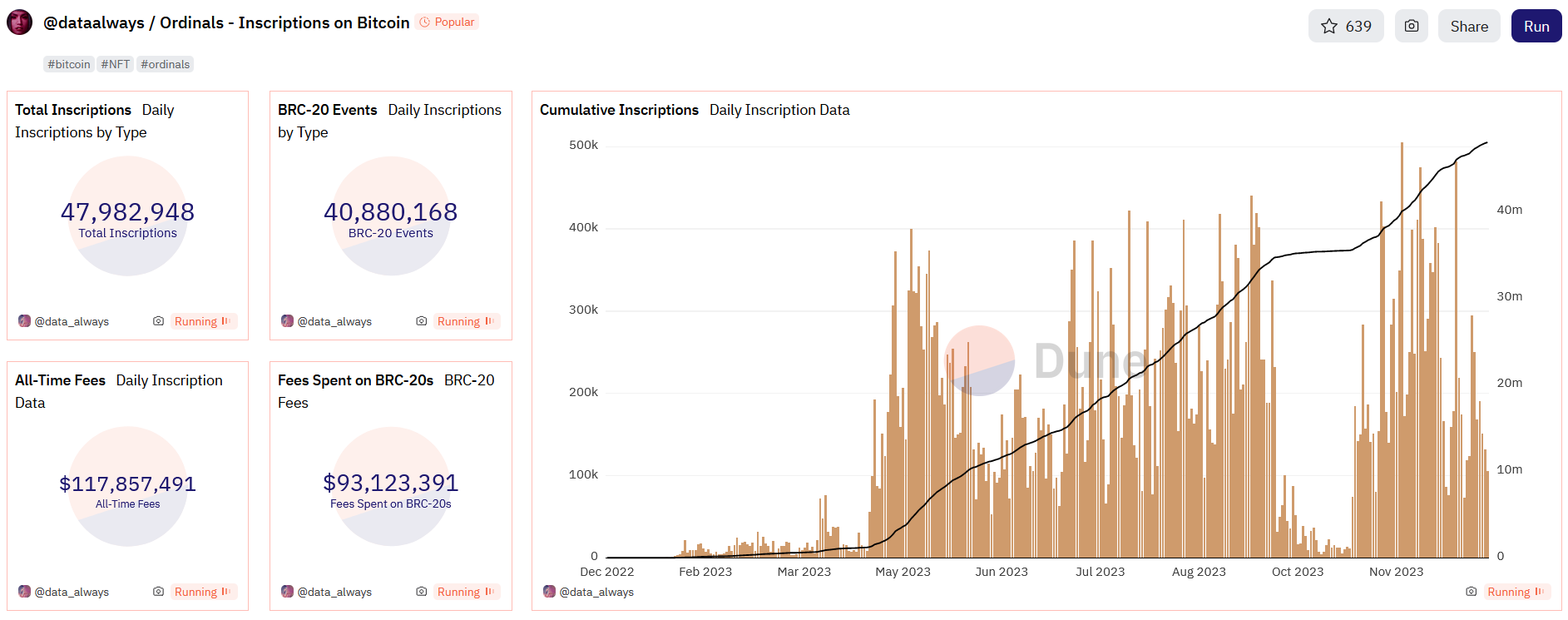

This transformative second for Bitcoin was very evident. In a brief interval of barely one yr, Ordinals inscriptions surged, capturing the eye of crypto lovers from numerous chains and even these exterior the crypto house. This surge in exercise led to a notable migration of NFT homeowners and builders from Ethereum to Bitcoin. Many digital artists additionally seized the distinctive alternative to specific themselves on the oldest and most safe blockchain globally, injecting a renewed sense of innovation into the Bitcoin ecosystem.

The innovation not solely attracted merchants, buyers, and a focus to the core Bitcoin house but additionally intensified the drive amongst Bitcoin builders. Miners on the Bitcoin community benefited from elevated community charges and have been in a position to generate substantial income.

Whereas some considered the Ordinals protocol as simply one other innovation within the blockchain house, discerning observers and analysts acknowledged the seismic shift it introduced. It represented a brand new wave of innovation, hype, and experimentation throughout the Bitcoin ecosystem, which had been absent earlier than its introduction.

Nevertheless, an enormous query nonetheless looms over this new protocol: will it stand the take a look at, or will it simply fizzle away?

Through the 2023 Blockchain convention, quite a few Ethereum builders took centre stage to showcase how their initiatives benefit from the Ordinal protocol.

One noteworthy instance is Eril Ezerel, the founding father of Subjective Labs, who launched an Ordinals explorer able to monitoring over 1,000 Ordinals collections. Ezerel remarked, “Now that it’s been found, persons are returning to crypto’s oldest coin in giant numbers.”

Whereas Ezerel’s assertion could carry a level of exaggeration, it holds substantial implications. The migration of distinguished and priceless NFTs from rival blockchains to Bitcoin suggests a big position reversal, positioning Bitcoin to additional solidify its standing because the main digital asset platform and greater than only a peer-to-peer worth switch system. The OnChainMonkey Story serves as an illustration of this paradigm shift unfolding quickly.

The Bitcoin ETFs Impact

2023 was the yr when quite a few conventional monetary establishments determined to embrace the Bitcoin pattern via ETFs. Questions have been raised concerning the influence of mainstream adoption on Ordinals and BRC-20 tokens. Will these establishments understand them as worth drivers for Bitcoin or dismiss them as mere ‘bugs,’ as Luke Dashjr described it?

Understanding why these establishments are coming into what some view as a speculative business is essential. The first motivators for these giant funding corporations are income and development. Crypto, notably Bitcoin, is seen as an untapped alternative for progressive development past conventional property. The attraction lies within the potential for elevated income, diversification, and tapping into the rising curiosity in digital property, together with NFTs. The approval of Bitcoin ETFs is anticipated to set off a rush amongst these establishments to put money into the Bitcoin ecosystem in a regulated method.

If Ordinals on the Bitcoin community are considered as a way of diversifying the worth of Bitcoin, separate from buying and selling, it would obtain assist, which can encourage widespread acceptance. Not like NFTs on different blockchains, Ordinals inscriptions actually exist on-chain, which may very well be seen as a worth driver by itself, probably prompting broader adoption and use. Bitcoin’s dynamic nature and evolution from Satoshi Nakamoto’s authentic imaginative and prescient recommend that these establishments could change into extra deeply concerned in Bitcoin than initially anticipated.

Bitcoin ETFs are anticipated to introduce Bitcoin to the worldwide mainstream and set up it as a brand new asset class. This improvement has already began exhibiting its ripple results as it has triggered a brand new wave of ETF purposes, extra particularly, Ether spot ETFs. It should undoubtedly move right down to probably affect mainstream involvement and funding in different DeFi providers, together with Ordinals and NFTs constructed on these platforms.

The blockchain business is slowly gaining legitimacy via Bitcoin and is poised for thrilling instances forward, and the notion that Bitcoin ETFs function a computer virus to legitimise and produce different underlying improvements, similar to Ordinals, into the mainstream, appears believable.

Fuel Charges Debacle

Whereas Ordinals probably supplies one other use case for Bitcoin because it chases widespread adoption, it could be a trigger for it to falter. The emergence of Ordinals and BRC-20s has ignited a contentious dialogue throughout the Bitcoin group, resembling a type of “civil battle” over ‘gasoline charges.’

In distinction to simple peer-to-peer transactions, the creation and switch of BRC-20 tokens are intricate processes that demand extra blockchain house. Whereas a typical bitcoin transaction could also be quantified in kilobytes, an Ordinal inscription, the muse for a BRC-20 token can occupy as much as 4MB in dimension. This whole dimension contributes to the transaction on the bitcoin blockchain, impacting the related on-chain transaction prices.

One faction of Bitcoin lovers contends that the blockchain ought to completely accommodate monetary transactions to keep up minimal charges. Conversely, one other faction values the extra innovation and performance launched to Bitcoin by the Ordinals protocol, intensifying the talk.

The controversy has led some miners to take a stance by excluding inscriptions from their mining block templates, as noticed in Luke Dashjr’s Ocean Pool. This heated debate even took centre stage on the Bitcoin Convention in 2023 as “The Nice Ordinal Debate.” Members passionately argued each in favour of and towards the need of inscriptions on the Bitcoin community.

The discourse often turned private, however in the long run, the moderator, Pete Rizzo, supplied his concluding ideas, “I believe Bitcoin is altering, and I believe it’s vital to have an adaptive psychological mannequin of what Bitcoin is.”

Disclaimer: This piece is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of economic loss. All the time conduct due diligence.

If you wish to learn extra information articles like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Neighborhood.