Microsoft backing out some leases is making a scare amongst AI buyers. The Day by day Breakdown seems to be on the influence rippling by means of tech.

Thursday’s TDLR

Commerce conflict worries hit shares

LULU studies earnings

Microsoft information hits AI shares

What’s taking place?

Escalating tariff considerations helped gasoline yesterday’s decline in US shares, with the auto business being the most recent to come back underneath fireplace.

The Trump Administration introduced a spherical of 25% import tariffs initially focusing on absolutely assembled automobiles. These are set to enter impact on April third, however will develop to incorporate main vehicle components by Could third.

It didn’t assist that Microsoft is reportedly backing out a number of US and European information heart initiatives, which sparked concern about provide outstripping demand with regards to AI infrastructure. Whereas Microsoft solely fell 1.3% on the day, Nvidia, Broadcom, and different chipmakers fell a lot additional on account of this concern.

Need some excellent news, although?

5 of the eleven S&P 500 sectors completed larger on the day, whereas greater than half of the shares within the index completed in constructive territory. Nonetheless, mega-cap tech nonetheless stays an issue.

5 of the Magnificent Seven shares fell greater than 2% yesterday, with Tesla and Nvidia every dropping greater than 5%. With these firms’ market caps totaling $15.6 trillion, these declines influence your entire market, even when different shares and sectors are rallying.

Need to obtain these insights straight to your inbox?

Enroll right here

The setup — Procter & Gamble

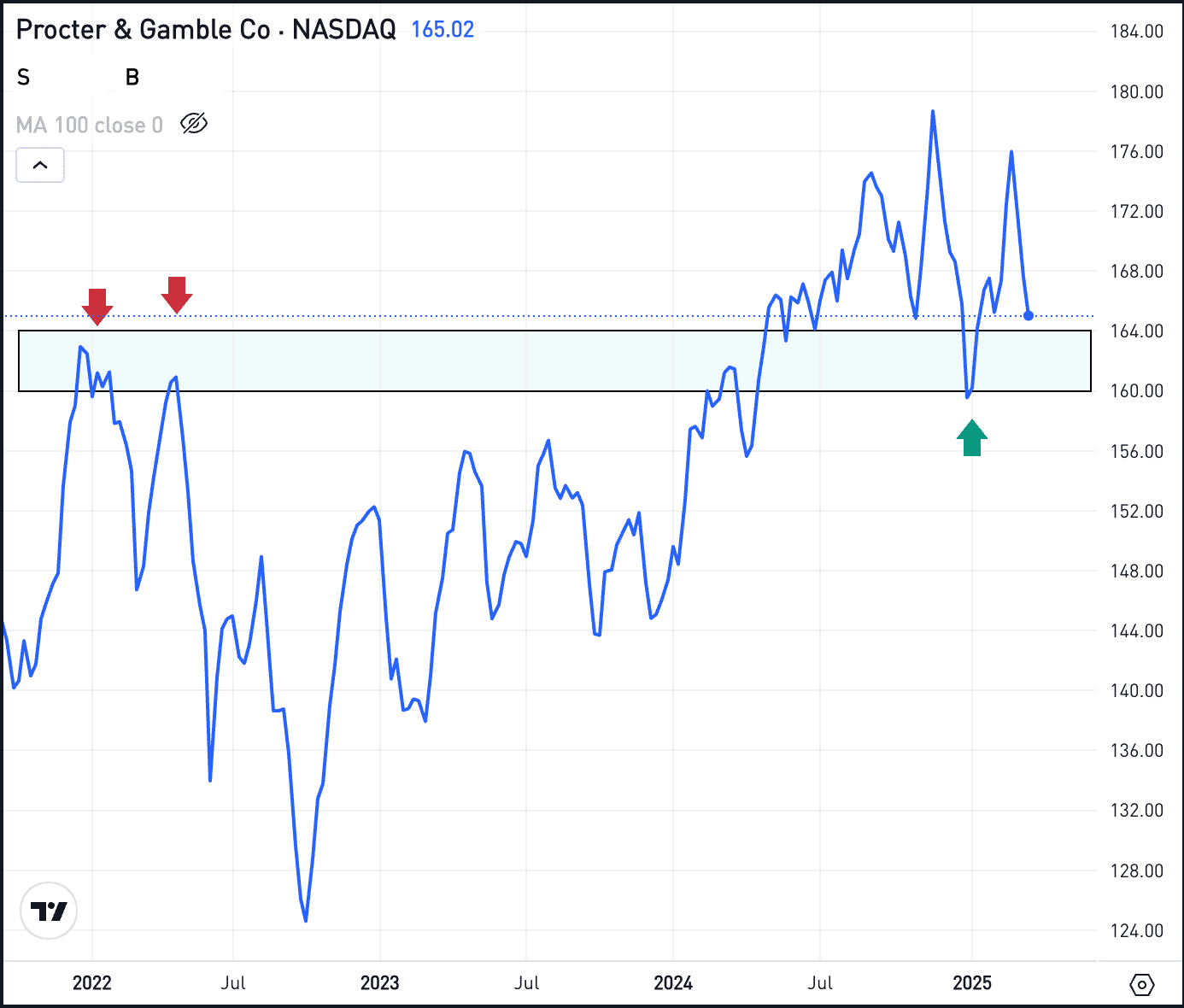

The $160 to $165 space had marked the prior bull market highs for Procter & Gamble in 2022, however the inventory is now pulling again to this space after not too long ago hitting new report highs.

P&G at the moment sports activities a dividend yield of two.4% and has raised its dividend for 68 consecutive years.

Whereas that long-term streak is nice, extra lively buyers are keeping track of the charts to see if this prior $160 to $165 resistance zone can now act as help.

If the inventory is ready to discover help on this space, it’s doable that P&G shares may take pleasure in a rebound, probably again towards its current highs close to $180. Nonetheless, if this space fails to carry as help, extra promoting stress may ensue.

Choices

Shopping for calls or name spreads could also be one option to reap the benefits of a pullback. For name patrons, it might be advantageous to have ample time till the choice’s expiration.

For people who aren’t feeling so bullish or who’re searching for a deeper pullback, places or put spreads might be one option to take benefit.

To be taught extra about choices, take into account visiting the eToro Academy.

What Wall Avenue is watching

DLTR – Greenback Tree popped after promoting its Household Greenback model for $1 billion. Buyers cheered the transfer, seeing it as an opportunity to streamline operations and concentrate on higher-performing segments.

LULU – Whereas earnings season is nearly over, Lululemon Athletica will report earnings after the shut. Analysts anticipate roughly 12% income development and earnings of $5.85 a share (representing development of about 17%). Can the agency ship? Try the charts for Lululemon.

GM – Shares of Normal Motors are underneath stress this morning, down over 5% in pre-market buying and selling. That’s as information of the auto tariffs weighs on the inventory worth. Nonetheless, Ford inventory is definitely up about 1% in pre-market buying and selling on account of comparatively decrease import publicity in comparison with its rivals.

Disclaimer:

Please notice that on account of market volatility, a number of the costs might have already been reached and eventualities performed out.