Main Developments for the Week

Bitcoin surges to yet one more all-time excessive, however stops shy of $100K

Solana reaches all-time excessive of $264, a number of filings submitted for SOL spot ETFs

XRP hits 3-year excessive – a possible game-changer for regulatory readability?

HBAR up 127.38% over previous 2 weeks, amid hypothesis over SpaceX satellite tv for pc crypto undertaking

ETH and the trail to $20,000 – analysts predict short-term correction, however stay bullish

Bitcoin ETFs hit new file with over $3.1B in weekly inflows

SEC Chair Gary Gensler broadcasts resignation amid Trump’s pro-crypto agenda

Hong Kong’s largest digital financial institution launches retail crypto buying and selling

Trump nominates hedge fund supervisor Scott Bessent as Treasury secretary

Justin Solar buys extra of Trump’s WLFI than must be obtainable

Bitcoin surges to yet one more all-time excessive, stopping simply shy of $100K

BTC’s Contemporary All-Time Highs – and Quick-Time period Resistance

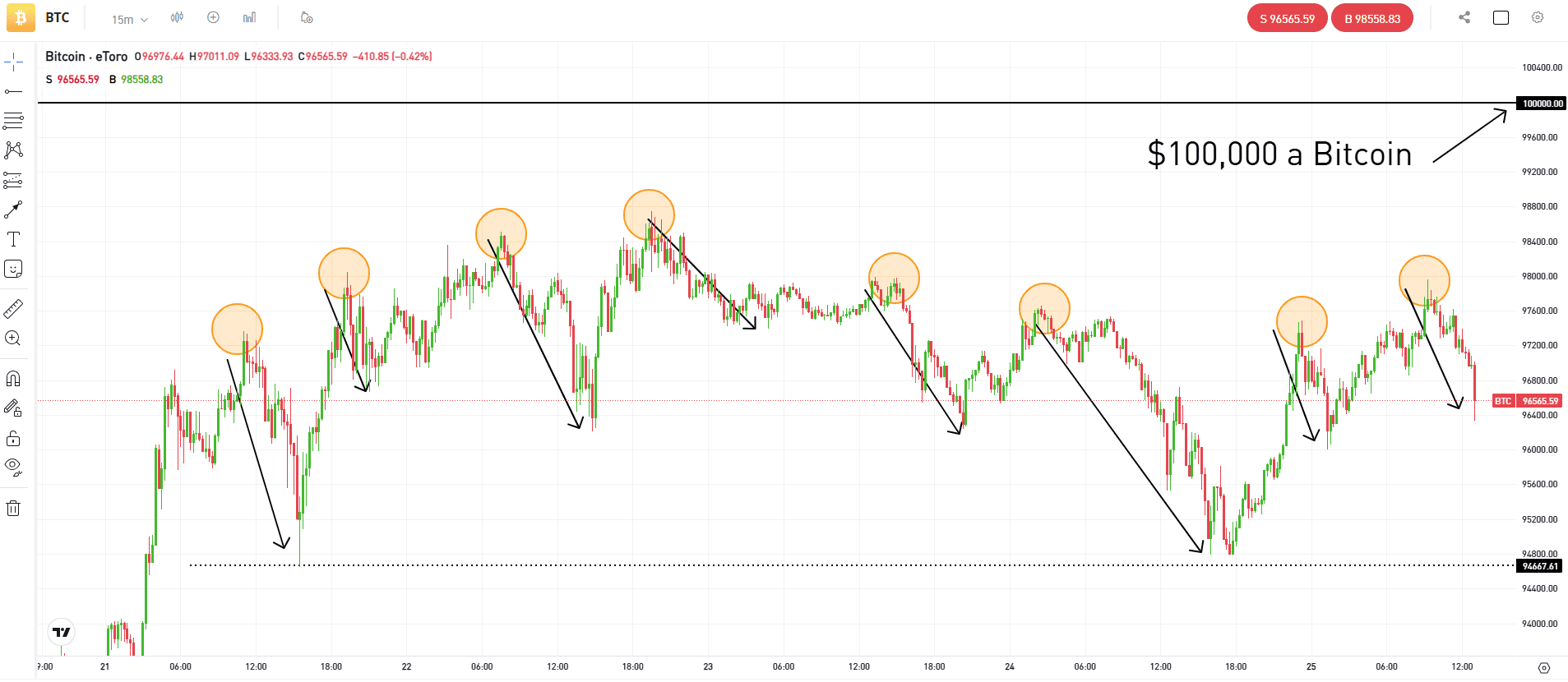

This week, Bitcoin set a brand new all-time excessive of $99,800, stopping simply wanting $100,000. This surge is a part of a broader post-election rally, pushed by optimism across the incoming purportedly crypto-friendly Trump administration in addition to an ongoing enhance in institutional demand.

Picture created by Sam North, eToro analystPast efficiency shouldn’t be a sign of future outcomes

As Bitcoin approaches this massively vital milestone, the value has pulled again a number of occasions resulting from merchants promoting forward of this psychological resistance degree. Weekend volatility noticed costs dip as little as $95,800, triggering $470 million in liquidations. Some buyers worry a possible wave of promoting strain as soon as the extent is reached, main them to exit early to safe earnings and keep away from being caught in a possible downturn, which creates a self-reinforcing cycle of sell-offs earlier than the large quantity is examined.

BTC’s tendencies reveal a narrative – discover our interactive journal and uncover one thing sudden!

Altcoins Rising: Key Gamers and Groundbreaking Strikes Shaping the Crypto Panorama

Whereas Bitcoin instructions the highlight, altcoins are exhibiting sturdy efficiency, indicating a rising momentum on this phase. Historic patterns present that altcoins usually surge after Bitcoin enters a parabolic part, and several other altcoins are already making waves.

Solana

Considered one of final week’s key movers is Solana, which reached an all-time excessive of $264. Month-to-month commerce volumes on Solana-based Decentralised Exchanges (DEXs) surpassed $100B for the primary time, positioning it as a crucial participant within the evolving DeFi ecosystem. Including to the bullish sentiment, a number of regulatory filings for Solana-based spot ETFs have been submitted, signaling growing institutional curiosity.

XRP

One other altcoin on the rise is XRP, which surged to $1.59, marking a three-year excessive, as market sentiment was buoyed by the announcement of SEC Chair Gary Gensler’s departure in January 2025. This improvement is seen as a possible game-changer for regulatory readability, with buyers hopeful that the brand new administration will undertake a extra balanced strategy to crypto laws.

Hedera Hashgraph

Hedera Hashgraph (HBAR) elevated its value share by virtually 140% between Nov 11-25 2024, partly resulting from hypothesis surrounding a groundbreaking undertaking with SpaceX. The undertaking would utilise HBAR’s blockchain to course of crypto transactions in orbit, and is tied to a satellite tv for pc launch scheduled for January 2025. Buyers are seeing this as a step towards broader adoption of blockchain expertise, notably in space-based purposes.

Rising Alternatives

Layer-1 and Layer-2 options, together with Chainlink (LINK) and Optimism (OP), are additionally catching consideration:

LINK: Breaking resistance at $13 has paved the best way for a possible surge to $18.

OP: Poised for a 60% rally if it clears resistance at $2.

Ethereum and the Path to $20,000

Ethereum, the second-largest cryptocurrency, has been slower to rally in comparison with Bitcoin, though it has gained 44% to this point in 2024. Analysts undertaking a short-term correction following Bitcoin’s $100,000 milestone however stay bullish on Ethereum’s long-term prospects. In line with eToro analysts, Ethereum’s continued dominance in good contracts and utility upgrades, may propel its value to $20,000 by 2025.

Macro Tendencies and Institutional Momentum

The broader market is buoyed by institutional curiosity and regulatory shifts. Spot Bitcoin ETFs proceed to draw inflows, led by BlackRock, whereas firms like MicroStrategy deepen their Bitcoin holdings.

In the meantime, the upcoming departure of SEC Chair Gary Gensler has created optimism for extra favorable insurance policies below the incoming Trump administration, which may additional stimulate market progress.

Don’t make investments except you’re ready to lose all the cash you make investments. It is a high-risk funding, and you shouldn’t count on to be protected if one thing goes incorrect. Take 2 minutes to be taught extra.

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any explicit recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product aren’t, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.