Decoding the 2025 Outlook

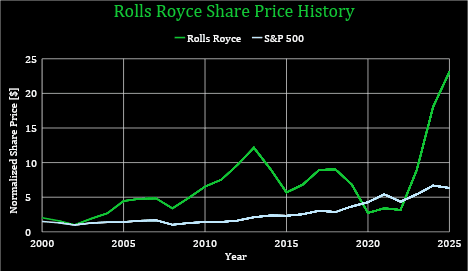

Rolls-Royce ($RR.L), a reputation synonymous with engineering excellence, has lately ignited investor enthusiasm. The appointment of CEO Tufan Erginbilgic in 2023 marked a pivotal second, along with his transformation initiatives delivering a exceptional 15% inventory worth surge in 2024 alone. However is that this a fleeting rally, or the beginning of a sustained ascent? Allow us to delve into the important thing drivers behind Rolls-Royce’s resurgence and assess its long-term potential.

A Transformation Taking Off

Erginbilgic’s strategic overhaul has delivered tangible outcomes, streamlined operations, and boosted effectivity at a formidable tempo. The group’s working revenue and margin improved from £0.65B and 5.1% in 2022 to £2.5B and 13.8percentin 2024. Free money elevated from £0.5B in 2022 to £2.4B in 2024.

Key initiatives aimed toward value discount and operational optimization are set to gasoline continued efficiency enhancements within the coming years. Moreover, important contract wins within the power, protection or marine sectors are poised to bolster top-line progress and drive additional economies of scale.

A Diversified Powerhouse

Rolls-Royce’s income streams are various, spanning:

Civil Aerospace

Manufacturing and servicing aero engines for industrial plane, a section pushed by rising air journey demand and engine service necessities. This division contributes roughly 50% of the corporate’s income and revenue. Within the pipeline there are backorders and orders from Airbus and Boeing.

Protection

Offering engines for army plane and vessels, together with the UK’s nuclear submarine fleet. The Aukus partnership and elevated international army spending present a robust tailwind. RR lately received a contract to provide $11.1B nuclear reactors for U.Ok. submarines.

Energy Programs

Providing energy technology, marine, and industrial options, together with a strategic concentrate on small modular reactors (SMRs) and knowledge heart energy options. In partnership with ČEZ RR will deploy as much as six SMRs within the Czech Republic.

Future Progress

The corporate’s deliberate re-entry into the narrowbody plane engine market within the subsequent decade presents a major long-term alternative.

Clients: Powering World Industries

Rolls-Royce caters primarily to industrial airways and army forces, delivering high-performance engines and energy techniques that prioritize reliability, refined expertise, and premium customer support, solidifying its management in industries requiring cutting-edge options.

Navigating a Tight Market

4 key gamers dominate the aero engine market: Rolls-Royce ($RR.L), Pratt & Whitney, CFM Worldwide (JV between GE Aerospace and Safran Plane Engines), and Normal Electrical ($GE). Different key rivals embody Siemens (energy techniques), Honeywell, and MTU Aero Engines.

GE offers energy and propulsion options and is a robust competitor for its revolutionary options and international presence. Siemens competes with RR within the built-in energy techniques market. Honeywell’s choices overlap with RR’s merchandise. MTU Aero Engines competes within the aviation sector. Pratt and Whitney is a formidable competitor for its revolutionary expertise and engineering experience.

Rolls-Royce distinguishes itself by:

Complete engine design and system integration capabilities.

In depth R&D investments and technological innovation.

A world presence and a robust model status.

Custom-made options and eco-friendly applied sciences.

Funding Thesis

Monetary Well being: Rolls-Royce has achieved investment-grade credit score scores and demonstrated monetary power by a GBP 1 billion share buyback and the resumption of dividends. The Complete Money Value/Gross Margin (TCC/GM) ratio highlights the success of the transformation efforts.

Information supply: 2024 Full Yr Outcomes Presentation

One of the best-in-class TCC/GM (whole money value/gross margin) ratio and a web money place contribute to the elevated resilience to EFH (engine flying hours) volatility.

Strategic Initiatives: Ongoing initiatives embody renegotiated contracts, margin enhancements, and investments in R&D, such because the UltraFan engine and next-generation energy techniques. The UltraFan is a jet engine demonstrator that improves gasoline effectivity and reduces emissions. It’s the world’s largest aero engine. Capability expansions in key amenities will help elevated manufacturing and repair calls for.

UltraFan and SMR alternatives.

Progress in energy techniques by decrease carbon options and battery power storage.

Sturdy protection sector demand.

Increasing civil aerospace market share and improved engine time-on-wing.

The corporate is main the SMR market with the biggest Megawatt electrical (MWe) out there and has achieved important regulatory milestones forward of the competitors.

Administration: CEO Erginbilgic’s strategic management and restructuring efforts have yielded spectacular outcomes.

Valuation

Present valuations recommend a possible upside of 20%. Given the wholesome base and measurable strategic initiatives, it’s our view that the chance for unfavorable returns is low.

Progress

LT-growth

WACC

Honest worth

Vs present

Excessive

18.5%

4.0%

9.5%

£ 880.94

20%

Medium

15.0%

4.0%

9.5%

£ 790.05

8%

Low

11.5%

4.0%

9.5%

£ 706.81

-4%

Common

£ 792.60

8%

Guide worth

£ -0.10

Present

£ 732.80

Rolls-Royce’s price-to-earnings (PE) ratio, a measure of its share worth relative to its earnings, is beneath the trade common, suggesting potential undervaluation. Rolls-Royce’s unfavorable e book worth is primarily because of losses incurred in the course of the COVID-19 pandemic, which considerably impacted the aviation trade.

Aerospace and Protection Rivals

Inventory Value [$]

Mkt Cap [$Billion]

PB

PE

Dividend Yield

GE Aerospace

192.12

208.06

10.67

31.86

0.74%

Pratt & Whitney

128.52

171.20

2.84

36.20

1.96%

Airbus SE ADR

44.20

147.19

7.00

32.50

1.02%

Boeing Co

148.15

111.47

(30.40)

–

0.00%

Lockheed Martin Corp

479.17

112.79

17.60

21.46

2.75%

TransDIGM Group Inc

1336.02

74.93

9.20

47.18

0.00%

Normal Dynamics Corp

271.94

73.51

3.33

19.97

2.21%

Northrop Grumman Corp

495.45

71.72

4.61

17.48

1.66%

Honeywell Worldwide

213.82

139.42

7.49

24.58

2.11%

MTU Aero Engines

163.96

19.08

5.86

21.28

0.60%

BAE Programs PLC ADR

82.76

69.02

4.16

25.00

2.02%

Rolls-Royce

732.80

87.76

(0.10)

26.25

0.77%

Common (excl. Boeing)

6.61

27.61

1.44%

Navigating Turbulent Skies

Key challenges for RR in a aggressive panorama are:

Sustaining a aggressive edge by steady innovation.

Navigating complicated regulatory necessities.

Addressing ongoing provide chain disruptions, that are anticipated to proceed for roughly 18 months.

RR manages these dangers by funding in R&D, compliance constructions and packages to make sure compliance and is in ongoing negotiations with gamers within the provide chain to handle supply of parts. Potential tariffs would have a restricted influence on RR, given a larger publicity to Europe and Asia than the U.S.

A Promising Trajectory

Rolls-Royce’s monetary well being, strategic initiatives, and market positioning recommend a promising progress trajectory. The corporate is well-positioned to capitalize on alternatives in civil aerospace, protection, and energy techniques. Whereas challenges stay, the potential for sustained progress and shareholder returns makes Rolls-Royce a compelling funding consideration.

Information supply: https://finance.yahoo.com/

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any explicit recipient’s funding aims or monetary scenario, and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.