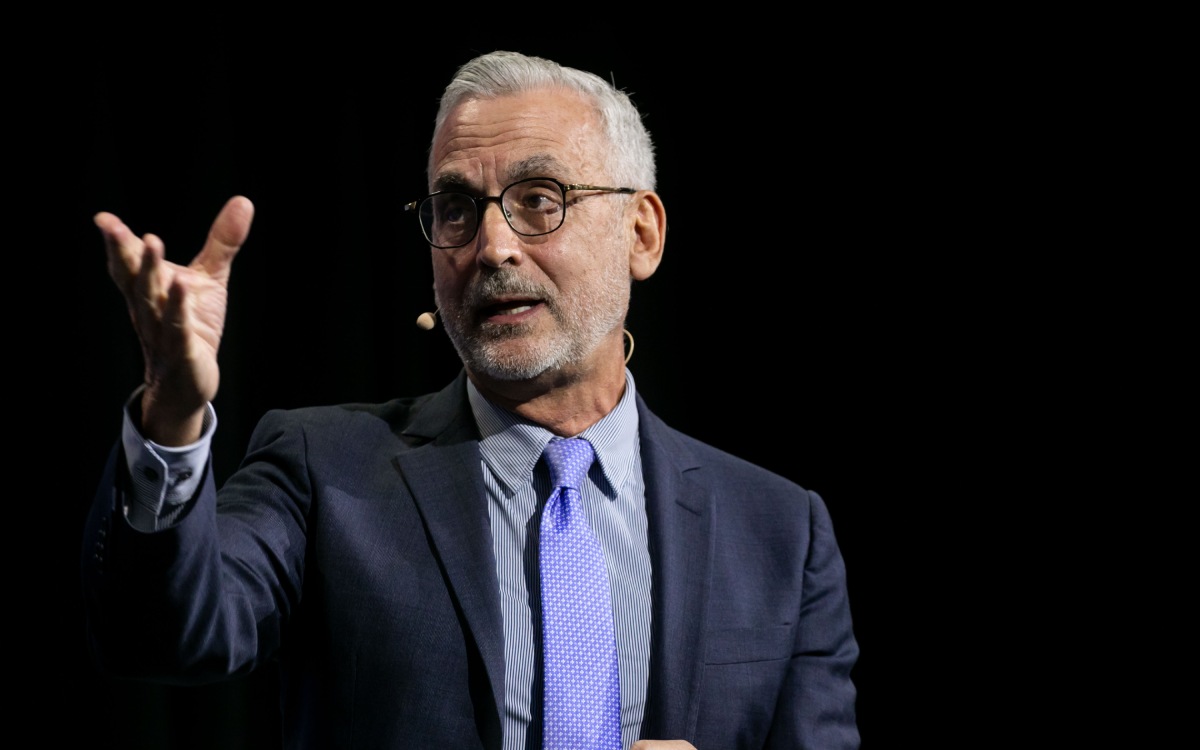

In a put up on X (previously Twitter), Stuart Alderoty, the Chief Authorized Officer (CLO) at Ripple, has vehemently denounced the US Securities and Alternate Fee (SEC) strategy below the management of Gary Gensler. Leveraging a dialogue initiated by Paul Grewal, Chief Authorized Officer at Coinbase, Alderoty didn’t mince phrases, portraying the SEC’s operations as akin to these of a “police state.”

SEC Acts As A ‘Police State’ Company

By means of an in depth put up on X, Alderoty amplified Grewal’s grievances concerning the SEC’s actions within the DEBT Field case. He articulated a robust stance towards the SEC, suggesting a misuse of energy below Gensler’s and Enforcement Director Gurbir Grewal’s watch.

Alderoty’s assertion was clear and pointed: “Please learn this thread from Coinbase’s Chief Authorized Officer. Beneath Gensler and its Enforcement Director Gurbir Grewal (no relation) the SEC behaves as if it operates in a police state exempt from the implications of its actions. Sufficient is certainly sufficient.”

Grewal’s thread outlined a troubling state of affairs the place the SEC, having secured a Momentary Restraining Order (TRO) towards DEBT Field, subsequently directed Coinbase to freeze property below risk of sanctions. The legitimacy of this order was later questioned as a result of revelation that the TRO was primarily based on SEC misrepresentations.

Grewal’s frustration was palpable: “These Senators are much more proper than they know…However somewhat than instantly pulling its order after admitting that it deceived the Courtroom, the SEC sat silently.”

In response to the SEC’s inaction, Coinbase took a defiant stance, as detailed by Grewal: “We then informed the SEC we wouldn’t comply additional except they defined why we should always. However we got no clarification in any respect.” This defiance highlighted the SEC’s reluctance to have interaction, additional fueling the controversy.

SEC Repeatedly Places Ripple CLO Into Rage

It’s not the primary time that Alderoty is slamming the SEC, Gary Gensler and its malicious practices towards the US crypto business.

In a damning evaluation, Alderoty not too long ago questioned Gensler’s suitability for his position: “Who else would rent him? He’s politically poisonous, he’s a serial loser within the courts, his workers has been caught mendacity to judges, his company’s Twitter account was hacked in essentially the most embarrassing means, and his sponsor at MIT give up due to shut Epstein ties.”

This broadside was a response to Gensler’s assertion of his intent to stay because the SEC’s chair if President Joe Biden is re-elected. Neil Hartner, Senior Employees Software program Engineer at Ripple, one other failure of Gensler’s management, “And he’s a nasty boss with SEC workers quitting on the highest charge in 10 years.” This assertion underscores a broader discontent with Gensler’s administration fashion and its influence on the SEC’s inside tradition.

This ongoing dispute between Ripple and the SEC, highlighted by Alderoty’s and Grewal’s feedback, casts a highlight on the tensions between the crypto business and the regulatory physique which has repeatedly acted as a “police state” company.

At press time, XRP traded at $0.53198.

Featured picture from Uzmancoin, chart from TradingView.com