Latest on-chain knowledge from Glassnode reveals that retail buyers, outlined as addresses holding 1 BTC or much less, have considerably ramped up their Bitcoin purchases previously two months. Though this attention-grabbing development amongst retail merchants may be very bullish for the main cryptocurrency, it has been contrasted by a deviating development amongst whale addresses, who’ve been offloading Bitcoin at an accelerating fee throughout this timeframe.

Retail Traders Accumulate Bitcoin At Document Tempo

Information from on-chain analytics platform Glassnode reveals that retail buyers have considerably elevated their Bitcoin purchases since mid-December. On common, these smaller buyers have been accumulating 10,627 BTC per day, a 72% improve in comparison with final yr’s every day common of 6,177 BTC.

This improve in Bitcoin accumulation contrasts with the perfect habits of retail merchants, who aren’t identified for his or her shopping for habits. As an example, Glassnode knowledge reveals that retail addresses bought massively into Bitcoin’s energy because it surged previous $100,000 for the primary time in November 2024.

Picture From X: Glassnode

Whales Improve Bitcoin Promote-Offs At 9x Increased Charge

Whereas retail buyers are aggressively accumulating Bitcoin, the following cohort of merchants (whales holding over 1,000 BTC) have been offloading Bitcoin at an accelerating fee. This development can be relayed by means of knowledge from Glassnode, which reveals that these high-volume holders have despatched a mean of 32,509 BTC per day to exchanges since November 24.

This can be a dramatic 9x improve in potential sell-side stress from these large-volume addresses in comparison with their yearly common.

The timing of this offloading aligns with earlier than and after Bitcoin’s surge previous the $100,000 mark in early December. This development means that long-term holders took benefit of this psychological milestone and have been doing so since then, particularly as Bitcoin continues to revisit the extent occasionally.

Picture From X: Glassnode

What These Shifting Dynamics Imply For Bitcoin’s Worth

The diverging habits between retail buyers and whales presents a posh state of affairs for Bitcoin’s worth trajectory. On one hand, robust retail accumulation signifies a rising perception in Bitcoin’s long-term worth, which might present a stable basis for future worth appreciation. Retail buyers stepping in to purchase means that constructive market sentiment is at a excessive for Bitcoin.

Nonetheless, the sheer quantity of Bitcoin being offloaded by whales introduces a substantial threat of short-term worth corrections. If this promoting stress persists and isn’t met with adequate demand, Bitcoin might proceed to expertise important pullbacks after each transient uptrend.

Bitcoin’s worth motion because it first broke above $100,000 in early December has been filled with ups and downs. It has already been two months since Bitcoin attained this milestone, however it continues to battle with the load of liquidity across the zone. On the time of writing, Bitcoin is buying and selling at $96,945.

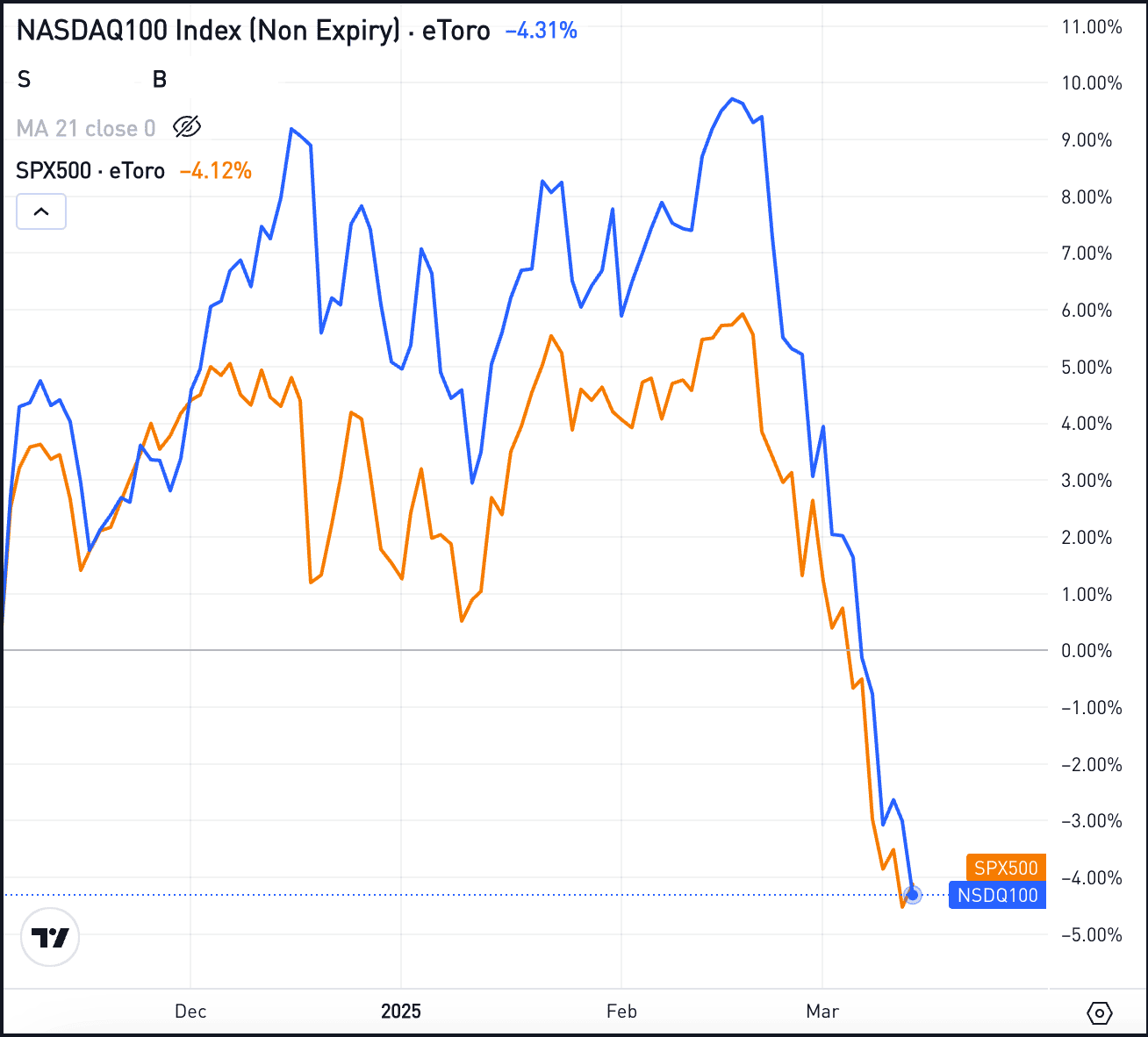

Featured picture from Getty Pictures, chart from TradingView