With latest estimates displaying a startling $528 million in withdrawals from digital asset funding merchandise, crypto markets are underneath nice flux. Rising US financial worries mixed with geopolitical considerations and important market liquidations assist to clarify this fall. The outflows seize a normal sense of concern amongst traders as they contemplate how attainable financial downturns would have an effect on the crypto scene.

Knowledge from CoinShares reveals that institutional crypto funding merchandise had their first outflow in 4 weeks final week—$528 million total. Together with geopolitical points and extra normal market liquidations throughout many asset lessons, this fall is ascribed to worries of a recession in the US.

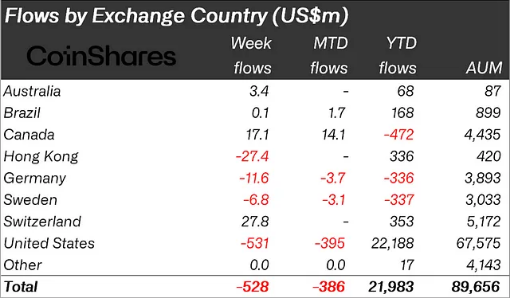

With $531 million, the US led these outflows; different areas like Germany and Hong Kong additionally helped to drive the pattern. Not surprisingly, Bitcoin and Ethereum have been affected; respective outflows have been $400 million and $146 million.

Supply: CoinShares

Supply: CoinShares

Patterns And Market Response

The overall market capitalization of cryptocurrencies has clearly dropped in response to money outflow. Following the revelation, massive cryptocurrencies like Bitcoin and Ethereum noticed worth declines, which helped to clarify the over $10 billion in worth misplaced from exchange-traded merchandise (ETPs).

Notably Ethereum had internet withdrawals of $146 million, which underlines the fragility of even the most important digital currencies underneath market stress. Reflecting this volatility, the Nasdaq futures fell 3% as typical markets responded to the creating turmoil.

Whole crypto market cap at $1.9 trillion on the every day chart: TradingView.com

Solutions From Enterprise Leaders

The rumors about our positions being liquidated are false. We not often have interaction in leveraged buying and selling methods as a result of we consider such trades don’t considerably profit the trade. As an alternative, we favor to have interaction in actions that present better help to the trade and…

— H.E. Justin Solar 孙宇晨 (@justinsuntron) August 5, 2024

Justin Solar, the creator of Tron, addressed the widespread rumors of liquidation floating across the society in the course of this monetary instability. He referred to as these assertions “fallacious” and attacked the dependence on leveraged buying and selling methods aggravating market volatility. Solar’s remarks spotlight a rising fear amongst enterprise executives concerning the viability of such buying and selling strategies, significantly in a scenario of uncertainty.

Crypto: Future Course

The crypto market struggles uphill to rebuild investor belief as financial worries loom large. Analysts consider that the current withdrawals could be an indication of a longer-term pattern as traders flee unstable economies for safer havens. The volatility seen within the crypto market displays a bigger pattern of threat aversion more than likely to persist till extra particular financial indicators present.

Lastly, the most recent $528 million outflow from cryptocurrency belongings emphasizes how unstable the market is in entrance of financial uncertainty. The way forward for digital belongings will likely be formed in nice half by the reactions of trade leaders and the final market response as traders negotiate this stormy terrain.

Featured picture from AARP, chart from TradingView