This text is featured in Bitcoin Journal’s “The Halving Challenge” and is sponsored by HIVE Digital Applied sciences LTD as a part of Bitcoin Journal’s “Purchase The Numbers” content material sequence. Click on right here to get your Annual Bitcoin Journal Subscription.

Calculated possibilities had been calculated by Greg @ learnmeabitcoin.com

Block 840,000 isn’t just one other block within the blockchain; it triggers the Bitcoin halving the place the block reward is decreased from 6.25 BTC to three.125 BTC, slicing the quantity of BTC mined every day in half. You don’t need to be a Princeton economist to know the affect this can have on the availability and demand dynamics for bitcoin. Past the apparent halving of the block reward, a brand new market has developed round Ordinals which may have a major affect on what occurs to the primary block of the halving. Contained inside the first block of the halving is an especially uncommon “epic sat”. Whereas Ordinals have divided some Bitcoiners on their benefit, there isn’t any arguing the affect they’ve had on Bitcoin.and it raises an necessary query, may Ordinals trigger a blockchain reorg? Via this text we are going to dig into the fundamentals of a reorg, Ordinals demand, how mining possibilities work, and at last who may pull off a profitable reorg.

Earlier than we dig into this “epic sat”, let’s construct an understanding of what a reorg is. The Bitcoin blockchain is a gradual and dumb database that creates blocks of knowledge each 10 minutes or so. It continues working as meant, however often, issues get tense. When two miners discover blocks practically concurrently, it creates a brief fork within the blockchain. This second of overlap results in a quick interval of uncertainty. These forks are resolved by the community via the longest chain rule, which is when the fork tip of the blockchain with extra proof-of-work (the longest chain or aka extra blocks) shall be adopted because the legitimate chain. Orphaned blocks from the shorter chain aren’t included within the longer one, and the transactions they include are returned to the mempool to be included in future blocks. This course of of 1 chain turning into longer than the opposite and turning into the accepted model is called a reorganization, or reorg.

Because of the incentive constructions constructed into Bitcoin mining, reorgs are often resolved as quickly as the subsequent block is discovered and added to the tip of one of many forked chains. It’s because discovering a block is extraordinarily tough, and miners are incentivized to work on the longest chain with a view to construct the subsequent block, and receives a commission. If they’re mining on the quick fork, the remainder of the community will go away them behind and they’ll have invalid blocks. The very last thing you’ll need is to construct a block that’s rejected by the community since you’ve constructed a block on a series and are rejected by the community because of the longest chain rule. In the course of the reorg interval of a fork, miners construct on whichever chain fork hits their node first and attempt to construct a block to get the longest chain.

Now don’t get nervous about reorgs. They occur each couple of months (on common) and usually contain one or two blocks. These quick reorgs are a part of the community’s common operation and rapidly resolve with none important affect on the community and its customers. It’s price noting that deep reorgs that encompass many blocks are uncommon and, correspondingly, extra disruptive. They are often triggered by a community break up resembling what occurred within the Blocksize wars, or a brand new giant miner coming to the community, or an try to double-spend transactions (that is very uncommon).

Most Current Reorgs

The Bitcoin protocol and its incentives are designed in order that there’s a low probability of deep reorgs occurring. Consensus guidelines and incentives are supposed to maintain the community secure and safe. For instance, most exchanges and cost processors require {that a} transaction be confirmed by a set variety of instances—often six or extra—earlier than a transaction will be thought-about last, thus vastly decreasing the probabilities of it being unwound by a reorg. Small reorgs occur and are mundane and frequent operations inside the Bitcoin blockchain, however giant reorgs are notable and really irregular.

About That Epic Sat

You’ve most likely heard the thrill about Ordinals, that’s “a numbering scheme for satoshis that permits monitoring and transferring particular person sats”. Some argue that Ordinals are a rip-off and so they don’t have any place in Bitcoin, however right here’s the factor, an rising market is quickly rising round Ordinals. For now, they’re right here, and they’re getting consideration from miners, devs, VC, collectors, scammers, and haters alike.

Relating to Ordinals, they’re labeled by their “rarity” and markets decide worth.

Ordinals rarity ranges:

+ widespread: Any sat that isn’t the primary sat of its block

+ unusual: The primary sat of every block

+ uncommon: The primary sat of every issue adjustment interval

+ epic: The primary sat of every halving epoch

+ legendary: The primary sat of every cycle

+ mythic: The primary sat of the genesis block

If we think about the state of affairs the place all Bitcoin has been mined, which means that each one 21 million bitcoins (or 2.1 quadrillion satoshis) are in circulation, we are able to calculate the full amount of every degree of Ordinals:

Unusual: There could be a complete of 6,929,999 unusual satoshis, similar to the primary satoshi of every block.Uncommon: There could be a complete of roughly 3,437 uncommon satoshis, similar to the primary satoshi of every issue adjustment interval.Epic: There could be a complete of 32 epic satoshis, similar to the primary satoshi of every halving epoch.Legendary: There could be roughly 5 legendary satoshis, similar to the primary satoshi of every cycle (noting a slight approximation because of division).Mythic: There’s 1 mythic satoshi, which is the primary sat of the genesis block.

These figures give an outline of how the rarity classifications would distribute throughout the full provide of satoshis as soon as all Bitcoin is mined, showcasing the distinctive and scarce nature of sure satoshis inside the Bitcoin community.

The Ordinals Market and Past

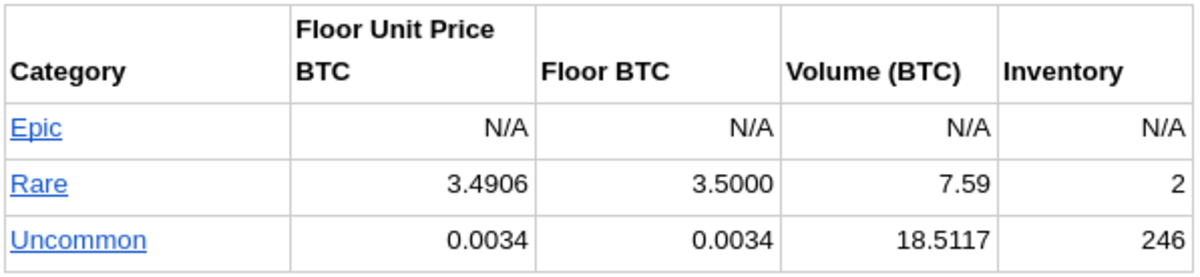

Over the previous 12 months we’ve seen speedy improvement in Ordinals expertise and markets. Ordinals markets first emerged in Discord again channels the place OTC offers had been being made, however as demand has grown, digital marketplaces have developed for purchasing and promoting Ordinals. US Primarily based Magisat.io lists varied varieties of Ordinals and has Uncommon sats listed for a staggering 3.49 BTC. This valuation has led to the creation of further stock of Ordinals past the class that was first described within the Ordinals documentation.

Present Market on Magisat.io for normal Ordinals

This knowledge exhibits that there’s a small however rising demand for Ordinals. You possibly can see the amount for Uncommon amd Unusual Ordinals are better than 26 BTC on the time of scripting this. Understand that this is just one market and there are a rising variety of OTC offers which can be taking place between consumers and sellers to not point out demand and enterprise taking place in different components of the world.

Trying past Ordinals marketplaces we at the moment are seeing Ordinals make their method to legendary public sale home Sotheby’s additional propelling the phenomenon in direction of the mainstream. In the event you look throughout the Pacific Ocean there may be additionally important demand for Ordinals and BRC-20 tokens, which might not be potential with out Ordinals. So the demand for Ordinals is actual and it’s rising, not waning.

The final important merchandise of be aware that might affect demand for this primary block of the halving is the activation of Runes. Runes is one other protocol launched by the identical creator of Ordinals, however the intention of Runes is to make a extra environment friendly token protocol. The kicker on that is that with it going dwell within the first block of the halving, this alone will trigger a major demand to problem these new tokens as rapidly as potential, presumably the primary Runes issued shall be extra precious than later issued Runes. “Sure there shall be reorg incentive for block 840,000, nevertheless it’s not for epic sat — it is for the 20btc in charges from Casey’s Runes.” mentioned Charlie Spears on X. This charge income name is theory nevertheless it comes from statement from earlier Ordinals and BRC20 exercise.

Sifting For Sats

In Bitcoin, “mud” refers to an quantity of bitcoin so small that it can’t be spent as a result of the price of a transaction charge could be increased than the quantity itself. The idea of a “mud restrict” due to this fact varies relying on the transaction charge and the kind of transaction being made. Nonetheless, there are common pointers for what is taken into account mud, primarily based on the kind of Bitcoin script or handle getting used.

The mud restrict is calculated primarily based on the dimensions of the inputs and outputs that make up a transaction. For a transaction to be relayed by most nodes and mined, its outputs have to be above the mud restrict. The mud restrict for the standard P2PKH (Pay-to-Public-Key Hash) transaction output is usually thought-about to be 546 satoshis when utilizing the default minimal relay charge of 1 satoshi per byte, however this could fluctuate relying on the community situations and the insurance policies of particular person nodes.

For various script sorts, the mud restrict calculation takes under consideration the dimensions of the script and due to this fact can fluctuate:

P2PKH (Pay-to-Public-Key Hash): That is the most typical kind, and its mud restrict is often round 546 satoshis.P2SH (Pay-to-Script Hash): Outputs for P2SH transactions can have a barely increased mud restrict as a result of the script itself is extra complicated, requiring extra knowledge to be included in a transaction.P2WPKH (Pay-to-Witness-Public-Key Hash) and P2WSH (Pay-to-Witness-Script Hash): These SegWit (Segregated Witness) transactions have completely different weight calculations, resulting in decrease charges for a similar quantity of knowledge. Consequently, the mud restrict for SegWit transactions will be decrease than for conventional P2PKH transactions. For P2WPKH, the mud restrict is likely to be nearer to 294 satoshis.MultiSig: Transactions involving a number of signatures (MultiSig) have increased mud limits because of the elevated knowledge dimension required to accommodate a number of signatures.

The precise mud restrict can fluctuate as a result of it relies on the transaction’s dimension and the present charge market. Moreover, modifications in Bitcoin’s protocol or node insurance policies can have an effect on these thresholds. It is also price noting that some wallets and providers would possibly set their very own mud limits primarily based on their operational necessities.

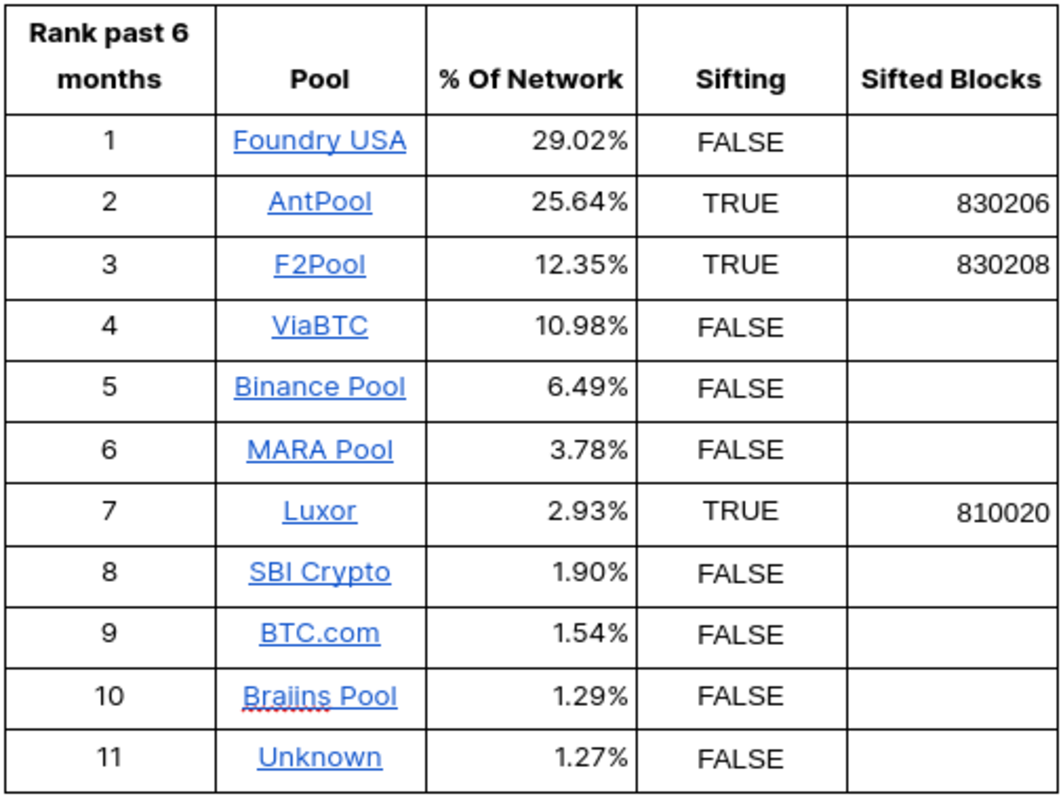

Swimming pools Sifting

Primarily based on the data above we are able to study blocks discovered by swimming pools to see if swimming pools are actively sifting blocks. What we see is 44% of the community is or has sifted for sats previously 12 months. We now have motive to consider that further swimming pools are in discussions with sifting expertise builders in deploying the tech on their swimming pools, however nothing has been made public at the moment. Our findings reveal {that a} very important proportion of the mining community sees worth in sifting for these sats, in any other case this could be a hobbyist endeavor. When this many massive gamers are collaborating, you understand there may be some market dynamics taking place.

Past blockchain investigation outlined above, miners are creating new markets of their very own in mining irregular transactions for varied tasks. Most notably is publicluy traded mining pool Marathon who launched a brand new service known as Slipstream which is able to mine complicated transactions resembling 1 sat UTXO which is way beneath the SEGWIT mud threshold of 546 sats. I carry this up as a result of as they’re providing this service, you possibly can’t assist however assume that Marathon sees or will quickly see worth in Ordinals of they’re prepared to speculate assets in serving Ordinal or Ordinal adjoining tasks with this service. Afterall, the duty of publicly traded corporations is to maximise worth for shareholders.

We all know greater than 40% of hashrate is sifting for sats, however what does that actually imply within the grand scheme of issues. Afterall, we’re speaking about one particular sat, the epic sat in block 840,000. We all know that Ordinals have worth in keeping with the very small market, we additionally know that this sat will possible be offered for greater than a single blocks reward, however the massive query is who may forcibly win this block? Proof of Work is all in regards to the longest chain and ethics don’t matter with regards to Bitcoin and the blockchain. The chain is reality, even in the event you had been to reorg. If you’re hashing and following consensus and also you construct an extended chain then you’re the victor. Primarily based on the desk from the earlier part, we are able to see who the highest swimming pools are from the previous six months. With that info we are able to mannequin the likelihood of those swimming pools forking and inflicting a reorg of the blockchain with a view to win the epic sat however we have to run the numbers. For this we are going to discover the mining part of the Bitcoin Whitepaper.

Mining Defined within the Whitepaper

Bitcoin mining is a race to discover a legitimate block by fixing a cryptographic puzzle, often known as proof of labor. The issue of this puzzle is adjusted by the community in order that, on common, a brand new block is discovered each 10 minutes, whatever the whole computing energy of the community. Now the safety of that is the place issues get fascinating. Part 11 of the Bitcoin whitepaper discusses the arithmetic behind the safety of the blockchain in opposition to attackers who attempt to alter the transaction historical past.

The paper makes use of a comparability to a gambler’s “damage downside” to clarify how tough it’s for an attacker to meet up with the remainder of the community as soon as they fall behind within the race so as to add new blocks to the chain. Primarily, if trustworthy nodes management extra computational energy, the likelihood that an attacker can catch up decreases quickly as they fall additional behind within the blockchain. The likelihood that an attacker can catch up turns into nearly zero if they don’t have a majority of the computational energy.

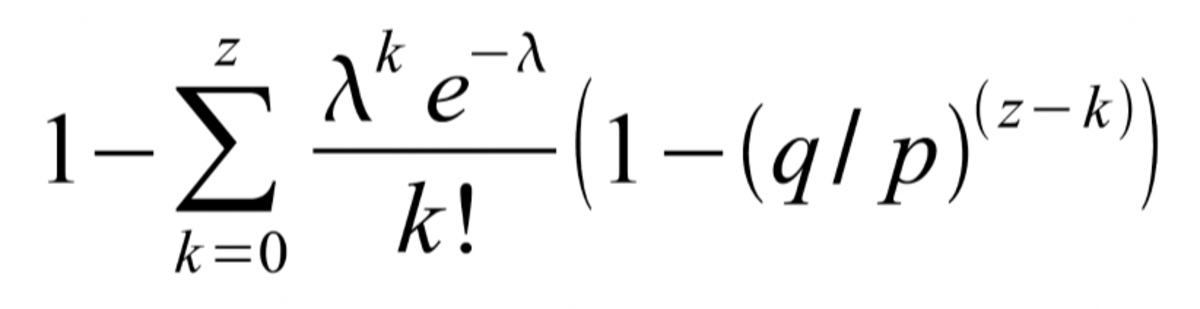

The part outlines the method the place transactions develop into safer as new blocks are added to the blockchain, utilizing a Poisson distribution to mannequin the probability of an attacker catching up from being behind the chain tip. This framework offers the idea for understanding how blockchain achieves safety via probabilistic means not absolute ensures.

Within the Bitcoin whitepaper, the Poisson distribution is used to mannequin the safety of mining. It is used to quantify the likelihood that an attacker can meet up with the trustworthy nodes after being z blocks behind, which is important when contemplating the chance of a blockchain reorganization. It affords a statistical view of how possible it’s for an attacker, with a sure proportion of the full community hash fee, to rewrite the blockchain historical past.

Changing to C code…

#embrace

double AttackerSuccessProbability(double q, int z)

{

double p = 1.0 – q;

double lambda = z * (q / p);

double sum = 1.0;

int i, okay;

for (okay = 0; okay <= z; okay++)

{

double poisson = exp(-lambda);

for (i = 1; i <= okay; i++)

poisson *= lambda / i;

sum -= poisson * (1 – pow(q / p, z – okay));

}

return sum;

}

Who Might Pull This Off?

Ordinals introduces a brand new incentive to reorg. Earlier than Ordinals, the specter of a reorg was centered round a double spend assault, however Ordinals launched the demand for particular person sats, on this case the demand to win a particular block. The query is that this, does the worth of a single Epic sat or block warrant abandoning the longest chain in hopes of discovering a pair fast blocks and successful that epic sat? Pubco mining swimming pools can have a tough time justifying such motion to shareholders, it appears negligent. However for personal mining swimming pools, they’ve completely different incentives and have a bit extra freedom in how they pursue income.

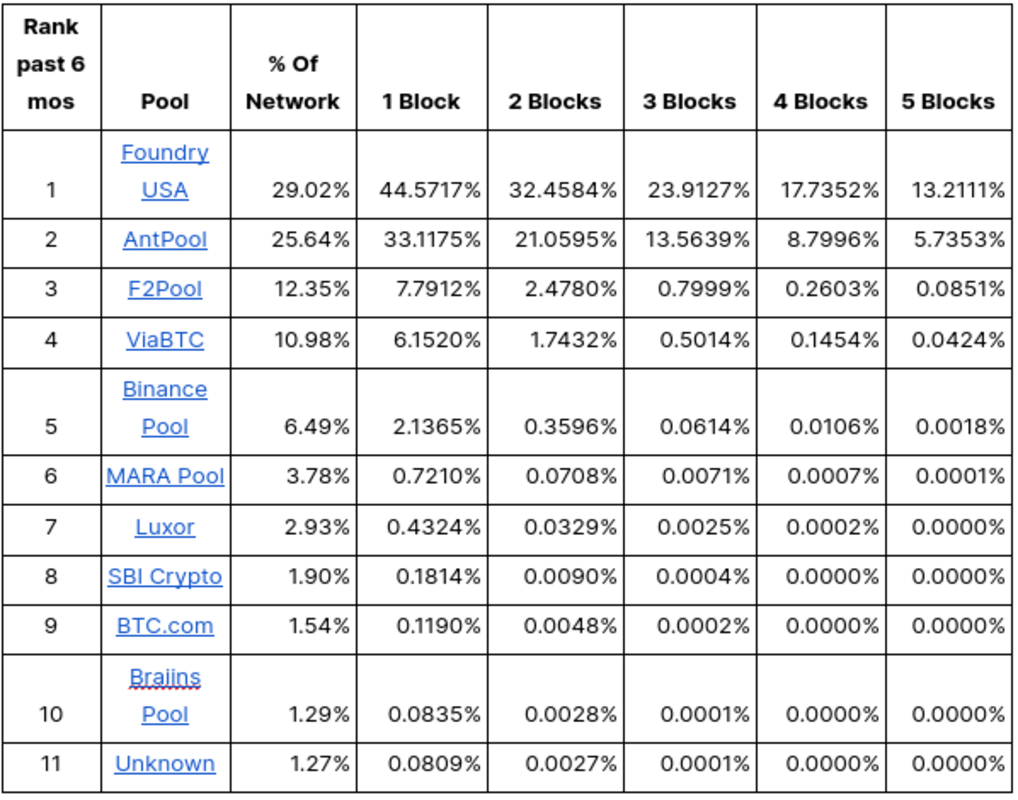

Trying on the prime 10 mining swimming pools by their % of the community, we are able to mannequin out who may pull off a reorg. One factor of be aware, the formulation described within the whitepaper solely mannequin catching up with the chain tip, nevertheless a reorg would require catching as much as the tip +1 block, so our values beneath present that likelihood.

The very first thing I observed was Foundry and Antpool have the next % likelihood of pulling off a reorg from 1 block behind than their very own % hashrate of the community. How may this be potential? It’s because A miner with 30% of the hashrate being 1 block behind and trying a reorg is at a drawback as a result of the remainder of the community (70% hashrate) collectively has the next likelihood of extending the present longest chain earlier than the miner can catch up and surpass it. Nonetheless, because of the randomness captured by the Poisson distribution, there’s all the time a non-zero likelihood that this miner may, via a streak of fine luck, mine sufficient blocks in a row to take over the longest chain, even from one block behind. That is statistically unlikely however turns into potential with increased hashrate percentages and quick reorg depths.

The following key takeaway is how profitable reorgs develop into much less possible for every block they’re behind. It’s exceptional how Foundry may nonetheless reorg from 5 blocks behind.

Conclusion

The Bitcoin area is bizarre (all the time has been) and bitcoin miners are the longest of lengthy with regards to outlook on Bitcoin. Primarily based on the reorg likelihood and the potential worth from the extra worth on the primary block of the halving, the likelihood of a reorg feels possible. In the event you take the BTC mined from this block, the epic sat, plus the projected quantity of charges that shall be earned from the discharge of Runes, greater swimming pools could be silly to not try to make a transfer to win this block. The one actual draw back of a reorg could be by engaged on the previous chain and NOT successful the reorg, so you’ll miss out on probably successful 1-2 blocks by mining on the unique longest chain. I do hope for fireworks. It is going to be legendary to listen to the discuss tracks from the brand new Wall Avenue monetary bros making an attempt to clarify this. On the finish of the day, miners should decide, that’s to easily construct on the longest chain or to try to construct the longest chain with heavy quantities of luck. They have to think about the tradeoffs and choose their poisson.

CODE

===========REORG-SUCCESS.RB=========================================

# —-

# Knowledge

# —-

miners = {

‘ foundryusa’ => 30,

‘antpool’ => 25.64,

‘f2pool’ => 12.35,

‘viabtc’ => 10.98,

‘binancepool’ => 6.49,

‘marapool’ => 3.78,

‘luxor’ => 2.93,

‘sbicrypto’ => 1.90,

‘btcdotcom’ => 1.54,

‘braiinspool’ => 1.29,

‘unknown’ => 1.27,

}

# ——–

# Equation

# ——–

def attacker_success_probability(q, z)

# p = likelihood trustworthy node finds the subsequent block

# q = likelihood attacker finds the subsequent block

# z = variety of blocks to catch up

p = 1 – q

lambda = z * (q / p) # anticipated variety of occurrences within the poisson distribution

sum = 1.0

for okay in 0..z

poisson = Math.exp(-lambda) # exp() raises e (pure logarithm) to a quantity

for i in 1..okay

poisson *= lambda / i

finish

sum -= poisson * (1 – (q/p)**(z-k) )

finish

return sum

finish

# ——–

# Outcomes

# ——–

# Run via every of the miners within the listing

miners.every do |miner, proportion|

# Print miner identify

places “#{miner}”

# Convert proportion to likelihood

likelihood = proportion / 100.0

# Calculate their success of changing a unique variety of blocks close to the highest of the chain

1.upto(5) do |blocks|

# NOTE!

# Add 1 to the variety of blocks.

# It’s because we do not need to calculate the likelihood of merely catching as much as the tip of the chain (which is what the equation calculates).

# To carry out a profitable assault, we would like calculate the likelihood of constructing a series that’s ONE BLOCK LONGER than the present chain. That approach, different nodes shall be pressured to undertake it and we can have efficiently rewritten the blockchain.

# Calculate success for particular variety of blocks primarily based on their hash share

success = attacker_success_probability(likelihood, blocks+1)

# Convert likelihood to proportion

success_percentage = success * 100.0

# present outcomes

places ” #{blocks} = #{“%.8f” % success_percentage}%”

# NOTE: The %.8f converts from scientific notation to decimal

# Modify the quantity (e.g. 8) to manage what number of decimal locations you need to present

finish

# Add hole between outcomes for every miner

places

finish

This text is featured in Bitcoin Journal’s “The Halving Challenge”. Click on right here to get your Annual Bitcoin Journal Subscription.