Este artículo también está disponible en español.

Ethereum is down when writing, mirroring the final efficiency throughout the board. The almost 2% drop within the crypto scene is as a result of contraction of Bitcoin, Ethereum, and high altcoins. At current, the whole market cap is all the way down to $2.17 trillion. It may put up much more losses ought to bears press on, reversing the positive factors of September.

Ethereum Below Strain, Will $2,350 Supply Help?

Within the final week alone, CoinMarketCap knowledge exhibits that Ethereum is down 10%, pushing losses beneath $2,400, a former help, now resistance. Whereas it may seem that the sharp dump of the higher a part of this week is discouraging participation, some merchants are accumulating at round spot charges.

Associated Studying

IntoTheBlock knowledge on October 3 exhibits that 1.89 million Ethereum addresses purchased 52 million ETH at across the $2,311 and $2,383 vary. That a considerable amount of consumers select to purchase, on common, at $2,350 means this can be a help degree that merchants ought to carefully watch.

Contemplating the variety of ETH accrued, sellers would want to exert extra effort to interrupt beneath this degree, forcing the coin in direction of $2,100 and August lows. Evaluating merchants’ motion and the September vary, the $2,350 degree falls at round 61.8% and 78.6% Fibonacci retracement ranges.

What’s Subsequent For ETH?

Technically, crypto costs, together with ETH, have a tendency to search out help round this Fibonacci retracement zone. Accordingly, how costs react between the $2,100 and $2,350 zone will probably form the medium to long-term development.

Associated Studying: What’s Holding Bitcoin Again? Analyst Says $71,000 Is The Magic Quantity

A refreshing bounce round this rising help and Fibonacci retracement zone can be an enormous enhance. On this case, ETH may rally, even above $2,800, as bulls goal $3,500.

Conversely, any sharp dump beneath August and September lows could simply set off panic promoting. Out of this, ETH can stoop beneath $2,100 and $2,000 and should fall to as little as $1,800, confirming losses of early August.

Contemplating the state of value motion, sellers have the higher hand. Over the previous few buying and selling periods, centralized exchanges have had large outflows.

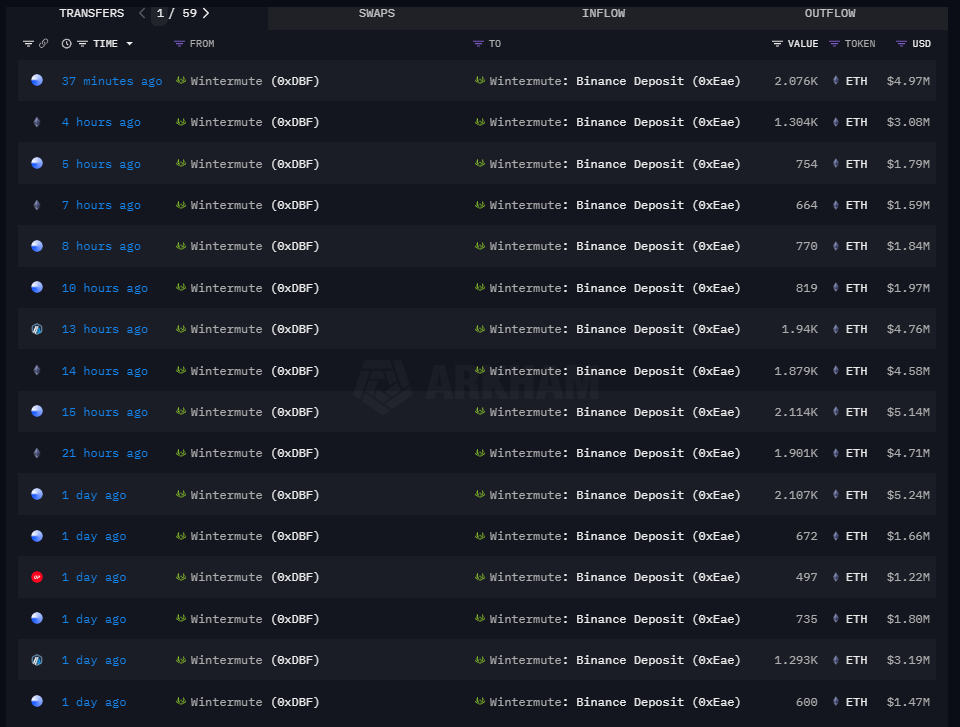

Earlier as we speak, The Information Nerd revealed that Wintermute, a crypto market maker, moved 14,221 ETH to Binance, indicating that they could promote. In August, Wintermute and different main market makers, together with Soar Capital, offered over 130,000 ETH, forcing costs decrease.

Function picture from DALLE, chart from TradingView