Market Outlook #249 (eleventh December 2023)

Hey, and welcome to the 249th instalment of my Market Outlook.

On this week’s submit, I can be masking Bitcoin, Ethereum, Polygon, Uniswap, Optimism, Alchemix, Altered State Machine and Raini.

As ever, when you’ve got any requests for subsequent week, ship them throughout.

Bitcoin:

Weekly:

Every day:

Value:

Market Cap:

Ideas: If we start by taking a look at BTC/USD, on the weekly timeframe we are able to see that final week closed at recent yearly highs, via $42k resistance on rising quantity. Value closed out the week simply shy of $44k and early buying and selling this week has seen value dump again under $42k however maintain above $39.7k as help, pushing up from that space again in direction of $42k, the place it’s at the moment sat. Taking a look at this, there’s little or no to recommend any slowdown, significantly after final week’s shut via that confluence of resistance. While we proceed to carry above $39.7k this week, I feel we see this consolidation round $42k result in additional growth subsequent week into the 61.8% retracement stage and prior resistance at $48k, the place it’s doubtless we begin to kind a neighborhood prime. If, nonetheless, this sell-off continues later this week and we shut the week again under $39.7k, it’s doubtless the native prime has fashioned right here and we are able to search for additional draw back subsequent week into $36k to retest all that prior resistance as help; under that stage, we filter all of the untapped lows into $33k. That’s the roadmap from each views going into 2024.

Turning to the day by day, we are able to see that value bought off sharply yesterday in one thing of a mini liquidation cascade, taking it from up close to $44k down into $40k, earlier than bouncing and now consolidating proper under that $42k stage. At current, $42k is day by day resistance, so reclaiming that over the following day or two would recommend an additional restoration of that cascade and certain a march to recent highs from there; if, nonetheless, $42k continues to behave as resistance this week, we might have additional to fall but earlier than discovering a backside, with $39.6k but untested – a second leg decrease into that stage adopted by a $42k reclaim can be a pleasant backside formation to search for longs. As talked about above, till we shut the upper timeframes under $39.6k, I don’t suppose this uptrend is finished fairly but. And above $45k there’s solely air into $48k.

Ethereum:

ETH/USD

Weekly:

Every day:

ETH/BTC

Weekly:

Every day:

Value:

Market Cap:

Ideas: Starting with ETH/USD, we are able to see that value closed firmly via resistance at $2170 final week, pushing as excessive as $2400 earlier than closing at $2350 on good quantity. We had been inches shy of that $2425 stage however value has rejected that resistance early this week, clearing out the prior weekly low into prior resistance turned help at $2170 and bouncing off it. If we are able to now maintain above that stage, that appears very very like a bit of flush earlier than growth past the 38.2% fib and reclaimed resistance at $2426, with $2650 the following stage of curiosity above that. If we shut the weekly again under $2170, I’d count on $1850 to be retested earlier than a backside is discovered, the place there’s loads of confluence. Turning to the day by day, we are able to see how the pair depraved proper into that prior resistance cluster earlier than bouncing laborious yesterday, so holding above $2137 over the following day or two is paramount for this construction to stay legitimate as resistance turned help; begin closing again inside these resistances and the image seems much less fairly, with a load of untapped lows seen earlier than that $1850 stage comes into view, the place the 200dMA can also be sat…

Trying now at ETH/BTC, final week retested 0.051 as help and held as soon as once more, bouncing off that to shut at 0.0537, however remaining firmly capped by 0.0551 as resistance. As talked about final week, the image could be very clear right here: under 0.051 we take out 0.04877 earlier than discovering a backside; and above 0.0551 and the 200wMA we development in direction of trendline resistance. No have to make it any extra sophisticated than that. An extended-term reversal solely turns into excessive chance as soon as we flip that multi-year trendline into help, for my part.

Polygon:

MATIC/USD

Weekly:

Every day:

MATIC/BTC

Weekly:

Every day:

Value:

Market Cap:

Ideas: Starting with MATIC/USD, we are able to see on the weekly that value bounced off that 200wMA final week and rallied again into help turned resistance at $0.92, closing proper at that confluence of resistance. Early this week, the pair has bought off, holding above the 200wMA and now sat in no man’s land throughout the prior weekly vary. Till we get a weekly shut above $0.93, we are able to’t make sure of additional growth / development continuation, however given the construction right here and the response off the 200wMA I’m leaning in direction of a breakout quickly. If we drop into the day by day, we are able to see that value additionally held above the 200dMA, front-running it as help earlier than reversing. So long as we now kind a higher-low above $0.77, I’d count on the following crack at $0.93 to provide means and for the pair to then broaden in direction of $1.30 within the coming weeks.

Turning to MATIC/BTC, we are able to see that value rallied off of help final week, wicking in direction of 1717 satoshis earlier than closing the week at highs round 2100. It is a promising signal for bulls, and if we are able to now maintain above 2000 I’d count on the vary to get stuffed in in direction of the 200wMA and prior help turned resistance at 2450. Dropping into the day by day, we are able to see how value faked out above the 200dMA earlier than retracing into that help cluster and now turning day by day construction bullish on the newest bounce. Acceptance above 2100 on the day by day right here is vital, as that will make it very doubtless we break past the 200dMA once more, and normally the second breakout from a bottoming formation shouldn’t be a fakeout, so we may count on to see 2450 satoshis adopted by 2950.

Uniswap:

UNI/USD

Weekly:

Every day:

UNI/BTC

Weekly:

Every day:

Value:

Market Cap:

Ideas: Starting with UNI/USD, we are able to see on the weekly that value poked above $6.30 final week, pushing in direction of $7.50 earlier than closing again close to $6.60. We undoubtedly have bullish construction right here however UNI stays inside a 580-day vary, having spent a lot of 2023 chopping round above vary help and under $7.50. From right here, I want to see this space round $6.30 maintain as help and value to shut the weekly via $7.50 later in December; that for me is the start of the following cycle for UNI, given how that stage has capped the pair since September 2022. Above it, I feel we take out the $9.90 excessive and proceed into the 23.6% fib retracement of the bear market at $13.87 earlier than discovering any significant resistance. Trying on the day by day, on this timeframe it’s key we maintain above $5.65 as reclaimed help; a pleasant wick under $5.84 into that stage adopted by a reclaim of $6.30 later within the week can be a very nice sign for additional upside, in my opinion.

Turning to UNI/BTC, we are able to see that value is now consolidating above multi-year help at 14k satoshis after deviating under it. While this stage continues to carry as reclaimed help, I feel it seems very very like the underside has fashioned right here and we are able to count on a transfer via 17.5k satoshis to return sooner relatively than later; above that, weekly construction turns bullish and I’d expect outperformance for UNI all the way in which again in direction of that 26.7k satoshis space. Dropping into the day by day we are able to see how the 200dMA continues to cap the rallies lately, so a transfer via 17.5k would additionally flip that into help, offering confluence for additional upside.

Optimism:

OP/USD

Every day:

OP/BTC

Every day:

Value:

Market Cap:

Ideas: As Optimism has solely been buying and selling for round 18 months I’ll focus right here on the Greenback pair.

Taking a look at OP/USD, we are able to see that value could be very a lot in an uptrend, having marked out a backside in June and a macro higher-low in October, then breaking via trendline resistance from the all-time excessive, flipping the 200dMA as help and persevering with to tear greater. Final week noticed the pair push via the $2 space as resistance into reclaimed resistance proper round $2.40, under which it at the moment sits. That is arguably crucial resistance on the chart at current, with it being each the 61.8% fib retracement of the bear market and the double prime from 2022. Settle for above this stage as reclaimed help and I feel we get a parabolic transfer in direction of all-time highs from there, with a excessive chance that this second bull cycle takes OP into value discovery past $3.30 given the market situations.

Alchemix:

ALCX/USD

Every day:

ALCX/BTC

Every day:

Value:

Market Cap:

Ideas: As each pairs look an identical right here for ALCX, let’s concentrate on the Greenback pair.

Taking a look at ALCX/USD, we are able to see that value had fashioned a long-term backside at $16.42, earlier than breaching it to kind a double backside at $13.46 in 2023. Subsequently, in August 2023, we deviated under that double backside, fashioned a recent all-time low at $10.27 after which consolidated for a couple of months between that low and prior help turned resistance, additionally discovering resistance on the 200dMA, above which the pair had not discovered help (past a short fakeout) for a number of years. Value has since emerged from this vary, reclaiming each $13.46 and $16.42 as help, turning day by day construction bullish. Concurrently, we have now turned the 200dMA into help, above which a higher-low has fashioned. Value rallied from that low into $26.44 final week earlier than rejecting and now retracing again into prior resistance at $18.70. So long as the pair can proceed to carry above $16.42 right here, I’d count on to see continuation greater, as that is very a lot a classical cyclical backside at current and any transfer above $26 will doubtless be the start of the following bull cycle for ALCX. For targets on spot luggage, $73 can be the primary space of curiosity after the hole fill, adopted by $178 after which $478 as main resistance.

Altered State Machine:

ASTO/USD

Every day:

ASTO/BTC

Every day:

Value:

Market Cap:

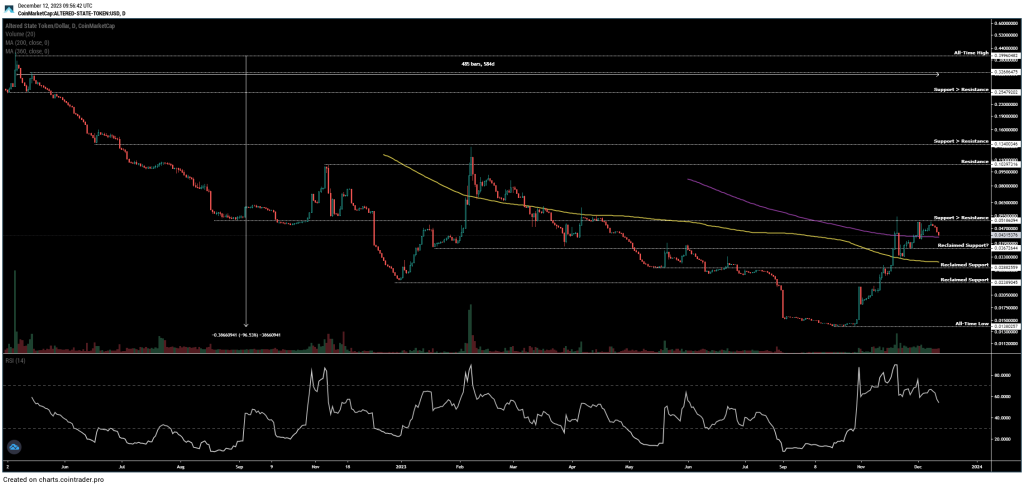

Ideas: Once more, as ASTO has solely been buying and selling for round 18 months, let’s focus right here on the Greenback pair.

Taking a look at ASTO/USD, we are able to see that value has concluded its first bear cycle, dropping 97% of its worth from the all-time highs at $0.40. Value backside in October at $0.014 earlier than starting a pointy rally since, reclaiming a number of ranges of help and shutting firmly above the 200dMA, which acted as help in November. Value is now sandwiched between help turned resistance at $0.052 and reclaimed help at $0.037, sitting marginally above the 360dMA at current. So long as the $0.037 space holds as help, I feel the construction right here is ok regardless of the divergence in momentum; shut under that and we doubtless retraced again in direction of $0.029 to seek out help once more, with $0.024 because the golden alternative for a spot entry if that comes. If this construction does maintain and value merely consolidates inside this vary, I’d look to purchase spot on acceptance above $0.052, as there’s principally no resistance above that for one more 100% rally, and no resistance past $0.13 all the way in which into $0.25. I feel when this one rips, it’ll actually rip, with recent highs past $0.40 doubtless in 2024.

RAINI:

RAINI/USD

Weekly:

Every day:

RAINI/BTC

Weekly:

Every day:

Value:

Market Cap:

Ideas: Starting with RAINI/USD, we are able to see that value closed final week at recent yearly highs for 2023, marginally via resistance at $0.05. We now have since continued to push greater early this week with $0.05 performing as help. If that stage can proceed to behave as help this week, there isn’t a actual resistance on the weekly timeframe again into the 38.2% fib of the bear market and reclaimed resistance at $0.08-$0.088. That may be the place I’d count on a neighborhood prime to start to kind, from which we might get the primary main correction for Raini of this new cycle. If, nonetheless, we deviate above $0.05 this week after which shut again under it, it’s doubtless the native prime is in right here and I’d search for a higher-low to kind above $0.035 earlier than continuation into that vary above. In the end, that is one I’m seeking to maintain for a lot of extra months but, with expectations of recent all-time highs past $0.20 in 2024, significantly given the Beam narrative.

Turning to RAINI/BTC, we are able to see that value is at the moment sat proper round that 38.2% fib however there isn’t an historic stage right here for confluence. I’d count on 156 satoshis to be retested as resistance if we are able to maintain above 121 right here. Past that stage, recent yearly highs are on the way in which via 183, with 230 satoshis the extent to observe for past that. Once more, if you happen to’re in a spot place like me, I’m now sitting on my arms till we hit 280 satoshis as main resistance, promoting a partial after which letting the remainder journey for recent all-time highs.

And that concludes this week’s Market Outlook.

I hope you’ve discovered worth within the learn and thanks for supporting my work!

As ever, be happy to go away any feedback or questions under, or e-mail me immediately at nik@altcointradershandbook.com.