Bitcoin is fixing cash.

Due to Bitcoin, anybody on this planet is free to switch cash over a peer-to-peer community with out having to undergo a monetary establishment. Cash that can’t be censored by authorities, devalued by governments, monopolized by companies, or stopped by borders.

Nonetheless, in relation to buying and selling, going by way of a trusted third celebration nonetheless stays needed. Why is that an issue? As a result of trusted third events all the time have been, and proceed to be, safety holes.

Bitcoin Buying and selling Is Damaged

People and monetary establishments alike depend on trusted third events similar to clearinghouses and exchanges to clear their Bitcoin spot and derivatives transactions.

“Banks have to be trusted to carry our cash and switch it electronically, however they lend it out in waves of credit score bubbles with barely a fraction in reserve.” – Satoshi Nakamoto, 2 Nov 2009

Sound acquainted? Sure, that’s precisely what occurred through the 2022 contagion occasion the place Celsius, Terra, Three Arrows Capital, BlockFi, Voyager, FTX and lots of extra collapsed. More often than not, finish customers, who trusted these third events, misplaced every little thing.

Centralized exchanges are inherently insecure as a result of funds may be pooled collectively with none oversight. Buying and selling and custody ought to by no means, ever be combined.

Wanting on the above listing of bankruptcies, one might really feel helpless and declare Bitcoin buying and selling a no go. As an alternative, we took a re-assessment and questioned: does Bitcoin buying and selling actually need to happen within the books of a trusted third celebration? Definitely not. And Bitcoin itself gives the answer!

Bitcoin is a posh and dynamic system that has not but discovered its equilibrium, and nobody can predict the last word function it’s going to play. Defining Bitcoin is difficult as a result of it intersects a number of domains. Some view it as a monetary asset, others as a forex, a community, and even as an ideological manifesto.

As builders of modern buying and selling options, we’re notably concerned about one dimension: Bitcoin as a technical infrastructure. This technical dimension is the least seen, most likely as a result of its relative complexity, but we discover it one of the crucial fascinating facets of this Unidentified Monetary Object (UFO).

And we firmly consider that Bitcoin the protocol gives the best constructing blocks for the event of sound monetary companies.

Constructing The Future Of Buying and selling On Bitcoin

Bitcoin’s code consists of operations that, when assembled, type a script. This listing of obtainable elementary operations developed over time, with the addition of latest operations to allow extra advanced scripts. These evolutions are sometimes gradual, however this gradual tempo helps protect the soundness and safety of the protocol.

The only script, after all, is the peer-to-peer switch of a unit of worth. The primary buying and selling platforms had been constructed by integrating this performance: it turned potential to switch funds immediately from a pockets to a platform for processing.

The Lightning Community is an software constructed from a extra advanced script. It permits for the risk-free and instantaneous switch of BTC. LN Markets was the primary buying and selling platform to combine this new protocol into its core growth.

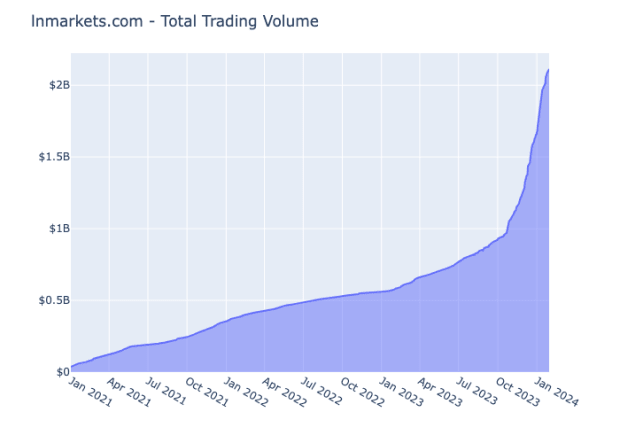

Concentrating on the retail market, its worth proposition is an excessive simplification of the buying and selling expertise: it takes only some seconds for a consumer to deal with every little thing from account creation to collateral switch, all completed immediately from a Lightning pockets. The worth proposition of immediate buying and selling introduced greater than $2 billion cumulative buying and selling quantity.

Constructing on this success, it was solely pure for us to show our consideration to Discreet Log Contracts. A DLC is a local “sensible contract” constructed on Bitcoin which permits the supply of a payoff relying solely on the publication of a value by an oracle.

At this time, we predict it’s time to construct on the DLC protocol to allow full trustless buying and selling and put an finish to the pooling of funds by trusted third events.

Belief Minimized Buying and selling On Bitcoin Is Now A Actuality

Over the previous few months, we’ve been constructing in stealth mode a trustless OTC derivatives buying and selling platform designed to fulfill the wants of crypto monetary establishments: DLC Markets.

Any form of monetary instrument may be traded on DLC Markets with nearly no counterparty threat: Bitcoin futures and choices, merchandise on hashrate and blockspace, and doubtlessly any asset on this planet.

Historically, buying and selling for establishments has all the time been centralized and standardized. Sooner or later, a clearinghouse (CCP) takes management of the funds and manages settlement. Paradoxically, regardless of technological developments, Bitcoin buying and selling is far riskier than conventional buying and selling: no regulation, buying and selling and custody in the identical place, conflicts of curiosity, quite a few dangers, and frequent bankruptcies.

DLC Markets goals to deal with these points. Drawing inspiration from conventional OTC buying and selling, we’re growing a market the place contributors can meet and transact. Much like an ISDA/CSA settlement, collateral is exchanged immediately between friends.

To handle settlement, a wise contract (DLC) acts as a CCP. This sensible contract is exclusive to every transaction, guaranteeing segregated fund administration, full transparency for transaction contributors, and confidentiality from exterior actors.

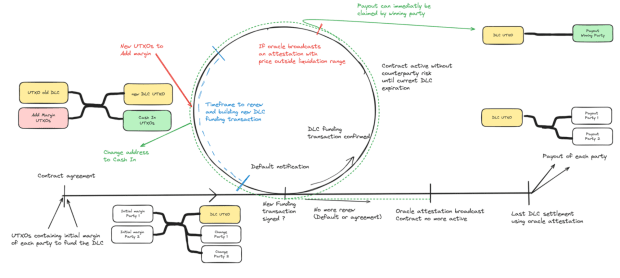

Market contributors can chat and submit bilateral requests for quotes (RFQ) to one another. Upon mutual settlement for a commerce, they verify the trades parameters and submit the preliminary margin to a wise contract on the Bitcoin blockchain. All through the lifetime of the commerce, margin calls, liquidation, and settlement might happen and unlock the corresponding end result within the sensible contract. The computation of any settlement is contingent solely on the publication of an unbiased oracle.

The oracle is a trusted third celebration to confirm sure occasions precisely. In contrast to an escrow, the oracle is just not tasked with decoding or executing the contract. No specific approval is required from the oracle to ascertain or unilaterally settle the contract. The one requirement is using knowledge printed frequently by the oracle, which is each freely obtainable and shareable.

Whereas conventional DLCs may be cumbersome to implement, we introduce a novel method with a coordinator to resolve the free-option dilemma when the DLC is initiated. This method additionally makes it potential to combine margin calls, liquidation and netting within the DLC course of.

Time move chart of margin name steps and hedged interval for DLC with most anticipated transactions format

For a technical deep dive on our answer, verify our white paper.

The Future Is Now

DLC Markets represents a paradigm shift, providing a trustless and safe different to the centralized exchanges which have lengthy dominated the monetary sector. You may already signal as much as check out our Beta!

To speed up Bitcoin as an infrastructure, we’ve accomplished the elevate of a $3 million seed spherical led by ego demise capital, together with Lemniscap and Timechain, becoming a member of our present buyers Arcario, Bitfinex and Fulgur Ventures. We’re very excited to associate with buyers who share our perception that bitcoin-native firms will change the world.

Welcome to a brand new period of transparency, effectivity, and resilience in derivatives buying and selling.

Extra information: https://lnmarkets.com/ & https://dlcmarkets.com/

It is a visitor submit by LN Markets. Opinions expressed are completely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.