This week, China introduced a major financial stimulus bundle geared toward revitalizing its slowing economic system. The measures, introduced by the Individuals’s Financial institution of China (PBOC), embody a mix of financial easing and capital market assist. These actions are designed to stimulate progress after current sluggish financial knowledge and a property market disaster. It’s the largest stimulus bundle because the pandemic. Analysts are questioning how productive the Individuals’s Financial institution of China’s liquidity injections could be, given extraordinarily weak credit score demand from companies and shoppers, and famous the absence of any insurance policies geared toward supporting actual financial exercise. Nonetheless, when requested on CNBC about what he seems to be to purchase in China, billionaire and Appaloosa Administration hedge fund founder and president, David Tepper answered: “Every thing! ETFs, I’d do futures – the whole lot.”

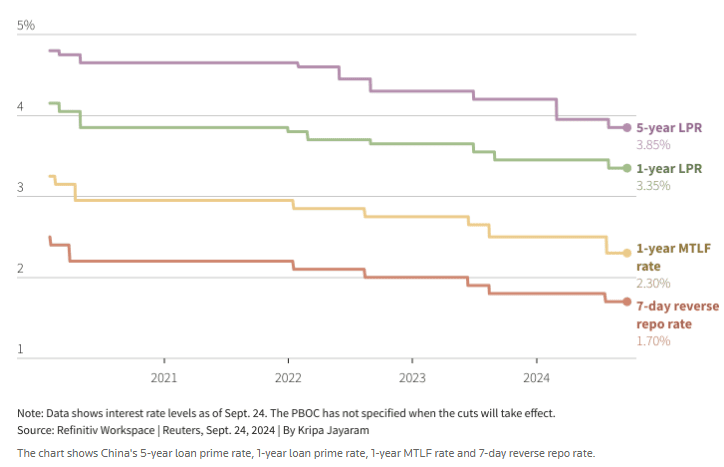

The PBOC choice comes after final week’s Fed’s hefty discount of the rate of interest and that is placing much less stress on the yuan that’s presently appreciating versus the US greenback ($USDCHN). However what are the stimulus measures?

Image supply: Etoro 1 Day chart

Key Stimulus Measures:

Financial Easing:

The PBOC will cut back the reserve requirement ratio (RRR) by 50 foundation factors, releasing up roughly $142 billion for brand new lending. Additional cuts of as much as 0.5 proportion factors could observe later this yr.

A discount in key rates of interest, together with a 0.2 proportion level lower within the seven-day reverse repo charge to 1.5%, will decrease borrowing prices throughout the economic system.

Mortgage and Property Market Help:

Rates of interest on current mortgages will likely be lower by 0.5%, with the minimal down cost for second houses lowered to fifteen%. That is a part of a broader effort to stabilize the property market, which has been in extreme decline

Capital Market Help:

The central financial institution launched a $71 billion liquidity swap program for funds and insurers to spice up inventory market exercise and can supply low-interest loans to industrial banks for share buybacks and growing inventory holdings.

Image supply: Reuters

Image supply: Reuters

Funding Alternatives:

On account of these measures, a number of sectors and funding property are anticipated to learn:

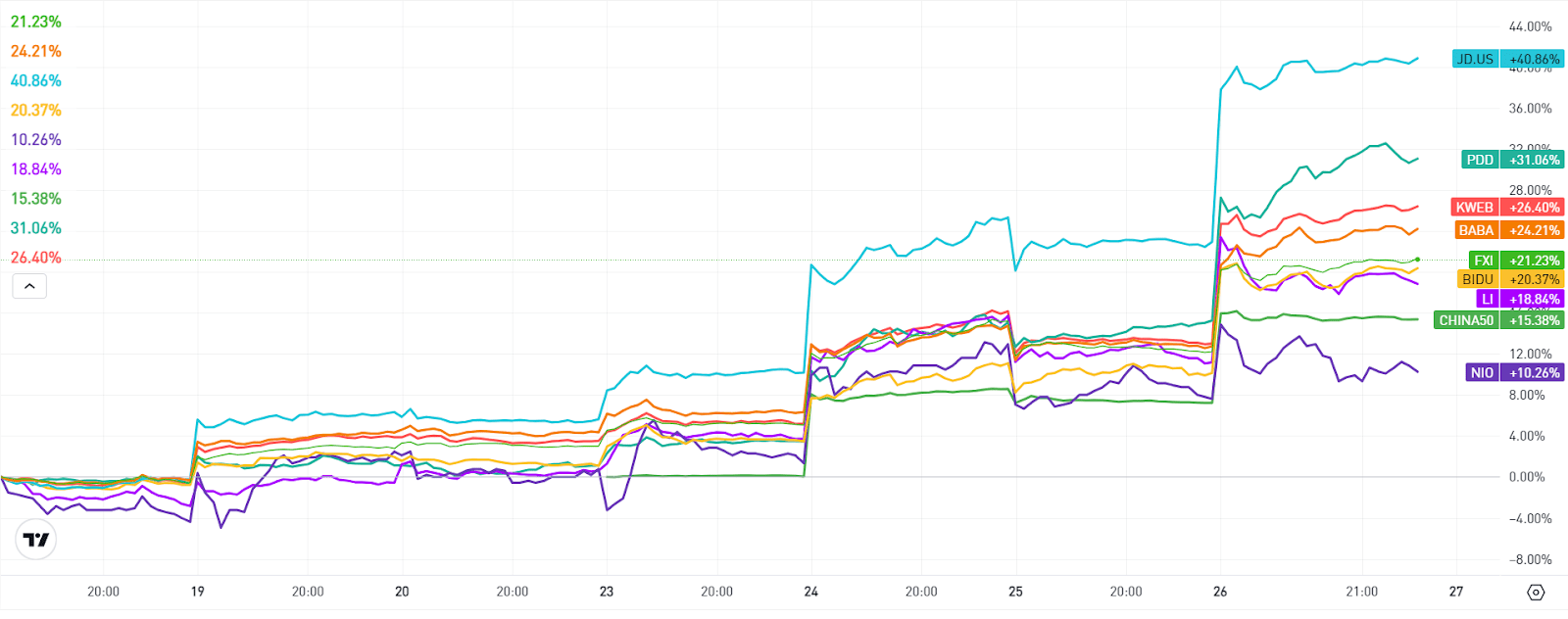

Chinese language Know-how Corporations: U.S.-listed shares of main Chinese language companies like Alibaba ($BABA), PDD Holdings ($PDD), and Li Auto ($LI) have surged following the announcement, with will increase of as much as 12% in some instances.

Metals and Commodities: China’s stimulus is boosting international demand for uncooked supplies. Copper costs have risen attributable to China’s function as the biggest shopper of commercial metals.

Chinese language Property Shares and Actual Property Funds: The property market measures, significantly the mortgage charge cuts, may gain advantage Chinese language actual property companies and funds with publicity to the sector, although these investments stay high-risk.

Image supply: eToro quarter-hour chart

Image supply: eToro quarter-hour chart

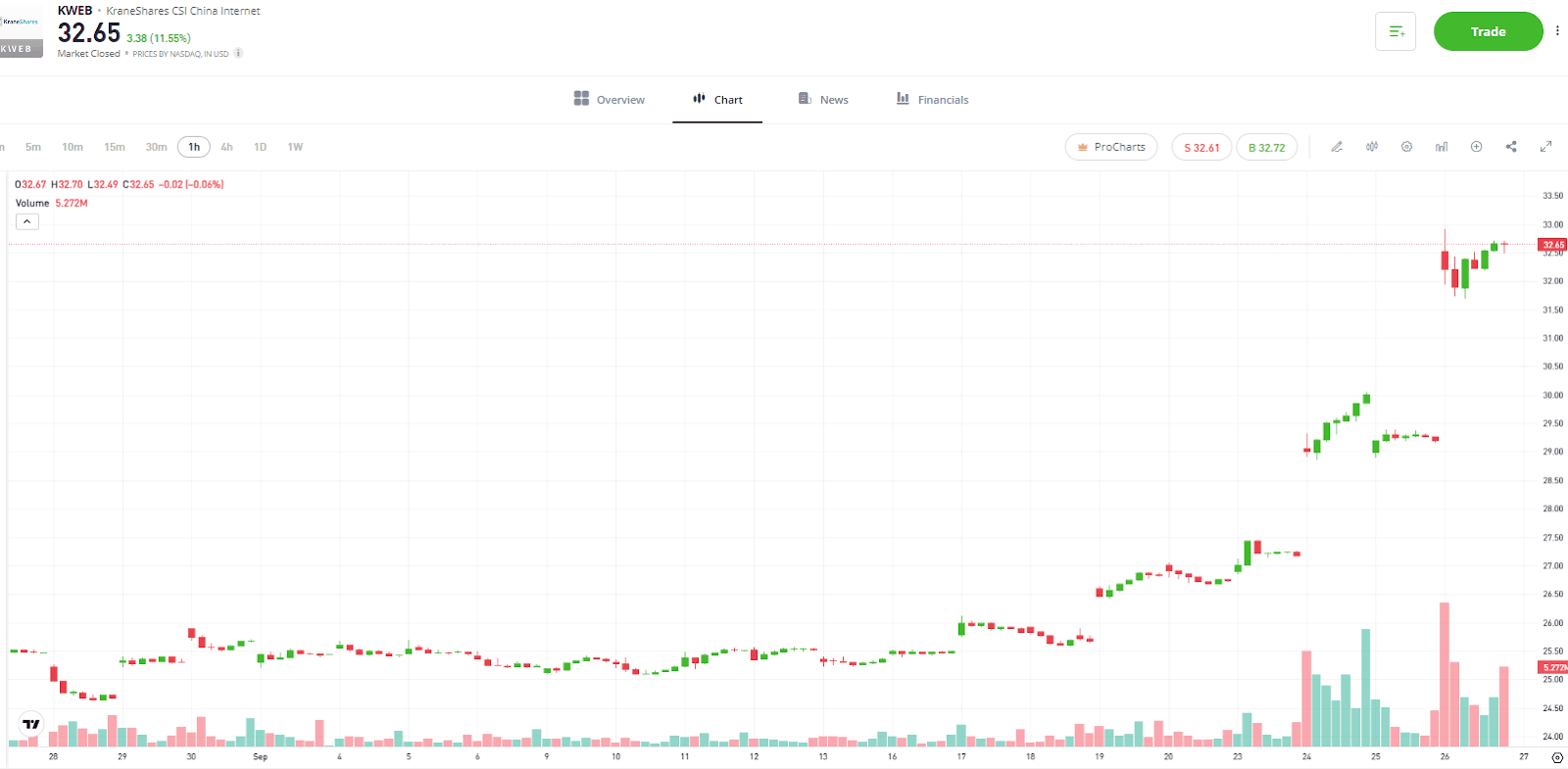

To discover particular investments benefiting from these strikes, you may have a look at exchange-traded funds (ETFs) monitoring Chinese language shares like KraneShares CSI China Web ($KWEB) or particular person U.S.-listed shares of firms like Alibaba ($BABA), JD.com ($JD), Baidu ($BIDU), NIO ($NIO) and Li Auto ($LI). The market already reacted positively to the stimulus bundle and now we have seen a surge (see image above) in all these property.

Charts supply: eToro

Charts supply: eToro

KraneShares CSI China Web ETF ($KWEB) tracks and mirrors the outcomes of publicly traded Chinese language firms that target web companies. Up to now month the index gained 28%, with over 22% enhance previously week (see charts above), attributable to market expectations that we are going to lastly see a stimulus bundle geared toward preventing the slowdown within the Chinese language economic system. However a look at the long run chart exhibits that the fund traded at a excessive of 104 USD in 2021. Normally such stimulus have long run implications on the economic system and firms efficiency.

Billionaire and Appaloosa Administration hedge fund founder David Tepper stated his huge guess after the Federal Reserve’s charge lower was to purchase Chinese language shares. What’s David Tepper shopping for in China? “Every thing,” he says.

Tepper additionally famous the Chinese language market is cheaper than U.S. equities. “You’re sitting there with single a number of P/Es with double-digit progress charges for the large shares that commerce over right here,” Tepper stated. “That’s sort of versus what, you understand, the 20-plus on the S&P.”

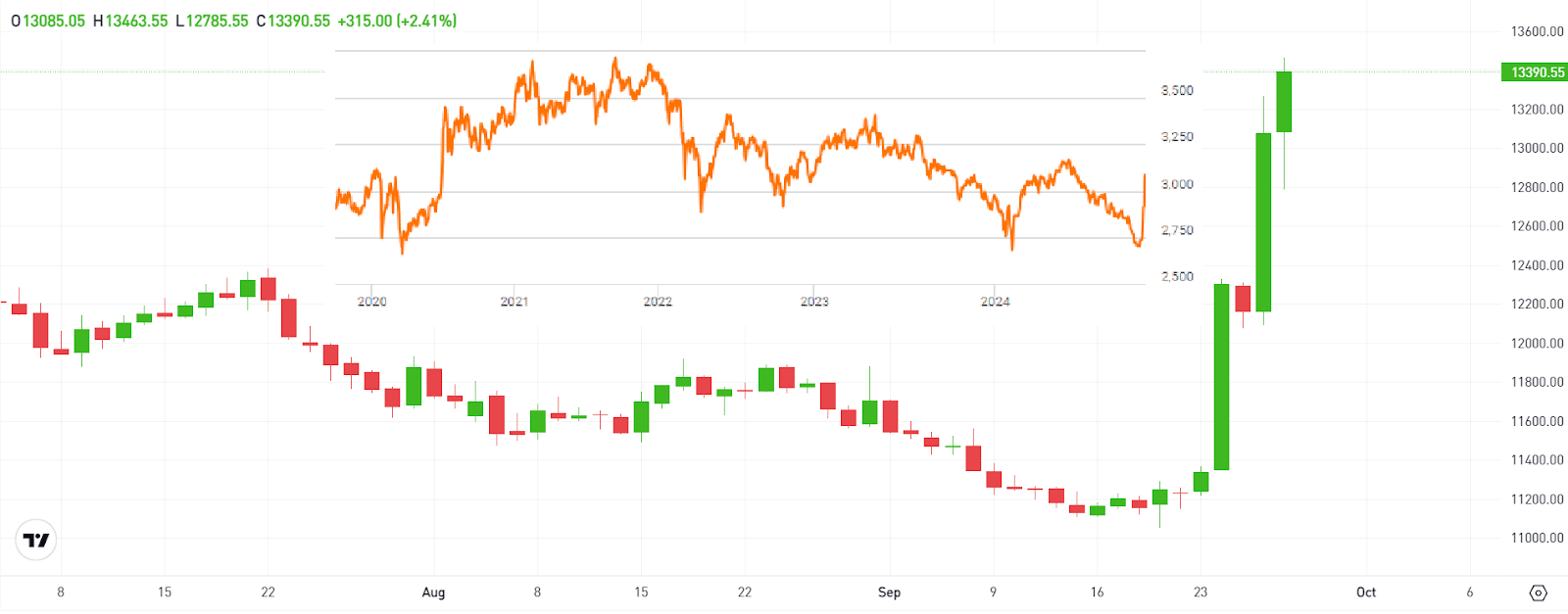

Supply: eToro CHINA50 1 Day chart, Looking for Alpha 5Y chart

Supply: eToro CHINA50 1 Day chart, Looking for Alpha 5Y chart

The Shanghai Index ($CHINA50) – see image above – gained over 12% previously 5 days, and the stimulus measures are having a constructive influence on different Asian markets as properly, because the regional economies expect to learn from revitalization of the Chinese language economic system.

Yr so far the Shanghai Index returned virtually a 3% enhance however it’s at -1% previously 12 months and at solely 5% progress previously 5 years. However there may be nonetheless room for progress for the Chinese language monetary markets when you have a look at the 5 years chart (the orange chart within the nook of the above image), because the index remains to be properly under the 2021 heights. Whereas now it’s wanting that the Chinese language market is having loads of alternatives, excessive volatility, geo-politics and the management over the economic system by the Chinese language authorities can convey dangers into the monetary markets too. Whereas wanting on the alternatives, buyers must also fastidiously contemplate the dangers that they might face and make their very own evaluation.