Lululemon’s sturdy development has made it the second most beneficial sportswear model globally, pushed by worldwide demand, and a loyal buyer base.

Regardless of latest good points, Lululemon’s valuation stays comparatively low in comparison with friends, suggesting potential upside if development continues.

Nonetheless, dangers from competitors, shifting client tendencies, and financial uncertainties may impression its development trajectory.

After rising by over 10% since its final earnings report, Lululemon overtook Adidas to turn out to be the world’s second most beneficial sportswear producer. What many wrote off as a inventory previous its prime is wanting extra like a diamond within the tough. Whereas most retailers wrestle with weak client tendencies and international financial uncertainty, Lululemon continues to face out.

This athleisure designer is holding its top-line development going, propelled by new designs, retailer expansions, and surprisingly sturdy demand in China. Couple that with a loyal, higher-income client base, and you’ve got the recipe to defy business tendencies.

However after its newest rally, traders should ask: Is that this yoga-based model priced for perfection, or is there nonetheless room to develop?

What does Lululemon do?

Lululemon Athletica remodeled from a distinct segment yoga-wear model into a world athleisure participant, providing a variety of merchandise—from technical athletic clothes and footwear to health equipment—for each women and men.

Lululemon embraced e-commerce and made on-line gross sales a key a part of its technique and enabled the model to broaden its footprint. Its distinctive method to advertising – creating a way of group and belonging made Luluemon not only a model, however a life-style. This has been a profitable playbook for a lot of manufacturers.

How is administration dealing with development?

Lululemon is executing its Energy of three×2 plan, which laid out targets in 2021 to double three KPI’s by 2026.

(lululemon.com)

Firstly, Lululemon plans to double males’s income by 2026. It’s utilizing its confirmed mannequin of technologically superior premium materials to determine itself in males’s working, coaching, and yoga, whereas increasing into new classes reminiscent of tennis, golf and mountain climbing and tapping into footwear and equipment.

Secondly, the model doubled down on e-commerce and intends to double on-line revenues by 2026. They’ve a strong basis already. Over 39% of gross sales are carried out on-line and Lululemon has over 24 million membership customers, reinforcing its group method.

Thirdly, the corporate plans to quadruple international income from 2021. It has vital alternatives to broaden globally, having just lately entered China and began enlargement into EMEA and APAC. Out of its 749 shops, 138 are in China, 47 in Emea and 105 in APAC, establishing a foothold in these markets and creating additional alternatives for Lululemon.

The place Lululemon is missing

Expert administration is the important thing to success on the earth of trend. Below the present CEO, the corporate has been increasing, nevertheless it got here at a value. Luluemon has misplaced a few of its luster with a scarcity of innovation, or what the corporate calls “newness”. It recognized and began engaged on the problem, managing to barely revive development within the final quarter, significantly within the troublesome girls’s section.

We’ve got to say the U.S., the place comparable gross sales have been down -3% for the primary time final quarter. Weakening customers have dragged on many companies, and it was time for Lululemon to really feel the sting.

This scary development has considerably reversed course as income development elevated to 2% YoY and comparable gross sales declined -2% as in comparison with -3% final quarter. It stays to be seen if it is a long-term restoration trajectory or a seasonal blip, however administration was optimistic about US development on the earnings name. Enhancing macroeconomic situations might present a lift to gross sales in 2025.

Quarterly beat spurred investor optimism

The December 2024 quarterly report confirmed an organization nonetheless in development mode. Internet income for Q3 FY2024 reached $2.4 billion, representing a 9% year-over-year enhance. This top-line enlargement was fueled by a mixture of retailer openings, enhancing e-commerce penetration, and profitable product launches within the males’s and footwear classes. Comparable gross sales rose 3%, with gross margins of 58.5%.

Earnings per share (EPS) got here in at $2.87, a notable enchancment from $2.53 in the identical interval final yr. The corporate additionally raised its full-year income steerage from a variety of $9.5 billion to $9.7 billion, reflecting administration’s confidence in sustaining this momentum.

China: Why Lululemon is excelling the place others wrestle

Gross sales in China surged by 40% within the first two quarters – with costs 20% greater than within the U.S. It is a hanging demonstration of Lululemon’s pricing energy.

Whereas many Western retailers are going through points in China amid altering client preferences and fierce native competitors, Lululemon is bucking the development. China gross sales surged by roughly 25% this quarter, outpacing development in nearly each different geography. So what’s the key?

Lululemon’s model message of wellness, high quality, and premium craftsmanship resonates with Chinese language customers who worth authenticity and way of life over cut price pricing.

Moreover, the corporate has localized its method, partnering with native health influencers, internet hosting group yoga occasions, and providing merchandise tailor-made to the preferences and local weather of Chinese language cities. Mixed with Lululemon’s digital technique—leveraging Chinese language social media platforms and integrating with native e-commerce giants—allows it to satisfy customers the place they store. This method has allowed the corporate to maintain its Chinese language operations rising.

Is Lululemon undervalued?

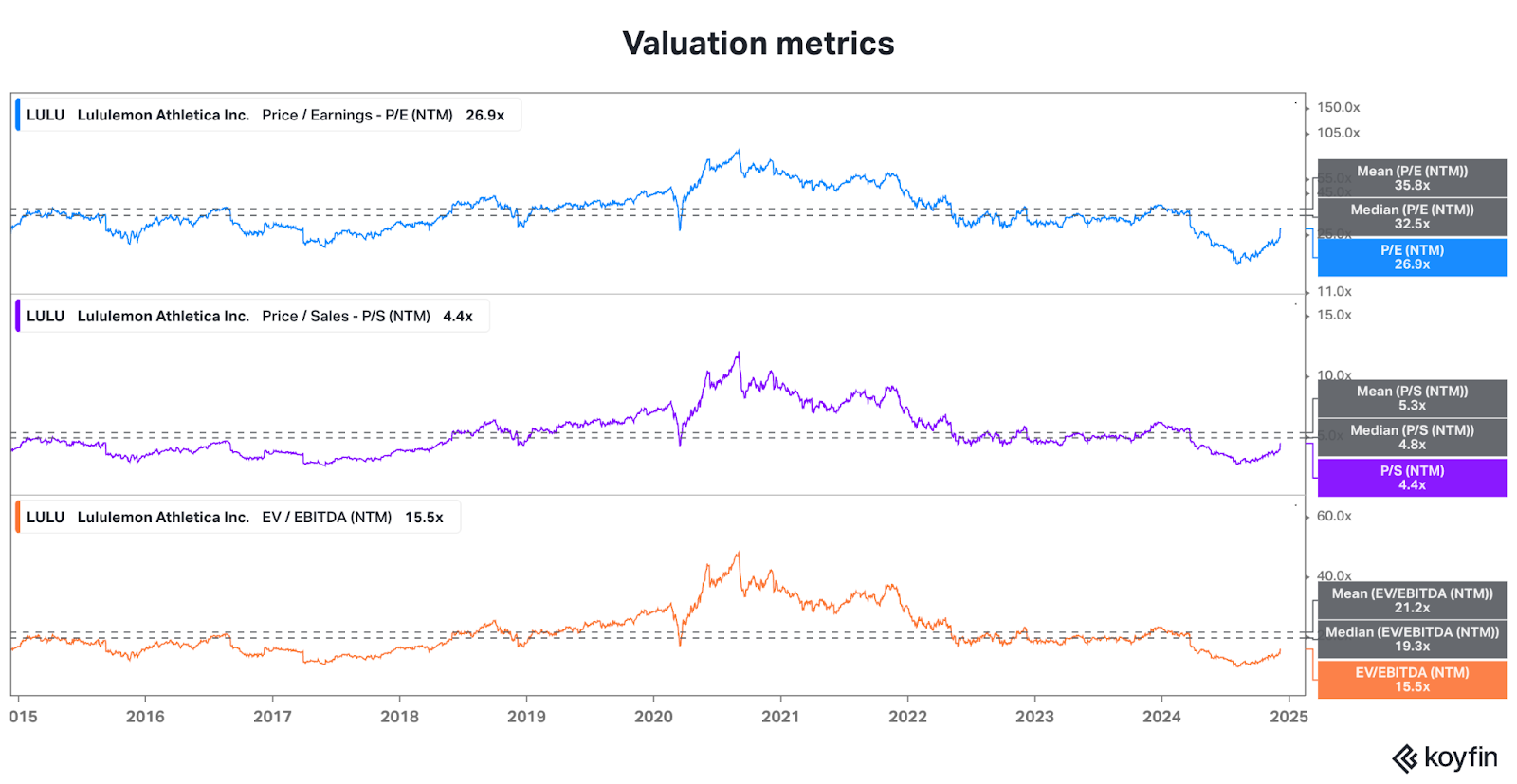

(koyfin.com)

Due to revenues rising 21% p.a. over the previous 10 years, Lululemon’s inventory was given a premium valuation. After development collapsed in 2023, the valuation turned its enemy, and the inventory collapsed over 50% from its highs as traders feared that Lululemon’s development was carried out for good. However with each income and earnings development outpacing estimates and rising in Q3, investor sentiment has improved. Proper now, the corporate’s P/E ratio stands at 27.43, which signifies about 20% upside from right here to the historic median.

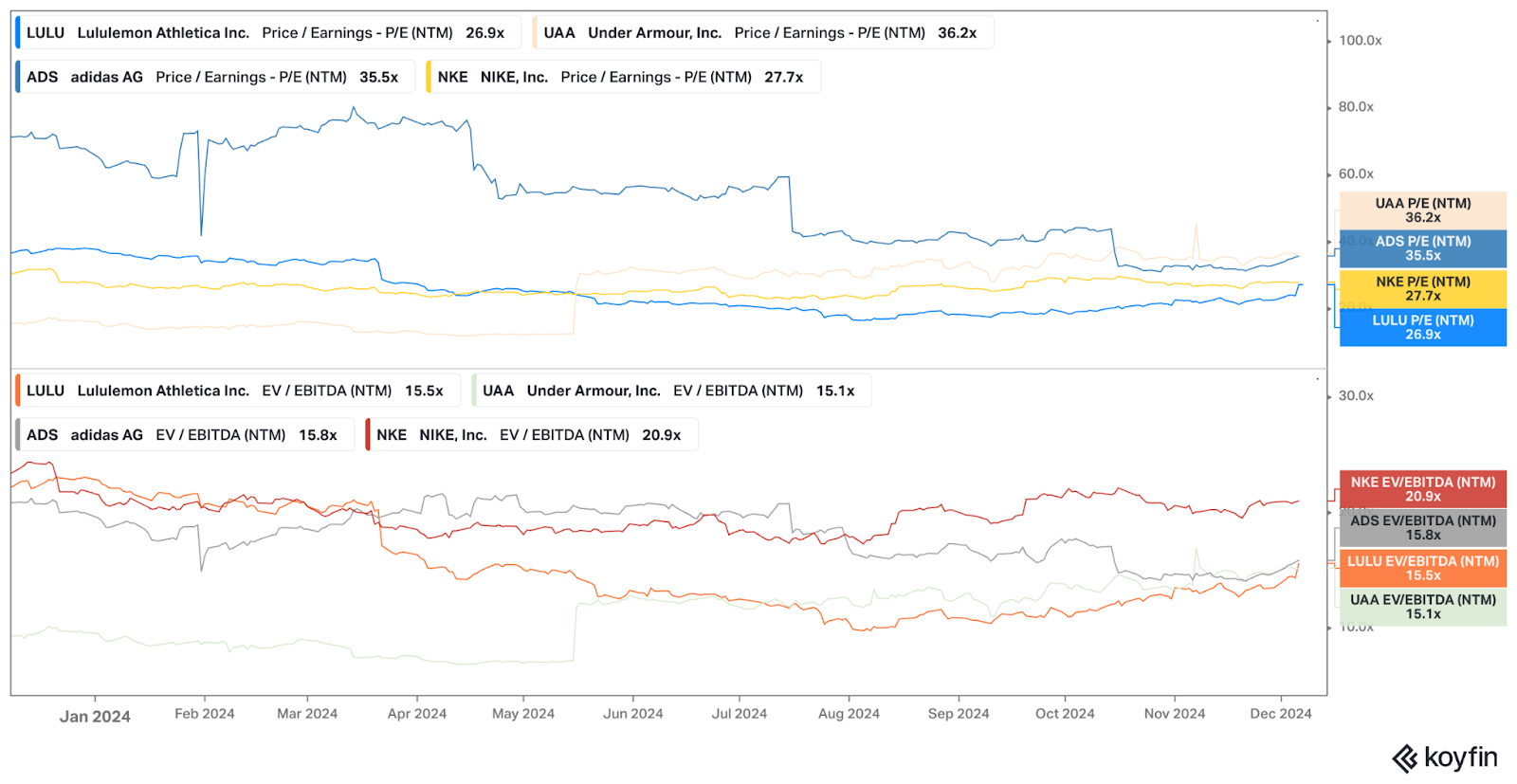

Wanting on the valuation of its friends, we are able to see that regardless of sturdy efficiency, Luluemon’s inventory remains to be buying and selling on the low finish of the group. This would possibly mirror much less urge for food from traders, but in addition create a possibility for the corporate to to develop if it proves itself to the market.

(koyfin.com)

Let’s take a look at three doable situations to see how Luluemon’s valuation stacks up:

Bull Case: Lululemon continues to develop earnings by 15%+ yearly over the subsequent 5 years, pushed by geographical enlargement and sequential development and margin enchancment due to a stronger client. On this situation, long-term shareholders would possibly reap vital rewards.

Impartial Case: Development moderates to round 10% per yr as markets like North America method saturation and China’s development normalizes. If margins keep sturdy, the valuation may compress to mirror slowing development. Whereas the aggressive evaluation means that Lululemon’s inventory might continue to grow, I might not anticipate explosive good points.

Bear Case: Weak spot in China catches as much as Lululemon, whereas slower international financial restoration would possibly inhibit enlargement. American customers keep weaker as a result of greater charges for longer. Margins would possibly face stress from competitors and better enter prices. The valuation would possibly compress and depart traders with a stagnating or slowly declining inventory.

For traders, it’s essential to gauge how international macroeconomic situations evolve and the way they may have an effect on the expansion trajectory towards excessive multiples. Lululemon might proceed to outperform, but when development stumbles, the inventory may face a harsh valuation reset.

What dangers is Lululemon going through?

Even the strongest manufacturers face challenges. For Lululemon, dangers embody elevated competitors from established names like Nike, Adidas, and rising direct-to-consumer manufacturers that would chip away at market share reminiscent of Alo Yoga or Vuori.

Shopper preferences in trend and health can shift quickly, and Lululemon’s premium pricing would possibly depart it susceptible if financial situations tighten and buyers start to commerce down. There’s already a rising development of dishevelled outsized clothes as in comparison with the modern, determine enhancing model of Lululemon’s merchandise.

Provide chain disruptions, rising materials prices, or sudden geopolitical tensions may additionally dampen development, particularly due to the chance of commerce wars with China.

Outlook for the enterprise

Lululemon stands at a juncture. The corporate’s newest quarterly outcomes present no signal of slowing down, with development firing on a number of cylinders. However we can’t ignore the truth that Lululemon is a standout within the business. It’s questionable whether or not the corporate is mostly a diamond within the tough, or if client weak spot simply hasn’t caught as much as this model but. Buyers have to resolve whether or not they’re comfy paying high greenback for development that relies on persevering with stabilization of financial situations.

For long-term traders who consider within the premium model, the inventory could also be a purchase. However for those who desire conservative bets, ready for a greater entry level is likely to be your greatest yoga pose. In the long run, Lululemon stays a beautiful enterprise, however within the attire business, success could be fleeting.