It solutions billions of searches every day, powers the world’s greatest video platform, dominates internet advertising, and is making an enormous push into AI and even self-driving vehicles; Google is all over the place. With over $90 billion in money and annual earnings exceeding $100 billion, Alphabet, Google’s guardian firm, is among the world’s most influential firms. However with regulatory threats looming and fierce competitors in cloud and AI, can Google preserve delivering for traders? Let’s discover out.

Google is a money-making machine. It continues to develop its promoting enterprise whereas innovating in cloud and AI. In 2024, it raked in over $100 billion in revenue and ended the 12 months with $90 billion in money.

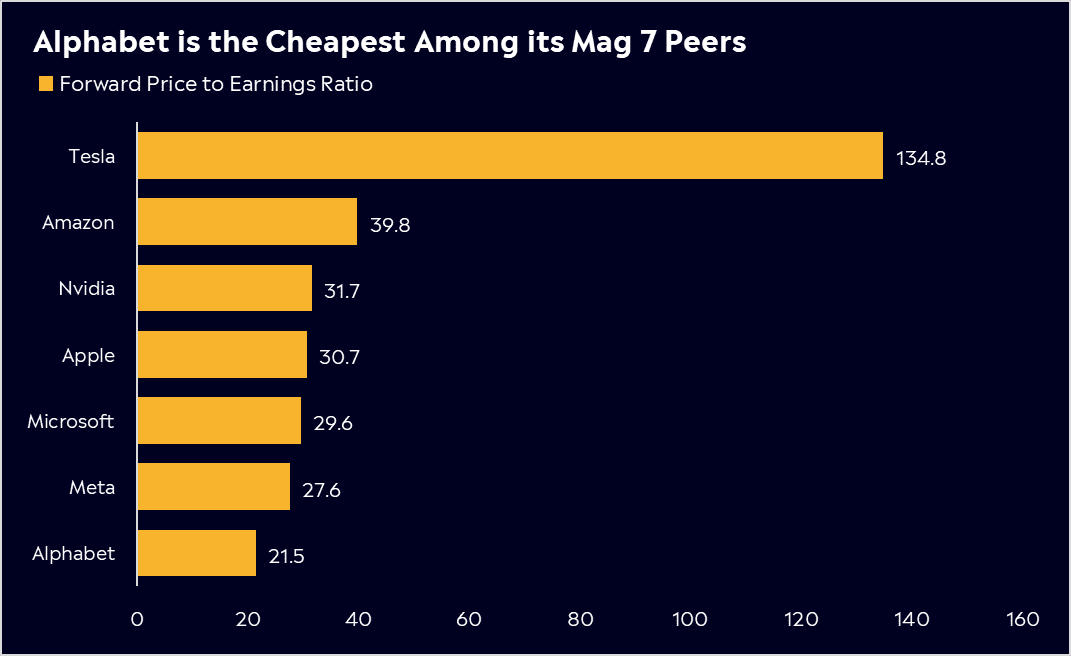

Alphabet at present trades at 21.5x ahead earnings, a compelling valuation given its buying and selling at a reduction to the S&P500 which is at present 23x value to earnings.

Wall Avenue likes it – Alphabet has 59 Purchase rankings, 15 Holds, and 0 Sells. From these rankings it has a median value goal of $218.60.signalling a possible 14% upside.

The Fundamentals

Google was based in 1998 by pals Sergey Brin and Larry Web page, ranging from a rented storage in California. As we speak, it’s one of the dominant companies on the earth, renaming itself Alphabet in 2015. This was as a result of Google turned extra than simply Google. Though Google generates most of its income from digital promoting, an enormous $265 billion in 2024, its attain extends far past search.

The enterprise generates its income from three key income segments:

Google Companies (87% of income) That is the moneymaker. Google’s dominance in search, video, and electronic mail makes it the world’s greatest digital promoting enterprise.

Search – The spine of Google, dealing with over 8.5 billion searches per day and producing billions in advert income.

YouTube – The world’s second-largest search engine (behind Google itself) and the largest video platform, monetised by way of adverts.

Android & Google Play—With over 3 billion units, Android is the most-used cell working system on the earth, with a 72% market share, in keeping with Statista. Sure, greater than iPhone’s iOS, which has simply 27.5% market share. Android generates income from app gross sales, subscriptions, and Play Retailer charges.

Chrome, Gmail and Maps – Whereas free for customers, these providers preserve folks in Google’s ecosystem, feeding information into its advert enterprise.

Google Cloud (12% of income)

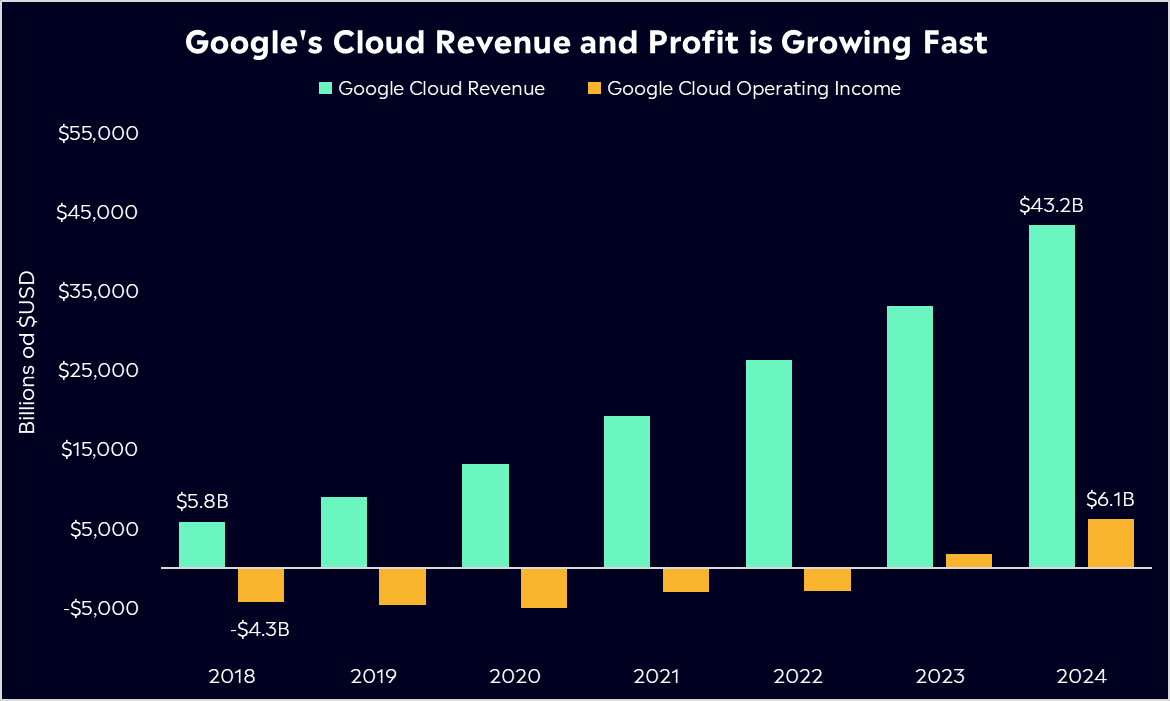

Google Cloud powers companies, AI fashions, and digital providers worldwide. It competes with Amazon Net Companies (AWS) and Microsoft Azure, serving to firms retailer information, run functions, and construct AI instruments. This phase additionally encompasses Google Workspace: Google Meet, Drive and Docs. Google Cloud has been Alphabet’s fastest-growing phase as demand for AI and enterprise cloud providers continues to soar. However it’s nonetheless enjoying catch-up to AWS and Microsoft.

Different Bets (Beneath 1% of income)That is the place Alphabet goals large. A few of these tasks might form the long run, whereas others would possibly by no means make a cent.

Waymo – Self-driving vehicles that would change transport ceaselessly.

DeepMind – Slicing-edge AI analysis.

Nest – Google’s good dwelling division division. Sure, it’s these little doorbell cameras!

Alphabet’s long-term development story has rewarded traders within the final decade. Shares have risen by greater than 670%, giving an annualised return of twenty-two%. To maintain the inventory engaging for retail traders, Alphabet has break up its inventory 3 times, now buying and selling at round $205.

Enjoyable Truth: Alphabet acquired YouTube for $1.65 billion in 2006. Alphabet makes round $1.65 billion in income from YouTube each 2.5 weeks. YouTube additionally has 2.5 billion month-to-month lively customers and is Australia’s 2nd most visited web site, behind… Google. Dominance.

Previous efficiency just isn’t a sign of future outcomes.*Supply: International Stats StatCounter

Competitor Prognosis

Alphabet faces fairly stiff competitors throughout all of its key enterprise areas. In promoting, it’s keeping off Meta with its suite of social apps, and TikTok continues to be a brand new formidable power up towards YouTube. Google stays the dominant search engine however faces challenges. AI-powered search remains to be evolving, however firms like Perplexity AI wish to disrupt conventional search fashions. In the meantime, Microsoft’s deep partnership with OpenAI provides it an edge, integrating AI straight into Bing and enterprise instruments by way of Copilot.

One among Google’s vital aggressive benefits is its long-standing relationship with Apple. In 2005, the pair signed an settlement to make Google the default search engine for Safari, which nonetheless stands right now. Given the huge iPhone consumer base, being the default search engine on Safari is essential for Google, because it drives vital search visitors and advert income.

Amazon (AWS) and Microsoft (Azure) are the dominant gamers in cloud computing, whereas Google Cloud is doing what it may to realize market share. Whereas it’s nonetheless enjoying catch-up, Google Cloud’s profitability turned constructive for the primary time in 2023, a key milestone in its growth.

An enormous problem to contemplate is the crackdown from US regulators. The Division of Justice has stated that Google unfairly maintains a monopoly in search and internet advertising. The DOJ might power Google to interrupt up, doubtlessly separating its search, promoting, or cloud companies. This could basically reshape the corporate. A Trump Presidency might be excellent news right here, significantly along with his stance on much less regulation. CEO Sundar Pichai attended Trump’s inauguration as he appears to be like to do what he can to cease any crackdowns. Trump’s relationship with large tech hasn’t at all times been a method; he has beforehand accused Google of bias in search outcomes. Nonetheless, a extra business-friendly administration might ease regulatory pressures.

Alphabet’s give attention to integrating AI and cloud know-how into its enterprise is positioning it to remain aggressive whereas its large consumer base retains its promoting machine rolling.

Monetary Well being Test

Alphabet reported its earnings earlier within the week, and the This fall consequence was fairly uninspiring. Income missed estimates, and Google Cloud, its key development phase, didn’t dwell as much as expectations. There have been brilliant spots. Google’s search, promoting, and YouTube revenues had been forward of estimates, however the focus has been on Cloud.

General This fall Income $96.47 billion +12% y/y, estimate $96.62 billion

Google promoting income $72.46 billion +11% y/y, estimate $71.73 billion

YouTube adverts income $10.47 billion +14% y/y, estimate $10.22 billion

Google Cloud income $11.96 billion +30% y/y, estimate $12.19 billion

Google’s promoting income is its bread and butter by way of its search enterprise however that is now a mature enterprise with income set to develop within the single digits subsequent 12 months. For traders, the main target is on cloud, the place the corporate is seeing speedy development, with working revenue up over 250% in 2024. Importantly, Google’s search advert income retains rising regardless of the rise of AI search. The miss on income in its cloud enterprise is essential as a result of it didn’t reassure Wall Avenue that its heavy investments in AI are translating into better-than-expected development. That concern is extra related than ever with the emergence of DeepSeek and the truth that Alphabet additionally stated they see capital expenditures at round USD$75 billion in 2025, nearly USD$20 billion greater than analysts had anticipated. This reveals their dedication to rising information centres, AI infrastructure, and different applied sciences. That will look like a giant quantity, however Alphabet’s internet revenue rose to $100 billion in 2024.

Nonetheless, this was one quarter. Google Cloud’s margin development has been strong since 2018, rising at a outstanding tempo. For the complete 12 months 2024, its EBIT margin reached 14%, leaping to as excessive as 17.5% in the latest consequence. For some context, this was -74% in 2018. That development has helped increase Alphabet’s total revenue margins for the 12 months. It’s additionally value noting that the enterprise has a critical money pile. Free money stream remained robust at practically $25 billion for the quarter. For the complete 12 months 2024, Alphabet had USD$95 billion in money, which is about to develop to USD$153 billion in 2025. All in all, its This fall report was okay; it definitely wasn’t magnificent. Whenever you’re spending as a lot as they’re, traders need constant development and can change into impatient in the event that they don’t get that. Alphabet might want to justify its AI spending all through 2025, and if it may’t, shares will undoubtedly face some strain.

* Previous efficiency just isn’t a sign of future outcomes.

Purchase, Maintain or Promote?

In its most up-to-date earnings name, administration famous that demand was outpacing capability for its AI merchandise, simply one of many causes it plans to spend $75 billion in 2025, serving to to ease capability constraints as AI demand grows. Its AI positioning is a big constructive for the corporate, nevertheless it should preserve making market share beneficial properties in cloud to please Wall Avenue even when its extra conventional promoting enterprise retains delivering.

Alphabet at present trades at 21.5x ahead earnings. It is a fairly compelling valuation given the corporate’s robust place and the very fact it trades at a reduction to the S&P500, which is at present 23x value to earnings and it’s personal 10-year common of twenty-two.2x earnings.

Analysts nonetheless consider there may be additional upside for Alphabet shares. In accordance with Bloomberg’s Analyst Suggestions, it boasts 59 purchase rankings, 15 maintain rankings, and 0 promote rankings. With a median value goal of USD$218.60, that suggests a possible 14% upside.With its dominant advert enterprise, robust AI positioning, and discounted valuation, Alphabet stays a inventory for traders to observe. Whereas regulatory dangers and AI competitors shouldn’t be ignored, its management in search, cloud, and AI innovation positions it nicely for long-term development.

* Previous efficiency just isn’t a sign of future outcomes.

*Knowledge Correct as of 06/02/2025

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any explicit recipient’s funding goals or monetary state of affairs, and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.