Because the 2024 U.S. presidential election shapes up for a rematch between former President Donald Trump and present President Joe Biden, the cryptocurrency business is proving to be a major issue within the destiny of each contestants.

Trump, who hasn’t at all times been wasn’t a fan, is now positioning himself as a champion of crypto innovation. His marketing campaign is the primary main presidential marketing campaign to just accept cryptocurrency donations. After which, now we have Biden, who, since he took workplace in 2021, has adopted a measured strategy to crypto, which hasn’t been fashionable amongst digital forex customers and firms. Regardless of calling for analysis and tweeting about “tax loopholes that assist rich crypto traders,” Biden has mentioned little else on the problem.

We are able to’t definitively say that the destiny of the crypto business will depend on the elections, simply as we will’t say that the affect of the sector would resolve the elections. Nonetheless, it’s sure that the sector would have some affect on the elections, and the way forward for crypto within the U.S. could be enormously influenced by whoever wins.

However now we have a novel scenario. Each contestants have accomplished this earlier than. We are able to evaluate how crypto fared throughout their earlier administrations to realize insights into what would possibly come if both of them is in management once more. That is what this text does.

Crypto Beneath Trump (2017 – 2021): Booming Market, Few Guidelines

Market Efficiency: Booming Progress

When Trump took workplace, Bitcoin was valued at round $1,000. By the top of 2020, it had surged to about $29,000, rising about 150% yearly throughout that interval. Ethereum additionally noticed exceptional progress, reaching the $100 mark in 2017 and hitting about $750 by the top of 2020, with an annual progress charge of round 135%. The general cryptocurrency market worth skyrocketed from about $17.7 billion in early 2017 to almost $757 billion by the top of 2020.

Adoption and Innovation: Speedy Enlargement

Curiosity and consciousness in digital currencies grew considerably throughout Trump’s time, however public opinion was blended. In 2017, a small variety of individuals had Bitcoin or Ethereum, however by 2021, 16% say they personally have invested in, traded or in any other case used one.

Whereas some individuals had been enthusiastic about how crypto may change finance and know-how, others had been frightened in regards to the market’s ups and downs. For instance, Bitcoin’s wild value swings made some individuals cautious about its future.

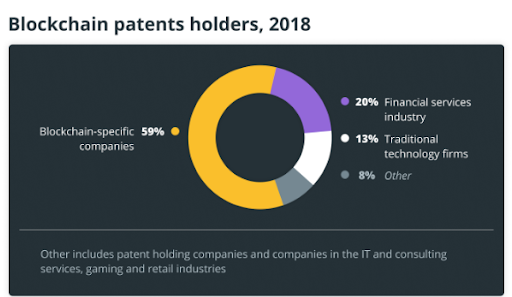

The Trump period additionally noticed a growth in blockchain innovation, with a notable enhance in blockchain patent filings led by corporations like IBM and Mastercard. These patents included new concepts for fee methods and safe digital identities, making transactions safer and extra environment friendly. The job market in blockchain and cryptocurrencies additionally skilled substantial progress, with corporations like Coinbase and Gemini hiring extra consultants in blockchain know-how, safety evaluation, and regulatory compliance.

Institutional Adoption: Early Movers

Institutional adoption of cryptocurrencies additionally started to take off throughout Trump’s presidency. Firms like MicroStrategy made vital Bitcoin purchases, amassing over $1 billion value by the top of Trump’s time period. Sq. (now Block, Inc.) additionally entered the market with a $50 million Bitcoin buy in October 2020.

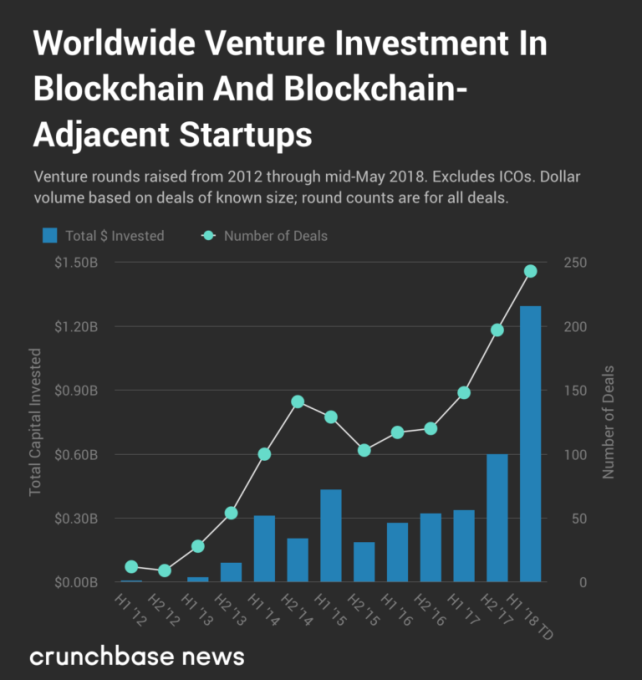

Enterprise capital funding in crypto startups noticed wild swings throughout this era. In 2017, round $1.3 billion was pumped into these startups, however this quantity skyrocketed to about $7.8 billion in 2018 as a result of a surge in Preliminary Coin Choices (ICOs) and Preliminary Change Choices (IEOs) as crypto tasks began elevating funds. Nonetheless, by 2020, this dropped to roughly $2.2 billion as a result of unsure rules and market instability.

Regulatory Method: Arms-Off

From 2017 to 2021, the cryptocurrency business loved comparatively pleasant remedy below the Trump administration regardless of his overt criticism. As a substitute of imposing strict guidelines, the federal government watched the business. This hands-off strategy allowed the business to flourish with minimal interference.

Regulators just like the SEC and CFTC had been cautious of their strategy to cryptocurrencies throughout Trump’s time. The SEC set guidelines for Preliminary Coin Choices (ICOs) and cracked down on scams. One notable case was in opposition to PlexCoin, the place individuals had been scammed out of $15 million. Lawsuits had been widespread and addressed points like crypto fraud and regulatory compliance. Some circumstances ended with corporations paying fines, whereas others helped set up new guidelines for dealing with cryptocurrencies. As an illustration, in 2019, the IRS supplied steering on reporting revenue from digital currencies, whereas SEC Chairman Jay Clayton emphasised investor safety with out stifling innovation.

Apparently, varied authorities businesses started exploring blockchain know-how functions throughout Trump’s presidency. The Division of Homeland Safety investigated utilizing blockchain to safe information from cameras and sensors, whereas the Meals and Drug Administration appeared into its potential for monitoring medicines.

Worldwide Affect: Rising Chief

Throughout Trump’s presidency, the USA emerged as a major participant within the international cryptocurrency scene. By 2019, the U.S. was dealing with about 22% of all Bitcoin buying and selling worldwide. States like Wyoming handed legal guidelines welcoming blockchain corporations, establishing the nation as a hub for blockchain innovation. The U.S. additionally engaged in worldwide efforts to create international requirements for cryptocurrencies, specializing in stopping prison actions and defending traders.

Crypto Beneath Biden (2021 – 2024): Extra Guidelines, Risky Market

Market Efficiency: Volatility and Stabilization

Beneath Biden’s administration, the crypto market has been characterised by elevated volatility and indicators of maturation. Bitcoin’s value skilled vital fluctuations, reaching practically $65,000 in April 2021 earlier than experiencing a collection of corrections. By mid-2024, Bitcoin’s value had climbed to $62,892. Ethereum adopted the same sample, reaching practically $4,800 in late 2021 earlier than settling round $3,352 by mid-2024. The overall worth of the cryptocurrency market hit an all-time excessive of round $2.15 trillion in 2021 however has since stabilized at about $2.22 trillion by mid-2024, reflecting each market corrections and elevated regulatory scrutiny.

Adoption and Innovation: Mainstream Integration

Cryptocurrency adoption continued to develop below Biden’s administration. A current report claims that about 20% of Individuals personal some type of cryptocurrency by mid-2024. This enhance occurred regardless of market volatility and new rules, pushed by elevated institutional backing and enhancements in blockchain know-how.

The demand for blockchain and cryptocurrency-related jobs remained robust, with corporations looking for professionals expert in blockchain improvement, good contract creation, and digital asset administration. Companies like Ripple and Circle expanded their workforce, significantly in areas of blockchain engineering and regulatory compliance.

Institutional Adoption: Widespread Acceptance

The Biden period has seen a dramatic enhance in institutional involvement within the cryptocurrency house. Main monetary establishments like BlackRock and Constancy started providing crypto funding merchandise, signalling rising mainstream acceptance.

Tesla made headlines when it bought $1.5 billion value of Bitcoin early in 2021, though it later paused its plans to just accept it as fee.

Enterprise capital investments in blockchain know-how reached unprecedented ranges, hitting about $25.2 billion worldwide in 2021, a staggering 713% enhance from the earlier 12 months. This surge was pushed by elevated demand for crypto-related services and products, with $6.3 billion particularly invested in corporations offering crypto storage and pockets providers.

Regulatory Method: Elevated Scrutiny

In distinction to his predecessor, the Biden administration paid critical consideration to the crypto sector. Notably, in his second 12 months in workplace, Biden signed an Government Order to ascertain a complete authorities technique to handle the dangers and advantages of digital belongings.

This strategy centered on client safety, market equity, and stopping unlawful actions. Companies just like the SEC, CFTC, and FinCEN intensified efforts to fight scams, market manipulation, and non-compliant exchanges. The administration additionally initiated discussions about implementing guidelines for DeFi, together with anti-money laundering (AML) and know-your-customer (KYC) necessities to curb unlawful actions.

Notably, the federal government additionally explored the know-how. The administration’s blockchain-based digital forex challenge is an instance of these acts.

Nonetheless, the defining trait of the period has been the elevated authorized actions in opposition to cryptocurrency-related corporations for non-compliance with unclear guidelines.

Worldwide Affect: Established International Participant

Beneath Biden’s administration, the USA has struggled to take care of its management place. Different nations and areas took extra proactive measures to safe their stake within the sector.

The European Union and Asian nations just like the United Arab Emirates, South Korea, and Japan have an edge over the U.S. in defining how they wish to relate with digital belongings, an important factor to do to benefit from the sector. Although the U.S. nonetheless leads in cryptocurrency buying and selling quantity and blockchain innovation, that lead is shak

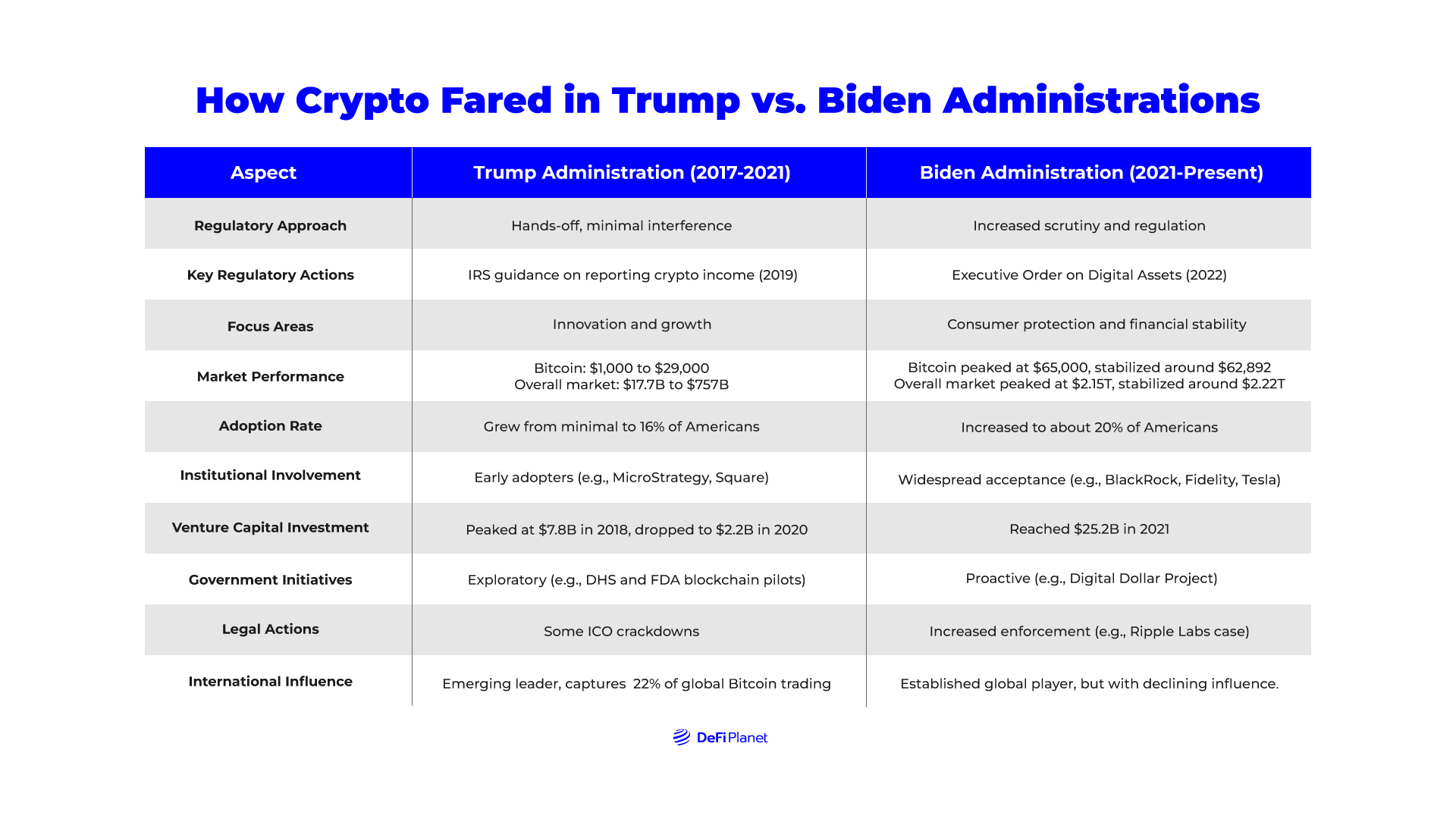

How Crypto Fared in Trump vs. Biden Administrations

Closing Ideas

The contrasting approaches of the Trump and Biden administrations to cryptocurrency regulation replicate not simply differing political philosophies but additionally the quickly evolving state of the crypto market. Throughout Trump’s presidency, when crypto was simply coming into the zeitgeist, a hands-off strategy allowed for fast innovation and positioned the U.S. as a pacesetter on this rising discipline.

Nonetheless, because the market matured below Biden’s watch, the much less fascinating elements of cryptocurrency turned extra obvious. The spectacular collapses of tasks like Terra/Luna and exchanges like FTX highlighted the necessity for stronger client protections. On this mild, Biden’s extra reactionary and regulatory strategy will be seen as a justified response to the evolving panorama. That mentioned, there’s room for debate on whether or not the Biden administration has struck the fitting steadiness.

Wanting forward, the way forward for cryptocurrency regulation within the U.S. is of paramount significance. Whether or not led by Trump, Biden, or one other candidate, the following administration might want to navigate a fancy panorama. They have to steadiness fostering innovation, sustaining U.S. competitiveness within the international crypto market, and defending customers and the broader monetary system. Key issues ought to embody creating clear rules, encouraging accountable innovation, collaborating on international requirements, addressing environmental issues, and exploring the potential of central financial institution digital currencies whereas preserving monetary privateness.

Finally, the objective needs to be to harness the advantages of cryptocurrency and blockchain know-how whereas mitigating its dangers. It will require nuanced, versatile insurance policies that may adapt to this quickly evolving discipline.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein needs to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of monetary loss. At all times conduct due diligence.

If you want to learn extra articles (information experiences, market analyses) like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

“Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”