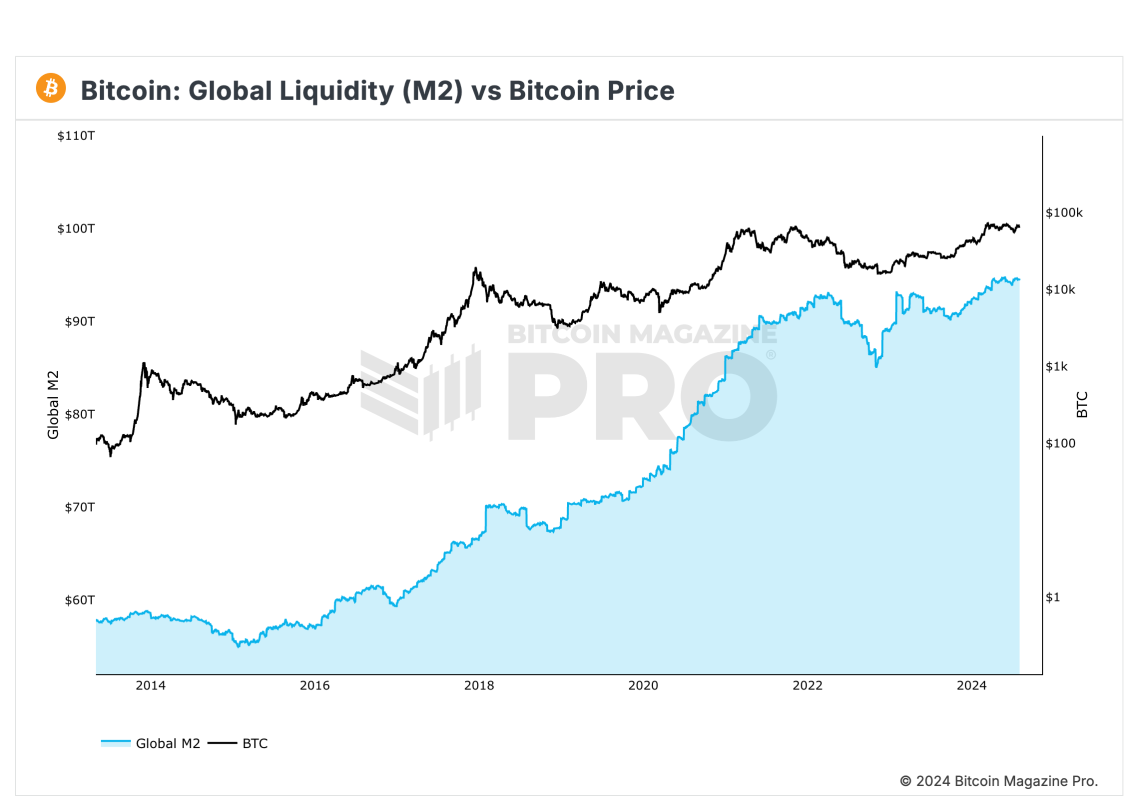

In accordance with knowledge from Bitcoin Journal Professional, the worldwide cash provide, also referred to as world liquidity, has hit an all-time excessive of $95 trillion; Bitcoin traders and analysts carefully watch this key indicator, as greater liquidity has traditionally preceded main bull runs.

International liquidity is the whole sum of money circulating within the world monetary system. It encompasses the M2 cash provide of main economies just like the U.S., China, EU, Japan, and many others. M2 contains money, financial institution deposits, cash market mutual funds, and different near-money belongings.

This determine lately hit $95 trillion, approaching the $100 trillion milestone. The earlier all-time excessive was round $95 trillion, as properly, when Bitcoin hit a brand new ATH in March this 12 months at $73,000 and $90 trillion when Bitcoin hit its peak of $69,000 in November 2021.

Increased world liquidity encourages spending on riskier belongings like Bitcoin. Previous knowledge reveals a powerful correlation between liquidity enlargement and Bitcoin bull markets. It is because more cash creation sometimes leads central banks to decrease rates of interest and implement quantitative easing. This dynamic has performed out repeatedly over Bitcoin’s historical past.

Some traders view Bitcoin as a substitute for the central banking system as a result of it has a set provide schedule. Bitcoin may very well be poised for an additional value surge if the present upward liquidity development persists.

Bitcoin has already recovered to round $64,500 after dipping beneath $60,000 briefly final month. With world liquidity hitting new highs, Bitcoin seems primed to proceed its bull run.