January’s wrapping up, and the Federal Open Market Committee (FOMC) is ready to kick off 2025 with its first huge choice on rates of interest.

Perhaps Fed Chair Jerome Powell will launch an official $JPOW token on Solana. Clearly.

Jokes apart the FOMC assembly, set to finish January 29, has markets bracing for impression—none extra anxious than Bitcoin holders, who’re eyeing potential aftershocks within the crypto area.

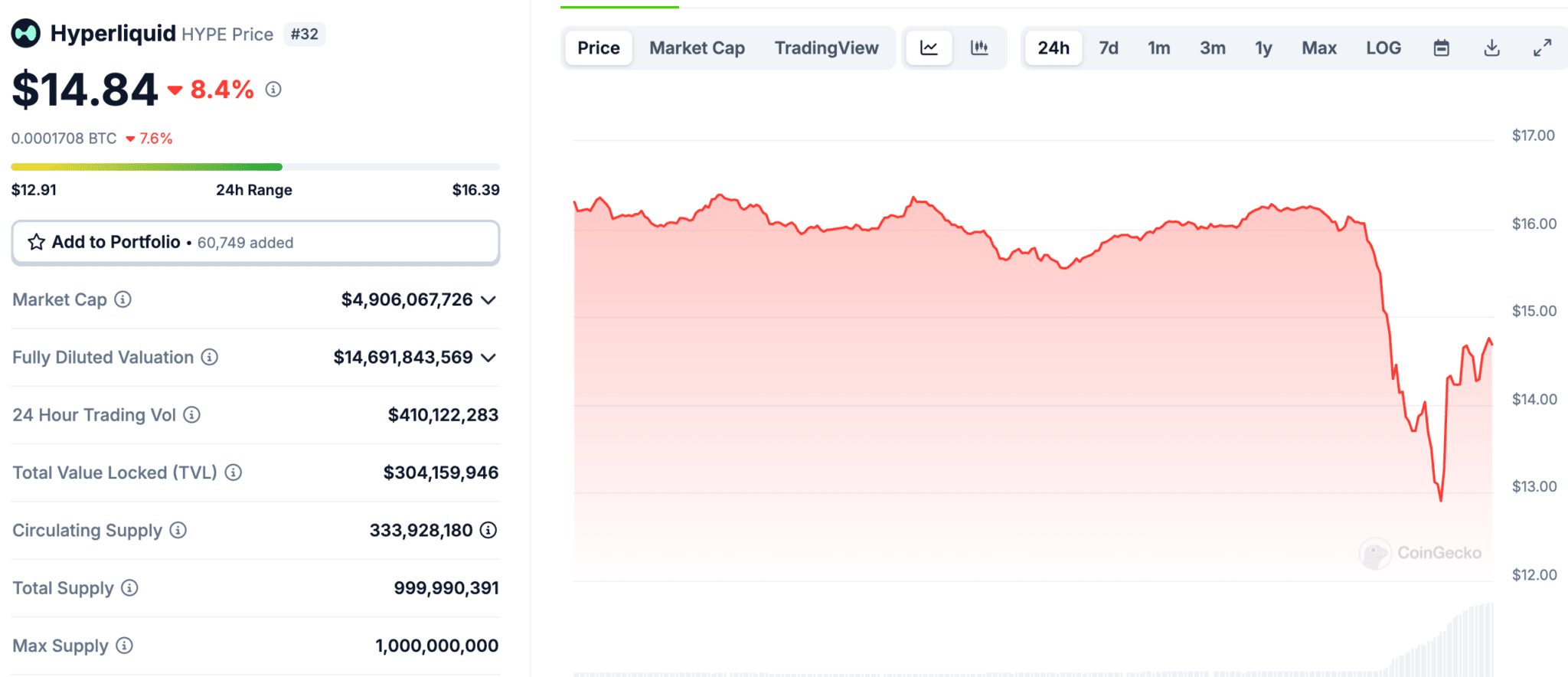

FOMC IN Focus Present Curiosity Price Expectations

Up to now, markets have been all however unanimous underneath President Donald Trump. The FOMC will maintain rates of interest locked at 4.25%—4.5% this month, with CME information putting a 99.5% chance of no motion.

The actual motion, nevertheless, might come later this yr, with inflation softening and key indicators stabilizing. Furthermore, rumors of potential charge cuts in spring are rising louder.

(Supply)

Authorities information displays a blended bag in 2025. As Fed Governor Lisa Cook dinner famous, employment continues to be sizzling, with wage development comfortably outpacing inflation. But inflation appears to be cooling.

December’s CPI exhibits manageable ranges, with core inflation nudging up barely to 2.9% from 2.4% in September. If the downward pattern in value pressures continues, a charge minimize is probably not far off.

Bitcoin Awaits the FOMC’s Subsequent Transfer

Federal Reserve Governor Michelle Bowman stood agency in opposition to additional charge cuts this month, citing cussed inflation and a resilient economic system. “Given the shortage of continued progress on reducing inflation and the continued energy in financial exercise and the labor market, I may have supported taking no motion on the December assembly,” she stated.

Governor Christopher Waller struck a extra hopeful tone, pointing to a slight dip in core PCE inflation to 2.8% and signaling optimism for a continued slide towards the two% goal. “Additional reductions can be applicable if inflation tendencies towards our 2% purpose,” he remarked throughout his January 8 tackle.

Bitcoin, in the meantime, finds itself wedged between $100,000 and $110,000, because the crypto market holds its breath forward of the Fed’s subsequent transfer. Analysts see little motion till the FOMC verdict drops. “Assuming no surprises from the FOMC assembly, we’re prone to see Bitcoin buying and selling sideways till the tip of the month,” stated dealer Krillin.

We may additionally see crypto pump off the announcement of a Bitcoin strategic reserve, which some anticipate to be introduced right this moment.

(Supply)

The potential for renewed quantitative easing additionally looms giant. If the Fed revives QE to inject liquidity, high-risk belongings like Bitcoin may get a recent jolt like sticking a fork into an outlet.

The Broader Implications of Excessive Curiosity Charges

The Fed’s 2025 charge choice gained’t simply have an effect on Bitcoin—it’s a high-stakes second for danger belongings throughout the board. A dovish stance may energize equities and tech shares, whereas a cautious Fed would possibly go away markets catatonic.

January’s consequence is a placeholder, leaving March and Might as the actual battlegrounds. The stakes are sharper than ever for Bitcoin, caught between institutional adoption and shrinking liquidity.

EXPLORE: Shopping for and Utilizing Bitcoin Anonymously / With out ID

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

The put up FOMC Curiosity Charges Choice 2025: What It Means for Crypto appeared first on 99Bitcoins.