Main Developments for the Week

Bitcoin surges to $75K on Trump’s early lead

21Shares: Ethereum is like ‘Amazon within the Nineties’

Dogecoin’s breakout from 3-year channel indicators 500% rally potential in 2025

Bitcoin celebrates sixteenth anniversary of whitepaper

‘Crypto will not be going anyplace’ — Florida chief monetary officer

MicroStrategy to lift $42B to purchase Bitcoin in ‘21/21 plan’

Mt. Gox sends 500 bitcoin to 2 unmarked wallets: Arkham knowledge

British-Asian macroeconomist claims to be elusive Bitcoin creator Satoshi Nakamoto

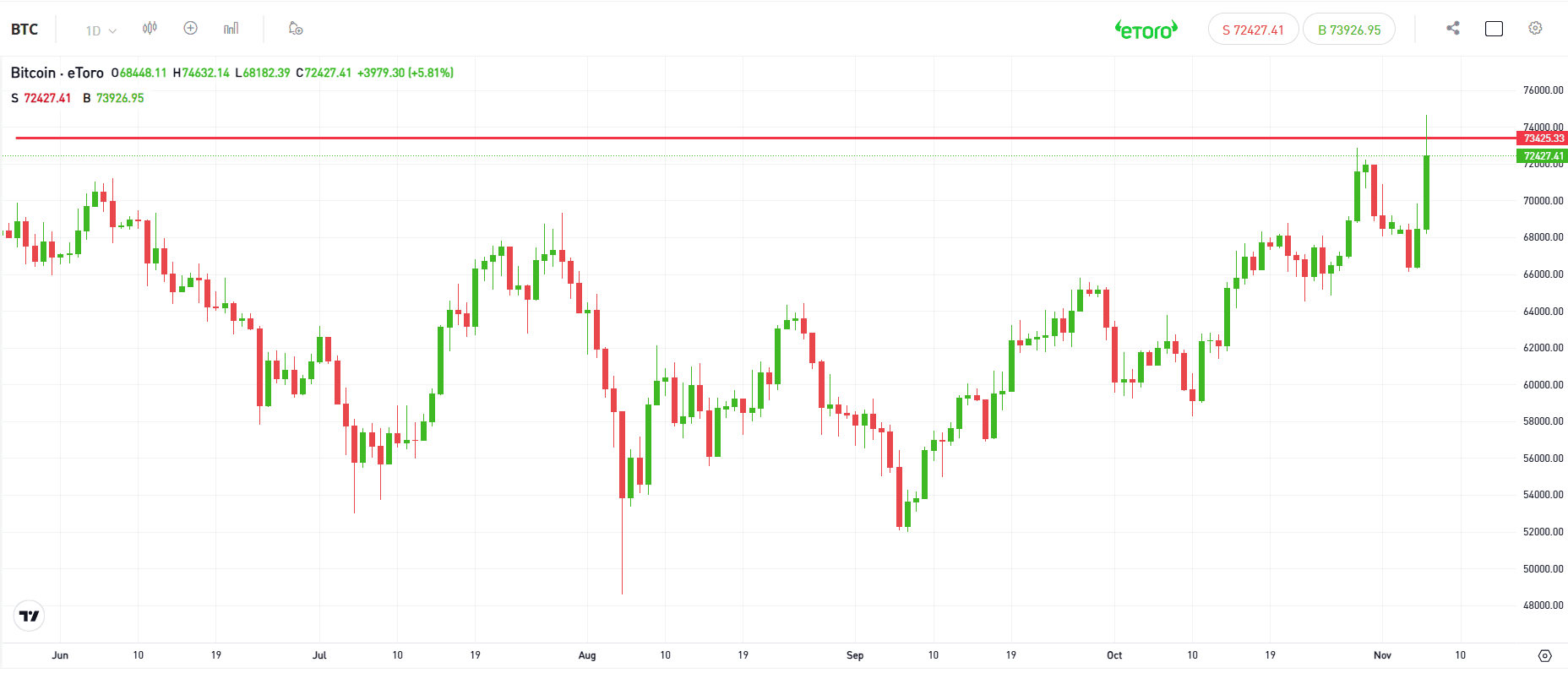

Bitcoin Hits All-Time Excessive as U.S. Election Outcomes Gas Market Volatility

Previous efficiency will not be a sign of future outcomes

Bitcoin reached a brand new all-time excessive of $75,000 on Nov. 6, breaking its earlier report of $73,800 set in March. The rally got here as early U.S. election outcomes confirmed Donald Trump taking a lead, sparking elevated curiosity and hypothesis within the crypto market. Bitcoin initially gained momentum within the New York market, in the end climbing over 7% previously 24 hours to hover round $72,000-$74,000 at time of writing.

Many analysts attribute Bitcoin’s value surge to constructive sentiment surrounding a possible Trump presidency. Bitcoin analyst Tuur Demeester famous that Trump’s rising odds on prediction markets like Polymarket have coincided with Bitcoin’s upward motion. On Nov. 5, as Bitcoin hit its new all-time excessive, Trump’s successful odds jumped to 80%, indicating elevated investor curiosity in crypto below Republican management.

Bitcoin’s Future: Potential Highs Amid Cautious Optimism

Whereas Bitcoin’s all-time excessive has energized the market, analysts have been cautious about its subsequent transfer over the previous week.

Bluntz sees potential for Bitcoin to succeed in $80,000 following a quick correction, with long-term targets between $130,000 and $180,000 if momentum holds, whereas Credible Crypto warns {that a} drop to $65,000 may sign a bearish shift except it holds as assist.

Peter Brandt, citing bullish chart patterns like an inverted increasing triangle, suggests a potential parabolic part with targets round $94,000 and a peak between $130,000 and $150,000.

As election outcomes unfold, these bullish projections are tempered by the necessity to monitor Bitcoin’s key assist ranges.

Volatility Anticipated Submit-Election

Regardless of Bitcoin’s current surge, market sentiment stays blended with expectations of ongoing volatility. On Nov. 4, Bitcoin ETFs noticed important outflows totaling $541.1 million, whereas BlackRock’s IBIT ETF gained $38.3 million, reflecting uncertainty amid the high-stakes election. With Trump holding a lead, Bitcoin’s path will possible be influenced by election outcomes and subsequent market responses.

Don’t make investments except you’re ready to lose all the cash you make investments. It is a high-risk funding, and you shouldn’t anticipate to be protected if one thing goes flawed. Take 2 minutes to study extra.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any explicit recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.