Crypto analyst Jamie Coutts says that the present correction in digital property is probably going a mid-cycle dip that may very well be taken benefit of.

Coutts says on the social media platform X that Bitcoin (BTC) and Ethereum (ETH) have held up a lot stronger than different crypto property, implying {that a} potential imply reversion is on the desk for smaller tasks.

“Smaller cap crypto property have been taking it on the chin since March excessive of this yr. The previous three months have seen the Prime 200 equal weight index fall 33% vs. the Market Cap index, which is down round 12%.

That is the breakdown of the three-month sector returns from my crypto classification framework:

Sensible Contract Platform -31.58% Infrastructure -43.28% Digital World -44.13% Digital Foreign money -31.59% DeFi -31.15% Purposes -38.33%

BTC and ETH have held up -11% and 5%, respectively.

If it is a common mid-cycle correction we’re experiencing, which I imagine is probably going, then anticipate some alternatives available within the mid and small caps as soon as the market settles.”

When the rebound occurs, Coutts says decentralized synthetic intelligence (AI) is one other sector that has “real alternative,” however the analyst doesn’t point out any particular coin or challenge.

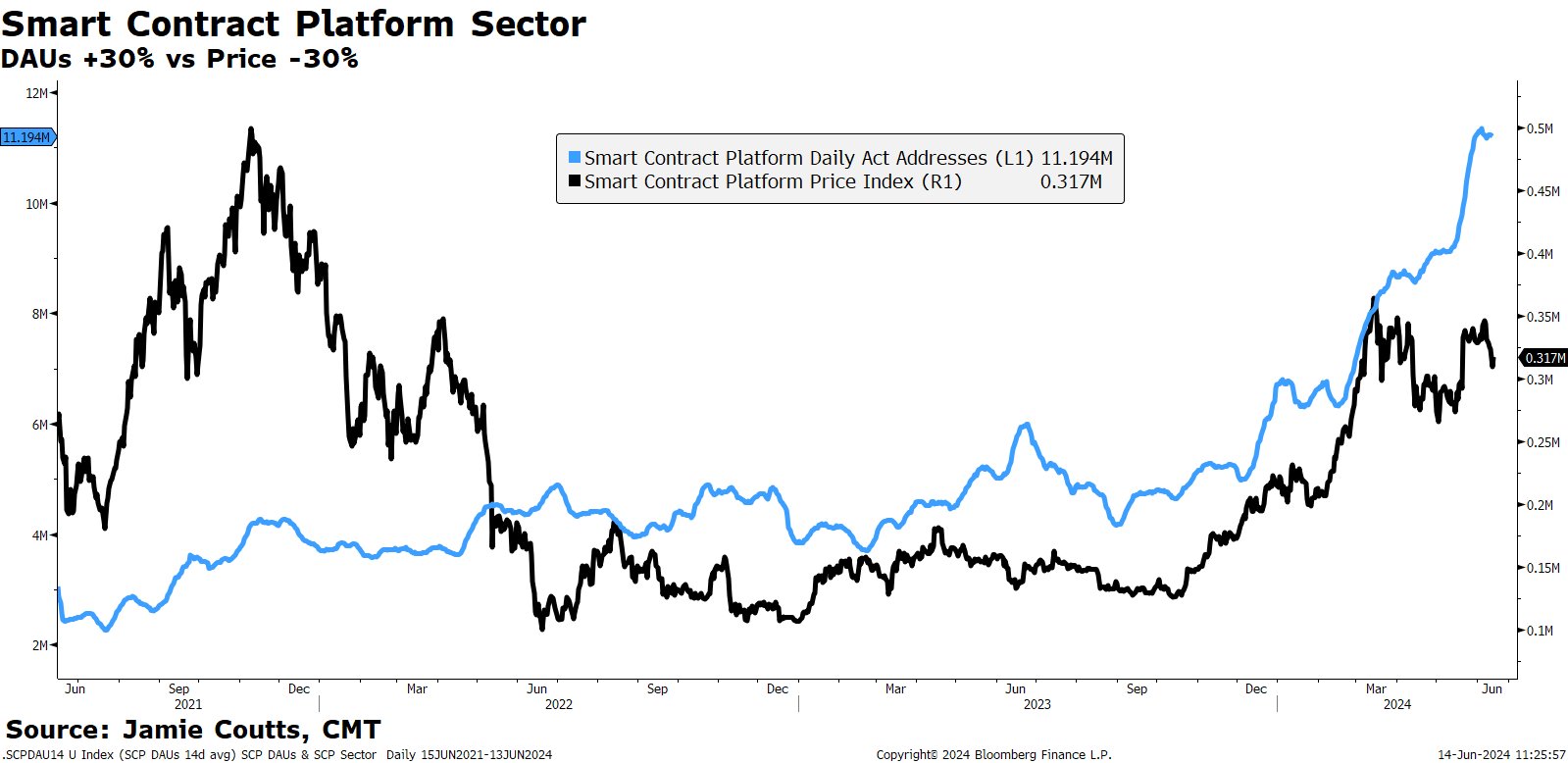

Coutts additionally shares a chart evaluating a declining value index of layer-1 good contract platforms to an growing variety of their every day lively customers (DAUs). The analyst means that the divergence is without doubt one of the greatest indicators of well being within the crypto ecosystem.

“Web3 customers appear much less price-sensitive than within the earlier cycle.

The variety of every day lively addresses (DAUs) on SCP (good contract platform) blockchains is up 30% since March, whereas the SCP sector index is down approx 30%.

In an indication of how wild the final cycle was, costs are 37% beneath the all-time excessive, but DAUs are 2.6x greater (4.2 million to 11.2 million).

One doesn’t equal the opposite however if you’re searching for a sign on the well being of the crypto ecosystem, this is without doubt one of the greatest.”

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Worth Motion

Observe us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any losses it’s possible you’ll incur are your accountability. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please notice that The Each day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney