Ethereum is buying and selling under the $1,900 stage as promoting stress continues to mount, elevating issues that the latest downtrend might lengthen additional. After shedding the crucial $2,500 help in late February, bulls have struggled to regain management. What started as a minor pullback has changed into a broader correction, disappointing buyers who had anticipated a bullish 2025 for ETH.

The failure to reclaim key ranges has eroded market confidence, and value motion stays weak throughout each brief and mid-term timeframes. Ethereum’s incapacity to maintain even transient recoveries has solely strengthened the bearish sentiment that has gripped the crypto house in latest weeks.

Including to the adverse outlook, new information from Santiment reveals that whales have offered roughly 500,000 ETH over the previous 48 hours. This huge distribution by massive holders highlights a transparent insecurity amongst a number of the most influential gamers out there — a development that might weigh closely on Ethereum’s near-term efficiency.

As ETH hovers under $1,900, all eyes are on whether or not bulls can defend remaining help ranges, or if continued promoting from whales and broader market uncertainty will drive the value additional down within the days forward.

Ethereum Whale Promoting Fuels Bearish Outlook

Ethereum is down 55% from its December excessive, with value motion persevering with to mirror the broader market’s weak spot. The selloff has been sharp and constant, fueled by rising macroeconomic uncertainty and world instability. The most recent wave of volatility was triggered by US President Donald Trump’s renewed tariff threats and unpredictable coverage path, which have spooked monetary markets and pushed capital away from high-risk belongings.

In consequence, Ethereum — a key altcoin with deep ties to speculative sentiment — has grow to be one of many hardest-hit main cryptocurrencies. Bulls are struggling to carry help close to the $1,800 stage, and each try to rally has been met with renewed promoting stress. With out a clear shift in development, ETH stays susceptible to additional draw back within the close to time period.

Including to the bearish sentiment, high analyst Ali Martinez shared information exhibiting that whales offered 500,000 ETH over the past 48 hours. This huge distribution from massive wallets means that even skilled market members are rising more and more cautious. Such exercise tends to precede deeper corrections, notably when accompanied by weak technicals and broader risk-off sentiment.

Except Ethereum can reclaim key resistance ranges and present indicators of accumulation, the present development could proceed to favor sellers. As markets digest macro developments, ETH holders are watching intently for any indication that the worst is over — however for now, the stress stays firmly to the draw back.

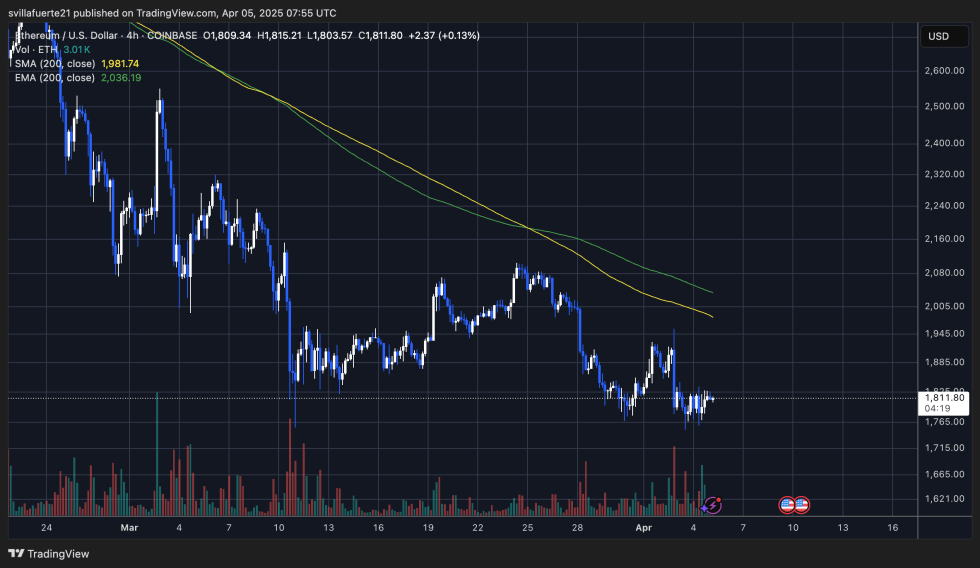

Ethereum Trades At $1,810 As Bulls Defend Essential Assist

Ethereum is buying and selling at $1,810 after repeated failed makes an attempt to reclaim the $1,900 stage. The value continues to face robust resistance, and bullish momentum has considerably weakened in latest weeks. Bulls at the moment are in a crucial place, with $1,800 rising as a very powerful help stage within the present cycle. A decisive breakdown under this mark might set off a deeper correction, probably sending ETH as little as $1,550 — a zone not seen since mid-2023.

The broader crypto market stays underneath stress, and Ethereum’s value motion displays that. Sentiment has been weighed down by macroeconomic headwinds and aggressive promoting from whales, including to the issue for bulls to regain management. Nonetheless, hope stays if ETH can stabilize and push increased within the coming classes.

A breakout above the $2,000 stage would mark a big shift in momentum and will spark a powerful restoration rally. That stage stays the psychological and technical threshold for a possible development reversal. Till then, Ethereum continues to stroll a tightrope between consolidation and additional draw back, with bulls needing to carry $1,800 in any respect prices to keep away from cascading losses. The following few days will likely be essential in figuring out ETH’s short-term path.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.