Information exhibits the Ethereum Open Curiosity has been buying and selling at comparatively low ranges not too long ago. Right here’s what this might imply for the asset’s worth.

Ethereum Open Curiosity Has Been Shifting Sideways Since Its Plunge

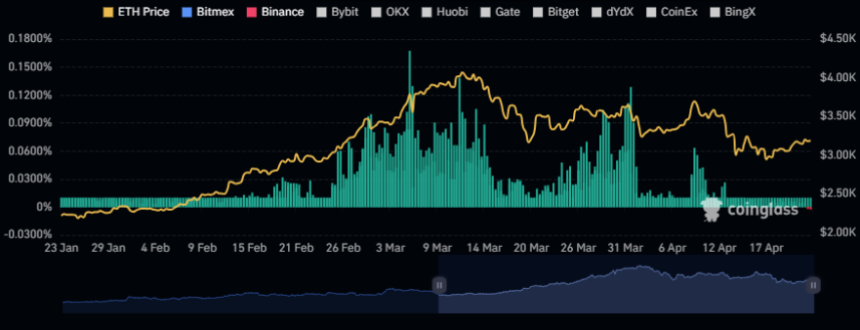

As defined by an analyst in a CryptoQuant Quicktake put up, the ETH Open Curiosity has adopted an identical trajectory as the worth of the cryptocurrency not too long ago. The “Open Curiosity” right here refers back to the complete variety of derivative-related contracts open for Ethereum on all exchanges.

When the worth of this metric goes up, it implies that traders are at present opening up new positions on these platforms. Usually, this sort of development results in a rise out there’s complete leverage, so the asset worth may grow to be extra unstable.

Alternatively, a decline within the indicator implies the traders are both closing up their positions of their very own volition or getting forcibly liquidated by their platform. Such a drawdown might accompany violent worth motion, however as soon as the drop is over, the market may grow to be extra steady because of the lowered leverage.

Now, here’s a chart that exhibits the development within the Ethereum Open Curiosity over the previous couple of months:

The worth of the metric seems to have witnessed a pointy plunge not too long ago | Supply: CryptoQuant

As displayed within the above graph, the Ethereum Open Curiosity registered a pointy drop earlier alongside the asset’s worth. The plunge within the metric was naturally attributable to the lengthy contract holders being washed out within the worth drawdown.

As the worth has principally consolidated sideways because the decline, so has the worth of the Open Curiosity. The quant notes,

This alignment suggests a cooling down of exercise throughout the futures market. Consequently, the market seems poised for the resurgence of both lengthy or quick positions, probably initiating a contemporary and decisive market motion in both path.

One other indicator associated to the by-product market that may very well be related for Ethereum’s future worth motion is the funding charge. This metric tracks the periodic charges that by-product contract holders are at present paying one another.

Optimistic funding charges indicate that the lengthy holders are paying the shorts a premium to carry onto their positions; therefore, that bullish sentiment is dominant. Equally, unfavourable values counsel {that a} bearish sentiment is shared by nearly all of the by-product merchants.

The chart under exhibits that the Ethereum funding charge has not too long ago turned pink.

The info for the ETH funding charges over the previous couple of months | Supply: CoinGlass

Traditionally, the market has been extra prone to transfer in opposition to the opinion of the bulk, so the truth that the funding charge has flipped unfavourable could also be an excellent signal for the probabilities of any potential uptrends to begin.

ETH Value

Ethereum has progressively elevated over the previous couple of days, as its worth has now reached $3,200.

Appears like the worth of the coin has gone up a bit over the previous few days | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, CoinGlass.com, CryptoQuant.com, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site fully at your personal threat.