Ethereum has made a restoration to $2,800 through the previous day as on-chain information exhibits the whales have been making large withdrawals from exchanges.

Ethereum Change Outflows Spiked After Value Crash

In keeping with information from the market intelligence platform IntoTheBlock, traders reacted to the newest crash within the Ethereum value by making outflows from exchanges.

The on-chain indicator of relevance right here is the “Change Netflow,” which retains monitor of the online quantity of the cryptocurrency that’s coming into into or exiting the wallets related to all centralized exchanges.

When the worth of this metric is constructive, it means the holders are depositing a internet variety of cash into these platforms. As one of many primary explanation why traders switch to the exchanges is for selling-related functions, this sort of pattern generally is a bearish signal for the asset’s value.

Then again, the indicator being unfavourable suggests the outflows outweigh the inflows and a internet variety of tokens is transferring out of the exchanges. Such a pattern can point out that the traders are accumulating, which is one thing that may naturally be bullish for ETH.

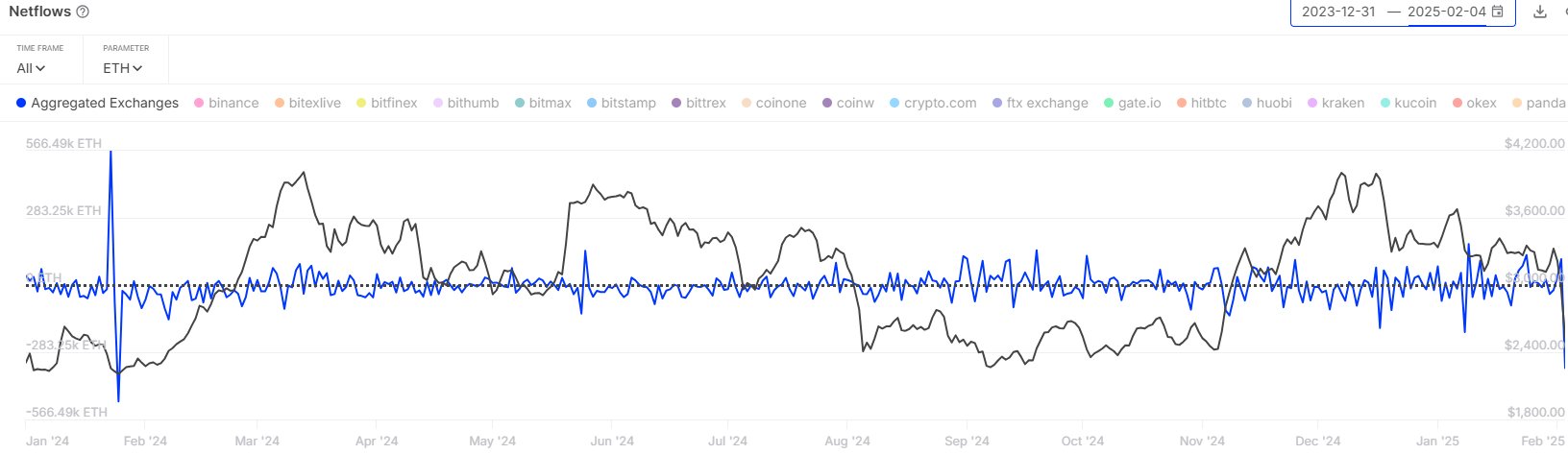

Now, here’s a chart that exhibits the pattern within the Ethereum Change Netflow over the previous 12 months:

As is seen within the above graph, the Ethereum Change Netflow noticed an enormous unfavourable spike yesterday after the crash within the asset’s value passed off.

In whole, the traders withdrew 350,000 ETH (price round $982 million on the present trade price of the token) from the exchanges on this outflow spree. “That is the best quantity of internet trade withdrawals since January 2024!” notes the analytics agency.

Given the timing of the outflows, it will seem probably that they have been made by whales trying to purchase Ethereum at low cost post-crash costs. The buildup from the traders has in flip helped the cryptocurrency attain a backside and make some restoration.

The Change Netflow might now be to control within the coming days, because the upcoming pattern in it may additionally affect the ETH value. Naturally, a continuation of the outflows could be a constructive signal, whereas a rise in inflows might spell a bearish end result.

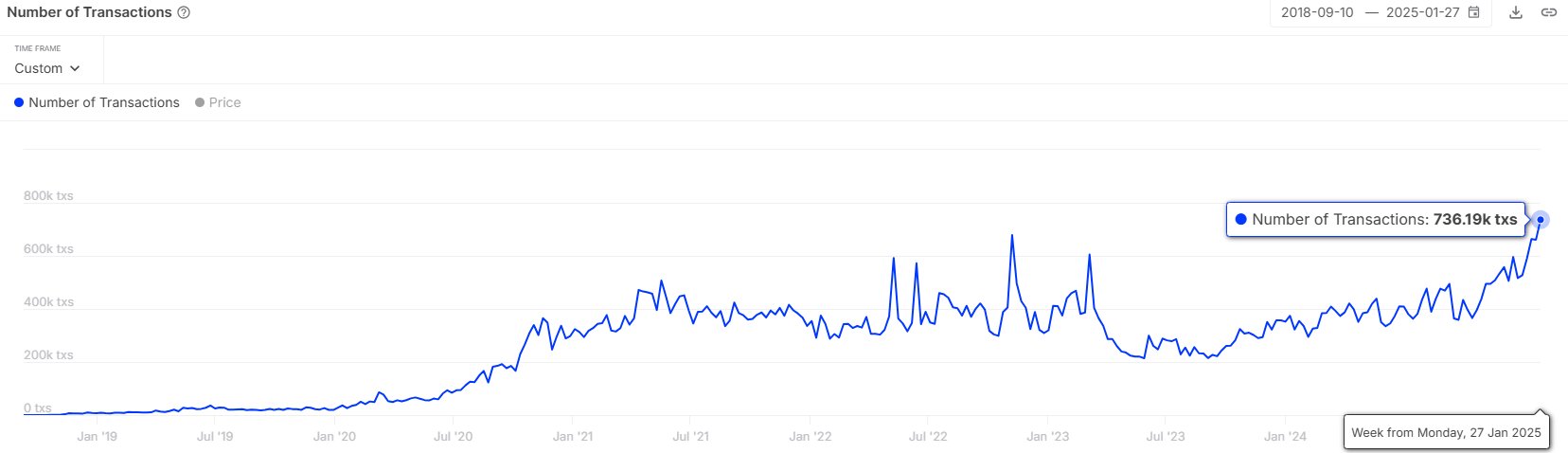

In another information, the quantity two stablecoin by market cap, USDC, has seen its transaction rely shoot up not too long ago, as IntoTheBlock has identified in one other X put up.

“USDC is changing into more and more fashionable, with the variety of each day transactions growing by over 119% within the final 12 months!” says the analytics agency. Stablecoins can find yourself performing as gas for unstable property like Ethereum, so elevated exercise associated to them generally is a good signal for the market.

ETH Value

On the time of writing, Ethereum is floating round $2,800, down greater than 11% over the past seven days.