Please see this week’s market overview from eToro’s international analyst staff, which incorporates the most recent market information and the home funding view.

Dangerous belongings up globally for a robust end of Q3

US GDP progress for Q3 was confirmed at 3.0%, and softer Private Consumption Expenditure (PCE) inflation information for August, at 2.2%, supported the Federal Reserve’s outlook for a “Goldilocks” situation. This optimism helped the S&P 500 and Dow Jones shut the week up by 0.6%, whereas the Nasdaq rose by 1.1%. The European STOXX gained 2.7%, and Japan’s Nikkei added 5.6%. Nonetheless, essentially the most outstanding efficiency got here from Hong Kong’s Grasp Seng, which surged by 13%, its greatest week in 16 years, highlighting a rotation in the direction of areas beforehand lagging the US.

As of the top of Q3, the S&P 500 is up 20% for the 12 months, Nasdaq +19%, Grasp Seng +21%, gold +28%, and Bitcoin +54%, providing sturdy returns throughout numerous funding methods. With This autumn historically performing nicely, optimism stays excessive for the rest of 2024.

China’s $284 billion stimulus bundle

Aid for Chinese language equities arrived when the Chinese language authorities unveiled a big financial stimulus bundle to deal with the slowing financial system and stabilise the property market. The PBoC lowered rates of interest, lowered reserve necessities for banks, and launched measures to decrease mortgage prices, benefiting 50 million households. Moreover, the bundle included new insurance policies geared toward bolstering the inventory market and issuing 2 trillion yuan in bonds to assist native governments and stimulate client spending.

Outlook October

October will shift the main target again from macro to micro, with JP Morgan unofficially kicking off the brand new earnings season on October 11, operating by way of to NVIDIA’s report in mid-November. Analyst expectations for realised income and earnings progress in Q3 stay modest however are considerably larger for the next intervals. As time goes on, investor consideration will more and more flip to the end result of the tense US presidential election on November 5, in addition to the high-profile BRICS Summit in Russia, starting on October 22. For extra steerage, watch our This autumn Funding Outlook video attributable to be launched on October 7.

The US labour market should not cool a lot additional

The US labour market information for September, due for launch on Friday, is of paramount significance to buyers. The Federal Reserve has made it clear that its precedence is to keep away from additional cooling of the labour market, as reaching a “gentle touchdown” stays its prime purpose. Any indicators of weak point within the labour market might enhance the probabilities of the Fed contemplating an extra 50 foundation level fee reduce in November. Nonetheless, such indicators can also set off heightened volatility within the markets. A reasonable enhance of 145,000 new jobs is anticipated, whereas the unemployment fee is anticipated to stay regular at 4.2%.

Rate of interest cuts not but enough for property growth

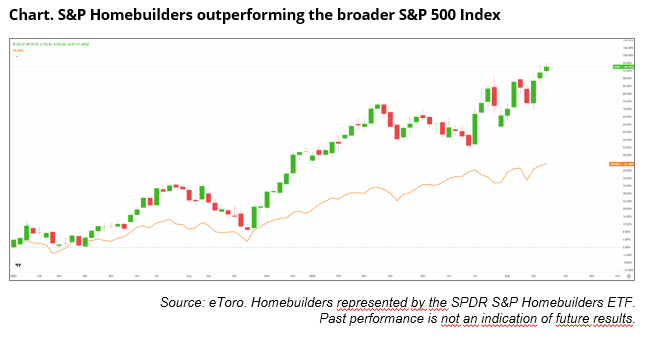

The US homebuilder sector has considerably diverged from the S&P 500 since late 2023 (see chart beneath), as buyers anticipate the constructive influence of forthcoming fee cuts on the housing market. The SPDR S&P Homebuilders ETF has delivered greater than double the return of the broader market for the reason that begin of 2023. Regardless of this optimism, a full restoration in the actual property sector has but to materialise, as weak constructing allow and housing begin figures counsel. Though there have been occasional sturdy months, a sustained upward pattern stays elusive. The 30-year mounted mortgage fee has dropped to six.1%, making homebuilding extra reasonably priced, however for a real growth, charges would wish to fall additional. The normalisation of financial coverage is on the horizon.

Earnings and occasions

Earnings are due for Nike (the place Elliot Hill will exchange John Donahue as CEO), Carnival Cruise Traces, Levi Strauss and Constellation Manufacturers. Traders will probably be watching not solely Chinese language shares reminiscent of Alibaba, Tencent, JD.com, PDD, BYD and NIO after the historic rally following the financial stimulus announcement final week, but in addition luxurious items makers reminiscent of LVMH, Tesla and Apple with a robust concentrate on the Chinese language client.

Trying forward on the agenda, subsequent week we’ll see Amazon Prime Huge Deal Days (Oct.8-9), TSMC month-to-month gross sales (Oct.9), Tesla robotaxi unveil (Oct.10), and JP Morgans Q3 earnings (Oct.11), marking the unofficial begin of the brand new earnings season.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any specific recipient’s funding goals or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.