The under is an excerpt from a current version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Bitcoin miners haven’t been working beneath regular circumstances for the previous a number of months. Bitcoin’s blockchain has seen a very intense diploma of demand over the previous a number of months, and it appears to be like like BRC-20s, and to a lesser extent, picture inscriptions, all made doable by the Ordinals protocol, bear an excessive amount of accountability. Basically, this protocol allows customers to inscribe distinctive knowledge on probably the most minute denominations of bitcoin, permitting them to create new “tokens” immediately on Bitcoin’s blockchain. Because of this portions of bitcoin price pennies by way of their fiat worth could however be purchased and bought a number of occasions, with each one in every of these transactions needing to be processed by the identical blockchain, to not point out the excessive demand seen whereas initially minting.

That is the place the Bitcoin miners are available in. The energy-utilizing computations undertaken by specialised mining {hardware} should not solely meant to generate new bitcoin, however additionally they can be utilized to confirm the blockchain’s transactions and hold the digital economic system flowing easily. With community utilization about as excessive because it’s ever been, miners have greater than sufficient alternatives to earn income simply by processing these transactions, and the precise manufacturing of newly-issued Bitcoin can take one thing of a backseat. As of February 2024, these situations have created a state of affairs the place mining issue is greater than ever earlier than in Bitcoin’s historical past, but the business is raking in giant income. Nevertheless, one of the vital dependable patterns within the Bitcoin market has been the sheer chaos that sees charges spike after which plummet. So, what is going to occur to miners after these situations change?

It’s this ecosystem that grew to become fairly disturbed on January 31 when federal regulators declared a brand new mandate: the EIA, a subsidiary of the US Division of Power (DOE), was going to start a survey of electrical energy use from all miners working in the US. Recognized miners will probably be required to share knowledge on their vitality utilization and different statistics, and EIA administrator Joe DeCarolis claimed that this examine will “particularly concentrate on how the vitality demand for cryptocurrency mining is evolving, determine geographic areas of excessive development, and quantify the sources of electrical energy used to satisfy cryptocurrency mining demand.” These targets appear simple sufficient at first look, however a number of components have given Bitcoiners pause. For one factor, Forbes claimed that this directive got here from the White Home, which referred to this motion as an “emergency assortment of information request.” This survey is explicitly created with the aim of analyzing the potential for “public hurt” from the mining business, and even included an apart that this “emergency” assortment would possibly result in a extra routine assortment anticipated from each miner within the close to future.

Clearly, language like this has left many locally extraordinarily uneasy, and several other main miners have already made statements condemning the initiative. The tone coming from regulators appears to be of an awesome narrative that these companies are a possible menace, whether or not by growing carbon emissions, taxing electrical infrastructure, or being a public nuisance. Among the most egregious claims are simply debunked, but it surely doesn’t change the truth that a couple of hostile authorities actions may drastically upset this ecosystem. Moreover, the world of mining already has a serious upset on the horizon, within the type of the upcoming Bitcoin halving. This common protocol baked into Bitcoin’s blockchain is ready to mechanically lower mining rewards in half someday in April, at block 840,000, and already some pessimists are claiming that this upset will probably be sufficient to place practically the whole business out of enterprise. What are the precise worst case eventualities right here? What are the most definitely ones?

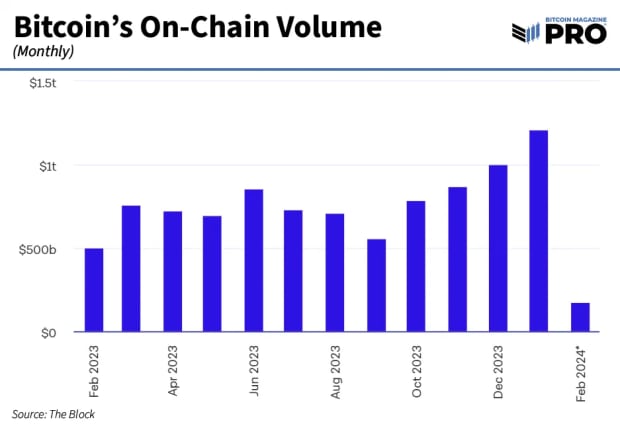

First, it’s essential to look at among the components inherent to Bitcoin which might be prone to affect miners, no matter authorities stress. The miners are in a weird market state of affairs as a result of transaction charges can generate income on the identical degree as precise mining, however the state of affairs could also be stabilizing. New knowledge reveals that Ordinals gross sales plummeted by 61% in January 2024, exhibiting that their affect on blockspace demand is prone to diminish. So, if sure miners are relying on these tokens to take care of income, that income stream shouldn’t be trying significantly reliable. Nevertheless, though community utilization from these microtransactions is prone to plummet, common transactions are literally trying nice. The buying and selling quantity of bitcoin is greater than it has been since late 2022, and it reveals no indicators of stopping. Absolutely, then, there will probably be loads of demand for the minting of recent bitcoin.

Bitcoin visitors has been growing for a number of months because the prospect of a legalized Bitcoin ETF grew to become increasingly more actual, and now that this battle is over, the buying and selling quantity has elevated at a larger charge. Whereas the halving can current alternatives and challenges for miners, none can declare that it’s an sudden occasion. Corporations have been getting ready for it as a matter after all, with round $1B of this elevated buying and selling quantity coming from miners themselves. Reserves of bitcoin held by miners are at their lowest level since earlier than the spike in 2021, and miners are utilizing the capital from these gross sales to improve gear and prepared themselves.

In different phrases, unbiased of any authorities motion, plainly the market situations are prone to shift resulting from these components. The underside could fall out for among the smaller companies that function on slim margins, however the total development in Bitcoin buying and selling quantity implies that there’ll at all times be alternatives to make income. Because it’s probably the most well-capitalized companies that may take advantage of in depth preparations for the halving, it could very effectively come to move that among the extra inefficient mining firms will be unable to outlive. From a regulatory standpoint, maybe that could be a wished end result.

The federal authorities appears principally involved with perpetuating the concept the mining business is a tax on society as a complete, consuming large quantities of electrical energy for an unclear profit. Nevertheless, solely probably the most environment friendly operations will probably be assured to outlive the halving and its financial fallout. Because the much less environment friendly ones shut their doorways, the survivors will probably be left with a a lot bigger slice of a smaller total pie. In addition to, if the open letters from a number of main companies are something to go by, these firms are absolutely ready to make a vocal struggle in opposition to any tried crackdown on the business. Contemplating that the survey itself remains to be in its first week of information assortment, it’s troublesome to say what conclusions it’ll draw, or how the EIA will probably be empowered to behave afterwards. Crucial factor to contemplate, then, is that these new traits are going down with or with out the EIA’s affect.

The survey is just simply starting, and the halving is just months away. There are many causes to be involved concerning the EIA’s affect on the mining business, but it surely’s not like that is the one issue. From the place we’re sitting, it looks as if the entire ecosystem could also be considerably modified by the point regulators are prepared for any motion, even when the motion is harsh. The folks left to face them will probably be hardened themselves, survivors and innovators from a chaotic market. Bitcoin’s nice energy has been its skill to vary quickly, permitting new fanatics the prospect to benefit from one algorithm, after which rise or fall as the principles change. It’s this spirit that propelled Bitcoin to its world heights over greater than a decade of development. In comparison with that, what likelihood do its opponents have?