Briefly

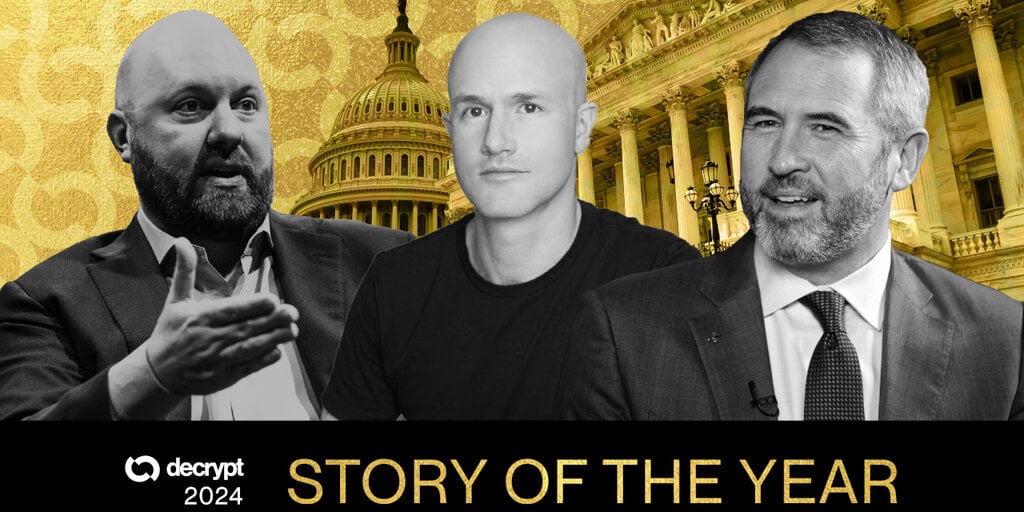

Crypto lobbying efforts led by Coinbase, Ripple, and Andreessen Horowitz modified the political panorama in 2024.

The plan labored, but it surely additionally set a dangerous precedent.

The story of the way it occurred, and what it means for crypto and past, is Decrypt’s 2024 Story of the Yr.

It was December 2022, FTX had simply collapsed right into a $32 billion greenback cloud of vapor, Sam Bankman-Fried was adjusting to life within the sick bay of a Bahamian jail, and Coinbase Chief Coverage Officer Faryar Shirzad was feeling cautiously optimistic.

Shirzad was a battle-tested D.C. insider with many years of expertise navigating the internal sanctums of Congress and the White Home. Because the steward of Coinbase’s repute on Capitol Hill, there was definitely loads in regards to the implosion of fellow crypto alternate FTX to trigger him concern—however on the time, Shirzad’s instincts led him to imagine the scandal might be productive.

“It appeared like, for all of the horrible features of the FTX debacle, it will have engendered one thing we thought was lengthy overdue: a transparent federal framework across the buying and selling of crypto belongings,” Shirzad advised Decrypt.

Misconduct in different industries had been identified to result in legislative reform in Washington. Firms like Coinbase have been itching for a crypto regulatory framework, and would have welcomed new legal guidelines designed to root out future FTXs and reward their compliant rivals.

We have been coping with a political drawback. And to cope with that political drawback, we wanted a political answer.

However such legal guidelines by no means got here. Over the following six months, as an alternative, most politicians distanced themselves from the business, contemplating it politically poisonous. In the meantime, a choose variety of progressive lawmakers seized on FTX’s demise as proof of crypto’s inherently prison nature.

Votes on digital belongings laws, simply months in the past on the precipice, have been now non-starters.

It took till mid-2023 for crypto coverage leaders like Shirzad to appreciate simply how drastically the bottom had shifted beneath their ft. Persistent efforts to sway lawmakers saved hitting partitions. Crypto’s current lobbying techniques have been now impotent.

“We started to appreciate that for all of our efforts, it didn’t matter,” Shirzad mentioned.

“We have been coping with a political drawback,” he mentioned. “And to cope with that political drawback, we wanted a political answer.”

That answer would transform the implementation of a company political spending technique by no means earlier than seen in American historical past—one that might value some $300 million; that might, inside barely greater than a 12 months, reverse the crypto business’s fortunes fully; and that some specialists imagine has paved the best way for already-influential firms to wield unprecedented management over the American political course of.

“Go huge or go dwelling”

By the autumn of 2023, the leaders of America’s wealthiest crypto firms had determined that, regardless of differing political beliefs, they’d no selection however to band collectively and do one thing daring to guard their younger business from extinction. Coverage specialists at these firms led the cost, convincing their bosses {that a} crypto tremendous PAC might be the trail ahead—regardless of the numerous dangers posed by such a method.

Tremendous PACs have been nonetheless a comparatively new political instrument. Birthed by a 2010 U.S. Supreme Court docket ruling, they allowed people and firms to donate limitless sums of cash to assist political candidates—as long as that cash wasn’t touched by campaigns straight.

The innovation upended American marketing campaign finance the second it was legalized. Political organizations like AIPAC, the pro-Israel lobbying group, seized on tremendous PACs as a way to reshape congressional races with unparalleled sums of money.

Ideologically pushed billionaires additionally turned notably infatuated with tremendous PACs. Hye Younger You, a Princeton professor specializing within the historical past of marketing campaign finance in the US, advised Decrypt that sponsoring normal pro-Democrat or pro-Republican tremendous PACs emerged “virtually as a political pastime” amongst America’s wealthiest elite between 2010 and 2022.

Throughout that complete interval, nonetheless, tremendous PACs have been all-but prevented by firms.

Why? PACs carried an anti-democratic stigma and have been related to partisanship—an alienating pressure that might flip off some portion of an organization’s buyer base. So America’s prime industries largely wrote them off, You mentioned, as extra bother than they have been value.

“It is fairly outstanding how little firms and business sponsored specific tremendous PACs,” she mentioned. “Till this election.”

That such a method was not solely untested but in addition dangerous wasn’t misplaced on the leaders of the three main firms who debated supporting a crypto tremendous PAC within the fall of 2023: America’s main crypto alternate Coinbase, crypto funds firm Ripple, and the Silicon Valley enterprise capital big Andreessen Horowitz.

What if the crypto business took pictures at main political gamers and missed? What if getting overtly political turned out to be model suicide?

These issues have been mitigated by the digital asset business’s more and more perilous place in late 2023. The SEC was coming in any respect method of crypto initiatives with full pressure. Any shot at change appeared much less dangerous than doing nothing.

“We might invested $150 million in defending towards litigation from the SEC,” Stuart Alderoty, Ripple’s chief authorized officer, advised Decrypt. “So we definitely knew that not getting coverage proper was an costly endeavor.”

“It was go huge or go dwelling,” he mentioned.

So the leaders of Ripple, Coinbase, and Andreessen Horowitz determined to go huge. Unprecedentedly huge.

It was definitely some huge cash by anybody’s measure. However given the choice, it appeared like a rational choice to make.

They bought in contact with the operators of Fairshake, a newly created crypto tremendous PAC that didn’t have a lot in the best way of funding or repute, however already existed. After vetting Fairshake’s management, which was comparatively inexperienced in comparison with that of different prime tremendous PACs, it was determined that the plan may work—as long as everybody concerned agreed on a number of elementary questions that might show essential to the street forward.

If Ripple, Coinbase, and Andreessen Horowitz gifted Fairshake a large conflict chest, would all of them have the abdomen to go after highly effective incumbent lawmakers? The reply, after some discomfort, was sure. May all of them agree on a bipartisan slate of candidates, to make sure the sturdiness of their coalition? Sure once more. What if that meant abandoning Republicans, who had been good to the business, within the identify of supporting pro-crypto Democrats?

Extra discomfort ensued—however in the end, positive. No matter it took.

In September 2023, Coinbase CEO Brian Armstrong donated $1 million to Fairshake. The following month, Marc Andreessen and Ben Horowitz gave $2.5 million apiece. In November, Coinbase donated $5 million. By Christmas, Andreessen and Horowitz gifted one other $14 million; Coinbase, one other $15.5 million. Ripple matched each companies by throwing $20 million into the pot.

“It was definitely some huge cash by anybody’s measure,” Ripple’s Alderoty mentioned. “However given the choice, it appeared like a rational choice to make.”

By the beginning of 2024, Fairshake had amassed practically $85 million, obliterating the earlier document held by a company group for tremendous PAC fundraising: the Nationwide Affiliation of Realtors’ comparatively meager $18 million fundraise in 2022.

By the eve of 2024’s presidential election, Fairshake and its affiliate PACs would increase practically $300 million.

The “crypto voter” and the “company cash demise star”

The gamers concerned disagree on the place the story goes from right here. What is thought for sure is that when 2024 kicked off, the overwhelming majority of Democratic lawmakers have been typically against crypto’s lobbying efforts, and whereas some Republicans have been supportive, most have been ambivalent.

By Might, crypto was a firmly ascendant trigger throughout the political spectrum.

Leaders of the crypto coverage motion are emphatic that this sea change was primarily due to a grassroots marketing campaign, instigated by Coinbase, to activate the so-called crypto voter and present lawmakers what number of thousands and thousands of Individuals have been keen to help—or oppose—candidates based mostly on their crypto stances.

Fairshake’s spending historical past tells one other story. In February, the tremendous PAC deployed over $10 million in a profitable bid to defeat Rep. Katie Porter (D-CA), a candidate for California’s open U.S. Senate seat.

They unloaded on her. That struck worry into the hearts of candidates.

This preliminary flex of Fairshake’s monetary muscle was important for a number of causes. For one, it was seismic in scale: this single spend on anti-Porter adverts dwarfed the candidate’s personal constructive advert spend by an element of 20:1, in line with Open Secrets and techniques.

Secondly, Porter wasn’t even notably anti-crypto; she not often if ever spoke on the topic. She was, nonetheless, one thing of a protégé of Sen. Elizabeth Warren (D-MA), a staunch crypto critic. The affiliation with Warren, apparently, was sufficient to set off the crypto business’s nuclear spending.

“Porter was not precisely crusading towards crypto, and but they unloaded on her,” Rick Claypool, a analysis director at Public Citizen, a shopper advocacy nonprofit, advised Decrypt. “That struck worry into the hearts of candidates.”

Within the spring, a handful of key crypto-related votes got here earlier than Congress: a vote within the Home on FIT21, a possible crypto market regulatory framework, and a vote in each chambers on the repeal of SAB 121, an SEC rule that discouraged banks from holding crypto.

Whereas each payments would have had a tangible affect on crypto if signed into regulation, their consideration in Might arguably served a extra essential function: performing as a litmus take a look at for lawmakers concerning their stances on digital belongings.

Months prior, Fairshake had signaled its intention to spend closely within the normal election. These tens of thousands and thousands of {dollars}, crucially, had but to be dedicated for or towards any normal election candidates when FIT21 and SAB 121 got here earlier than Congress.

Throughout these spring votes, Fairshake’s conflict chest hung within the air over Capitol Hill “like a company cash Dying Star,” Public Citizen’s Claypool mentioned.

The outcomes have been dramatic: 71 Home Democrats, together with Nancy Pelosi, broke with President Joe Biden to go FIT21. Twelve Senate Democrats, together with then-Senate Majority Chief Chuck Schumer, defied Biden to go a repeal of SAB 121. (The president subsequently vetoed the decision.)

Democrats dealing with battleground elections in 2024 demonstrated important modifications in tune. Rep. Elissa Slotkin (D-MI), for instance, was working for a hotly contested U.S. Senate seat in Michigan on the time; she held an “F” ranking on Coinbase’s “Stand With Crypto” watchdog website a month previous to the FIT21 and SAB 121 votes.

She then supported each initiatives in late Might. Briefly order, her Stand With Crypto ranking was upgraded to an “A.”

In September, Fairshake opted to throw thousands and thousands of {dollars} behind Slotkin and towards her opponent, a Republican who had vocally supported crypto for years. Slotkin in the end gained Michigan’s Senate race by a margin of lower than 0.34%.

Most crypto business leaders concerned in Fairshake’s operations see the conversion of politicians like Slotkin as proof of crypto’s salience among the many American public.

“I believe as soon as that turned crystallized for Democrats, it made it a way more clear selection,” Josh Vlasto, a spokesperson and strategic advisor for Fairshake, advised Decrypt. “‘We are able to transfer and embrace the expertise that our constituents clearly help and clearly have interaction with.’”

However in an election 12 months outlined by hot-button points like inflation, immigration, reproductive rights, and Israel’s conflict in Gaza, it’s not clear that crypto ranked as a excessive precedence for any significant group of voters. Mike Rogers, Slotkin’s Republican opponent, beforehand advised Decrypt that regardless of his robust help of the business, crypto virtually by no means got here up on the marketing campaign path in Michigan in 2024.

Some say crypto’s lack of grassroots energy was revealed by Fairshake itself within the tremendous PAC’s advert buys. Fairshake and its associates spent over $133 million throughout 68 congressional races in 2024; of that record-shattering spend, virtually none was used to buy adverts that talked about crypto in any way.

Decrypt couldn’t discover proof of a single normal election advert bought by Fairshake that talked about crypto or digital belongings; the tremendous PAC didn’t present proof of any such adverts when requested a number of occasions.

Fairshake normal election adverts seen by Decrypt as an alternative referenced points together with border safety and crime, the price of dwelling, and infrastructure.

“It makes me surprise,” Public Citizen’s Rick Claypool mentioned. “In the event that they have been so positive that each one they needed to do was mobilize the crypto plenty, then why wasn’t that the story they have been telling within the precise campaigns they put in entrance of voters?”

Fairshake’s Josh Vlasto pushed again on that conclusion. Whereas he conceded that the overwhelming majority of adverts purchased by the PAC didn’t focus on crypto, Vlasto asserted it’s common apply for particular curiosity teams to run adverts unrelated to their acknowledged mission.

“It is proof of effectiveness,” he mentioned. “If you are going to make investments important sources and help candidates that you simply imagine in, do it in a means that helps them win the race.”

Crypto’s dream situation

Within the build-up to November, issues have been trying good for Fairshake—or pretty much as good as they fairly might be in an election that was poised to return all the way down to the thinnest of margins up and down the poll.

For one, just about all battleground congressional candidates appeared on board with the business’s agenda. For one more, Fairshake had endorsed a firmly bipartisan slate of Democratic and Republican candidates within the normal election, and whereas that transfer definitely ruffled feathers and prompted defections, it didn’t trigger any main rifts among the many tremendous PAC’s internal circle of megadonors.

And even if Fairshake had (possible correctly) opted to remain out of the extraordinarily polarized presidential race, each Donald Trump, and, to a lesser extent, Kamala Harris, voiced help for crypto-related initiatives previous to Election Day.

And but, nothing may have ready anybody—together with Fairshake’s personal operators—for the tremendous PAC’s astounding conquest on November 5.

Not solely did Fairshake get its most prized “scalp” by defeating the crypto-skeptical chair of the Senate Banking Committee, Sen. Sherrod Brown (D-OH), with a pulverizing $40 million advert blitz—the PAC additionally noticed virtually each single one among its normal election candidates win throughout the board.

Whether or not Democrat or Republican, rural consultant or big-city senator, the clearest data-driven throughline to election evening was that in case you have been backed by Fairshake, you in all probability bought elected.

Add to that outstanding consequence the truth that Donald Trump gained re-election after going all in on crypto—and the pledges made by incoming Republican majorities within the Home and Senate to right away go digital belongings laws—and also you get a dream situation for the business that might have sounded delusional even a 12 months in the past.

Gone immediately have been any theoretical regrets amongst Fairshake’s megadonors about political blowback or spending too lavishly on elections.

Seen as investments, the hefty spends of Fairshake’s key donors have already reaped unimaginable rewards. Ripple, for instance, spent $63 million on the 2024 election, in line with Open Secrets and techniques. The corporate’s escrowed stash of XRP, a cryptocurrency its founders helped develop, has elevated in worth by greater than $100 billion since election day.

By all accounts, the prospects for crypto’s regulatory destiny in the US seem rosier than ever. A broader view of the potential affect of Fairshake’s techniques past crypto, nonetheless, seems extra grim.

Public Citizen’s Rick Claypool says he expects to see different company sectors try to copy Fairshake’s technique after the tremendous PAC demonstrated such a considerable return on funding for donors. These strikes, he mentioned, may simply dwarf crypto’s in measurement and affect—and pose a significant drawback for democracy.

“All issues thought-about, crypto is just not large,” he mentioned. “When you have different sectors or a number of sectors taking part in the identical forms of election video games, pooling cash to win a positive Congress, it makes it that a lot more durable for points that folks care about, however don’t align with a selected business’s revenue motive, to get by means of.”

Fairshake’s Josh Vlasto took concern with the notion that cash was purely to thank for the tremendous PAC’s successes. He maintained that his crew’s considerate and centered technique was simply as essential to their victories.

“It isn’t simply cash,” Vlasto mentioned. “It isn’t.”

Princeton’s Hye Younger You, in the meantime, felt conflicted in regards to the potential implications of crypto’s historic triumph in 2024.

“On one hand, the sheer amount of cash and the best way it would bias coverage outcomes is worrisome,” she mentioned.

Then again, You screens numerous PACs in her job, and couldn’t assist however really feel notably invested in Fairshake. In spite of everything, she owns some Bitcoin.

Day by day Debrief Publication

Begin every single day with the highest information tales proper now, plus unique options, a podcast, movies and extra.