Bakkt Holdings, the digital-asset market launched by the mother or father firm of the New York Inventory Change (NYSE), is reportedly contemplating a possible sale in mild of elevated takeover exercise throughout the crypto {industry}.

Bakkt Evaluates Strategic Options

In accordance to Bloomberg, sources acquainted with the matter have revealed that Bakkt has engaged a monetary advisor to discover numerous strategic choices, together with a possible breakup. Nonetheless, no last resolution has been made.

Intercontinental Change (ICE), the proprietor of main futures markets and the NYSE, launched Bakkt amid vital anticipation. The enterprise was introduced in collaboration with Starbucks and Microsoft, garnering substantial consideration.

Kelly Loeffler, Bakkt’s founding CEO, later served as a US Senator from Georgia for one 12 months. Earlier this 12 months, Bakkt confronted the chance of delisting from the NYSE after disclosing potential challenges in persevering with as a going concern.

Bakkt, which supplies a number of providers, together with buying and selling and custody, enters the market throughout a interval of consolidation throughout the digital asset sector.

Nonetheless, crypto costs have surged to near-record highs, prompting some companies to contemplate enlargement whereas others proceed recovering from the industry-wide downturn two years in the past.

Potential Breakup Thought-about

Bakkt went public in 2021 via a merger with a blank-check automobile. Within the first quarter of this 12 months, the corporate reported a lack of $21 million on $855 million in income. On Friday, Bakkt unveiled a partnership with Crossover Markets to develop a crypto digital communication community (ECN), additional increasing its choices.

Bakkt holds a coveted BitLicense from the New York State Division of Monetary Companies, a regulatory license required to function within the state.

Following the information, the corporate’s shares surged 15% to achieve $22.33 on Friday, a 27% improve for the week. The corporate’s market worth stands at roughly $300 million. Nonetheless, Bakkt’s inventory has declined round 30% over the previous 12 months.

General, because the digital asset market agency explores potential strategic choices, together with a possible sale, in response to heightened exercise within the crypto {industry}, it faces an important crossroads.

Bakkt’s suite of providers, BitLicense approval, and up to date partnership bulletins place it as a big participant available in the market. Nonetheless, {industry} members will intently monitor the corporate’s future trajectory and dedication to stay impartial or search a purchaser.

As of the newest replace, the full market capitalization of the cryptocurrency market has dipped beneath the $2.5 trillion mark. This decline has been primarily pushed by the lower within the worth of Bitcoin (BTC), the most important cryptocurrency by market capitalization. Bitcoin has skilled a drop from $71,000 and is presently valued at roughly $69,000.

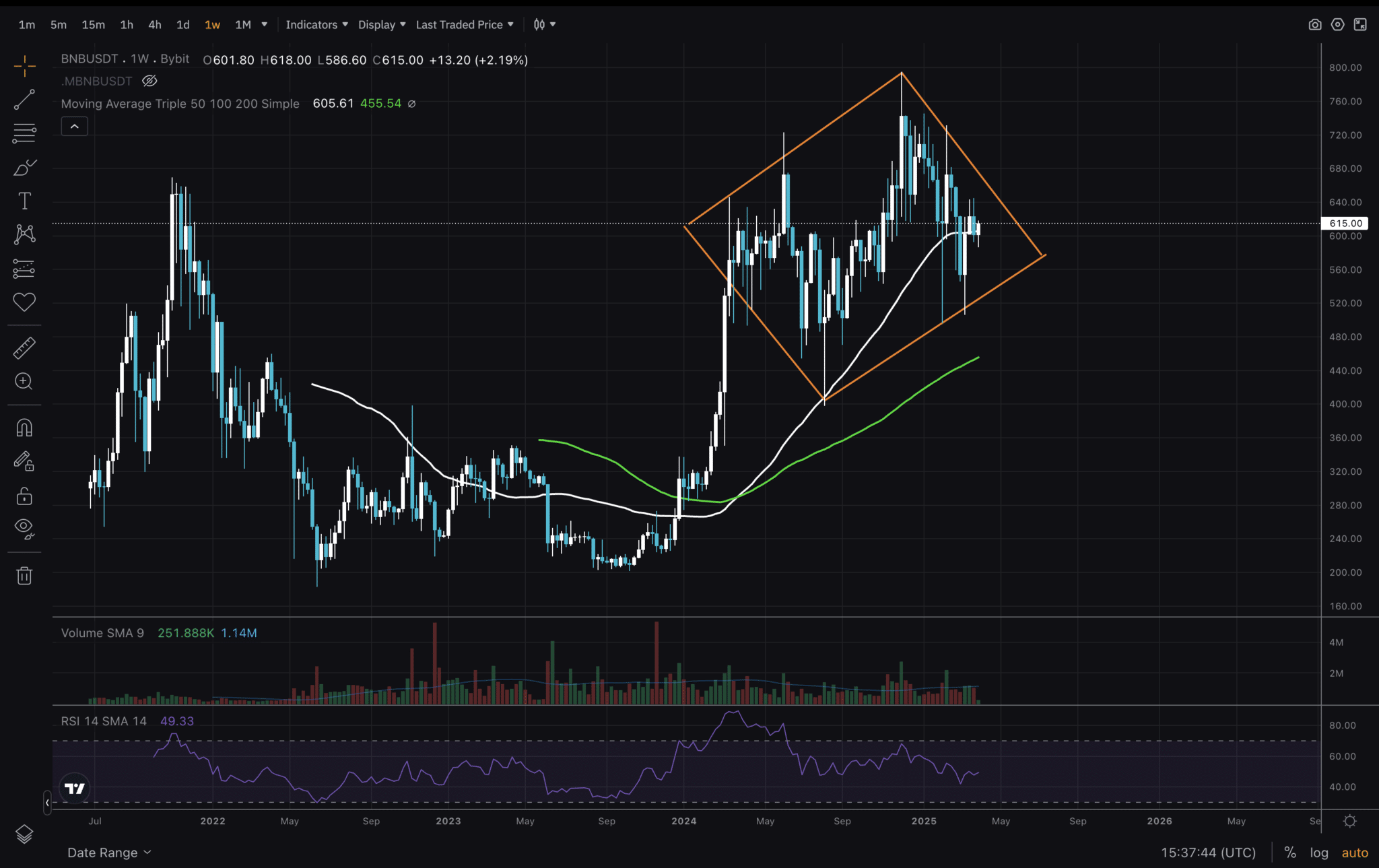

Featured picture from Shutterstock, chart from TradingView.com