Each bull run begins with a wave of capital inflows, one thing that excites these watching sufficient to trigger the concern of lacking out. On account of that FOMO, merchants & “paper hand” holders get emotional about holding “this rattling coin that simply does nothing,”. All whereas watching others straight line up, then dump their positions at magically the unsuitable time.

It’s not about capturing the primary wave of face melting income. It’s about utilizing that as an indicator to see how these items have truly labored out. There may be one catch although. It is best to solely try this when you perceive to ensure that this course of to achieve success, it have to be noticed and executed with little to no emotion. Additionally don’t hearken to social media both or you’ll nearly actually fail.

The wave of capital inflows run down, identical to water. That being the case, let me let you know what we do know. Each bull run that preceded us started with Bitcoin grinding as much as the Fibonacci 0.50 mark. It was solely when BTC crossed that mark that issues received thrilling. The 15-17 bull run would be the foremost focus of this text, resulting from a phrase depend cap.

For the reason that bear market lows, Bitcoin has been the most secure wager till the .50 fib. After that we’ve to observe our radar for what has technically damaged out throughout medium cap shares which can be doubling (+/-) BTC’s positive aspects in the identical timeframe. Rotate your allotted buying and selling quantity into it with out excuses, no “hodling” based mostly on emotions, or “the workforce”, and many others. This isn’t a lot about that, as it’s concerning the present eyes on them. Additionally identical to Solana this cycle, and Ethereum throughout the 15-17 run, there ought to be loads of time to scale out.

After that, I scale income into the basically strongest giant and medium caps. Currently the ETH/BTC reversal (since writing worth has damaged out up) signifies that, and the strongest inside its ERC-20 household (eg. LINK, MATIC, and many others.) are those to look at for the time being IMO (as seen within the chart beneath).

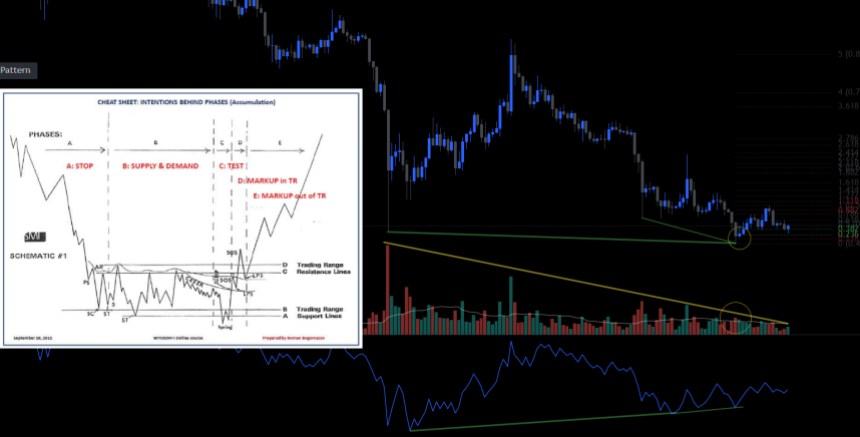

Happily, with some buying and selling training & expertise, the timing of these items turns into a lot much less of a guessing recreation. In the event you examine Elliott’s Wave evaluation, Wyckoff Schematics, chart patterns, quantity, and many others. When accomplished accurately (as seen within the MATICUSD chart beneath) you will be on the bleeding edge of those runs. Which ends up in a really completely satisfied Buying and selling account.

The place I transfer weight to subsequent has been at clear Fibonacci extensions of the runners, (which I’ve gauged from their prior actions). On this place I’ve seen it too many occasions to not perceive and worth that historical past could not repeat, but it surely typically rhymes. You may most simply determine the following runners through their technical breakouts that befell as Bitcoin crept up the fib scale and corrected on the main POI’s (as seen on the chart beneath).

The mechanic of capital inflows, stream down the road, throughout the small caps, micro caps & NFT’s, and many others. The way in which to catch huge positive aspects is comparatively straightforward in a bull market when you’re in it from the start. The subsequent trick is to maintain income.

Step Three – Securing Income

To retain income there are a selection of how to gauge targets as talked about earlier than with Fibonacci extensions, quantity paired with weekly candles, sentiment, Fibs, Elliott’s Waves and Wyckoff’s Distribution Schematics are greater than sufficient to come back out of every run with suitcases of revenue. So if that’s one thing that’s essential to you, both take the time to place the work in to study for your self or at all times be on the whim of others’ recommendation.

In the event you’re desirous about maintaining updated with the path of capital inflows, what I’m doing and when, preserve a lookout on NewsBTC or comply with me on Twitter for breakout and different related charts after I launch them, because the run continues, or DM me if you wish to study.

I’ll depart you with a couple of warnings that I’ve tried to share with my college students and other people near me, that are spoken from expertise and solely acknowledged in hopes that these phrases will defend anybody studying this from the identical laborious classes I and everybody I do know on this place have came upon the laborious manner, at the very least as soon as…

Whenever you really feel invincible, take income. When your prolonged household or associates begin asking on your recommendation on shopping for crypto, take income, and inversely after they let you know to promote, don’t. Lastly, probably the most helpful items of recommendation I’ve realized is, solely ever goal for the “meat of the transfer” not the precise high.