Enterprise capitalist Chris Burniske says that the present dip in digital belongings is typical of any bull market cycle.

In a publish on the social media platform X, Burniske, the previous head of crypto at Cathie Wooden’s ARK Make investments and present accomplice at Placeholder, factors out different corrections within the 2021 bull market cycle that in the end preceded new highs.

“In the course of 2021:

BTC drew down 56percentETH drew down 61percentSOL drew down 67percentMany others 70-80%+

You may give you all the explanations for why this cycle is completely different, however the mid-bull reset we’re going by isn’t unprecedented. These calling for a full-blown bear are misguided.”

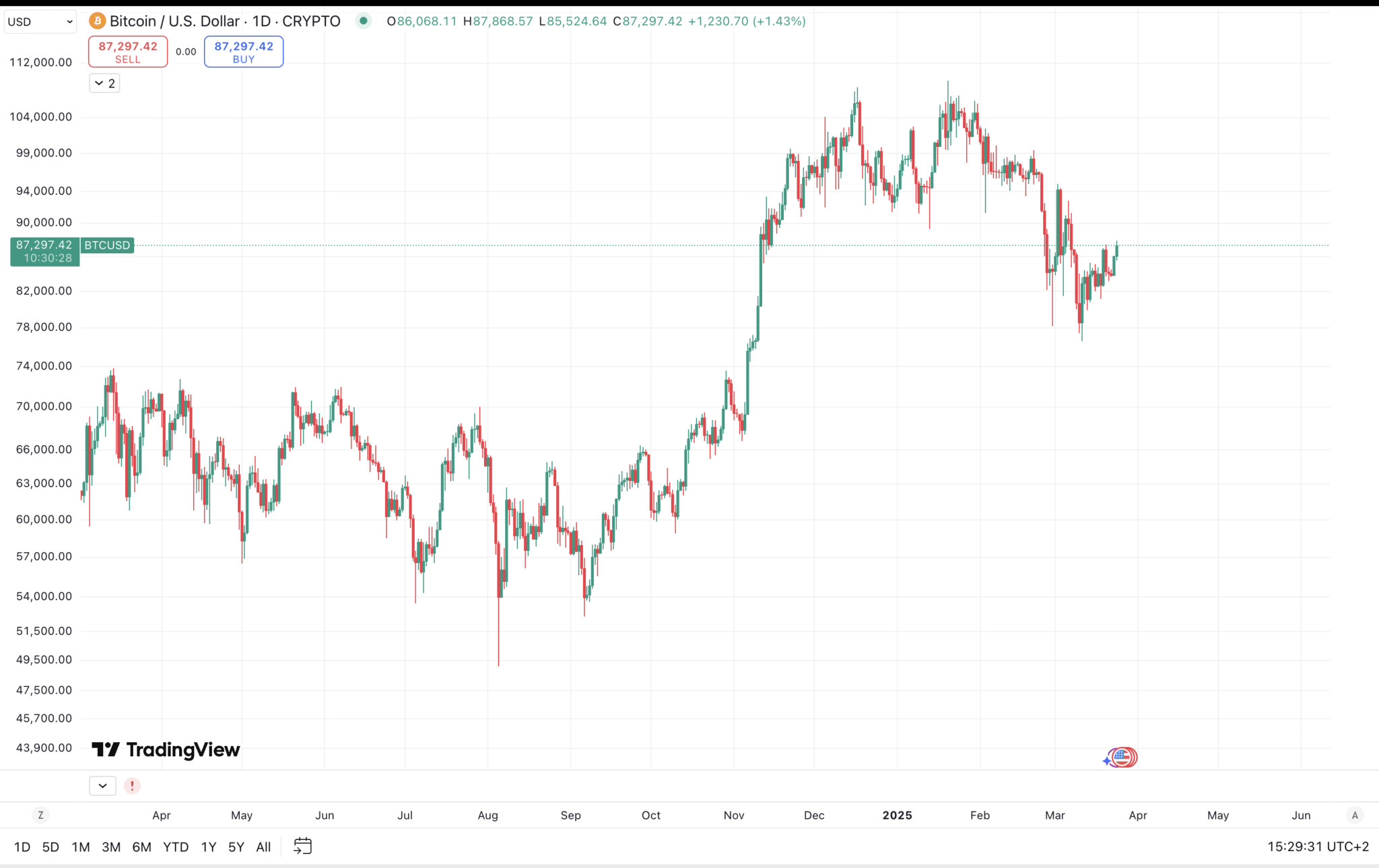

At time of writing, Bitcoin (BTC) is down 20% from its all-time excessive, Ethereum (ETH) is down 50% from its all-time excessive whereas Solana (SOL) is down 51%.

Earlier this month, Burniske mentioned that BTC’s lackluster worth efficiency appeared like a “mid-cycle high” harking back to April, Could, June of 2021, when “many mentioned it was over, top-callers gloated, after which we ripped in 2H ’21.”

Former Goldman Sachs government and present Actual Imaginative and prescient CEO Raoul Pal echoes Burniske’s sentiments. Pal, who has been vocally bullish on crypto, additionally believes the present correction is a pace bump on the way in which to new highs.

“You guys all must be taught persistence…

This was 2017. Very related macro construction:

5 x 28%+ pullbacks in BTCMost lasted 2 to three months earlier than a brand new highAlts noticed 65% corrections.All have been noise.

Go do one thing else extra constructive than stare on the display.”

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Value Motion

Comply with us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any losses it’s possible you’ll incur are your accountability. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in affiliate internet marketing.

Featured Picture: Shutterstock/dTosh/Roman3dArt