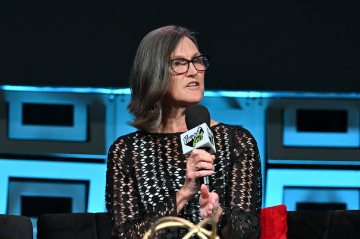

Cathie Wooden, CEO of ARK Make investments, despatched shockwaves via the cryptocurrency market by revising her Bitcoin value predictions upward in mild of the SEC’s current inexperienced mild for spot ETFs.

Wooden, already identified for her bullish stance, now sees the digital asset doubtlessly hitting $1.5 million by 2030, eclipsing her earlier $1 million projection.

Bitcoin ETF Approval Ignites Bullish Surge

This newfound optimism stems from the “inexperienced mild” Wooden perceives the SEC approval to be. In a CNBC interview, she said, “We expect the likelihood of the bull case has elevated with this SEC approval. This can be a inexperienced mild.”

ARK’s preliminary $1 million prediction was based mostly on a number of elements, together with the highest crypto’s hashrate, long-term holder provide, and energetic addresses, all of which have remained sturdy in comparison with earlier downturns. The ETF approval has merely added gas to the fireplace.

Cathie Wooden makes her $1.5 million bull case for the worth of bitcoin by 2030. https://t.co/r34iRNA9bG pic.twitter.com/chWWDH7ioE

— CNBC (@CNBC) January 11, 2024

However Wooden isn’t alone in her bullish outlook. Commonplace Chartered Financial institution not too long ago predicted Bitcoin might attain $200,000 by 2025, drawing parallels to the launch of the primary gold ETF in 2004.

Past value predictions, Wooden emphasised the broader implications of the ETF approval. She described Bitcoin as a “public good” and a “monetary superhighway,” highlighting its potential to revolutionize the way in which we work together with cash. She additional believes institutional traders’ entry via ETFs will considerably influence the digital asset’s value and trajectory.

BTC market cap at present at $900.106 billion. Chart: TradingView.com

Curiously, Wooden doesn’t anticipate the everyday “sell-on-the-news” state of affairs, suggesting market positioning has already adjusted to the ETF information. As a substitute, she expects substantial inflows from each institutional and retail traders, with retail doubtlessly main the cost.

Nevertheless, Wooden’s optimism is tempered with a dose of warning. She acknowledges short-term volatility however expresses sturdy long-term confidence in Bitcoin. In the end, she sees the restricted provide of 21 million cash as a strong driver of future worth, even with modest institutional allocation.

A Vital Turning Level

Whereas Cathie Wooden’s revised Bitcoin value prediction is undoubtedly attention-grabbing, it’s essential to keep in mind that it’s only one perspective. Cryptocurrencies are inherently risky, and predictions are notoriously tough to ensure.

Regulatory uncertainties and potential market bubbles stay considerations, highlighting the significance of thorough analysis and danger evaluation earlier than making any funding choices.

One factor is definite: the SEC’s approval of spot Bitcoin ETFs marks a major turning level for the world’s hottest cryptocurrency. Whether or not it fulfills Cathie Wooden’s bold imaginative and prescient for a $1.5 million Bitcoin future stays to be seen, but it surely has undoubtedly opened a brand new chapter within the ongoing digital forex saga.

Bitcoin surged to over $49,000 on Thursday, reaching its highest level since December 2021, pushed by the launch of U.S.-listed spot bitcoin exchange-traded funds (ETFs) and heightened anticipation. The cryptocurrency initially rose from beneath $46,000 to over $47,000, peaking at $49,042 throughout the early U.S. buying and selling session. Nevertheless, it later retraced all beneficial properties and fell beneath $46,000.

Featured picture from Getty Photos