In late 2019, Juventus launched the world’s first blockchain-based fan token, promising a revolution in fan engagement. Quick ahead to right this moment, and each single fan token has skilled excessive volatility with costs principally plummeting. This isn’t only a monetary accident; it’s a basic design failure. As we navigate via the aftermath, a brand new horizon emerges: Bitcoin and controlled monetary devices aligning completely with Monetary Honest Play (FFP) rules for sustainable sports activities financing.

The Mirage of Fan Token Innovation

Fan tokens have been praised as revolutionary instruments for deepening fan engagement via voting rights and unique rewards. Nevertheless, their sensible affect has been disappointing. The attract of blockchain expertise, whereas novel, didn’t translate into significant utility. As an alternative of enhancing fan engagement, the tradability of fan tokens overshadowed their supposed function.

Not solely have all tokens failed to take care of their preliminary value, however their volatility has uncovered followers to monetary danger, turning a instrument for engagement right into a speculative gamble.

A Monetary Folly

The arbitrary pricing of fan tokens, with no underlying worth to justify their value, has led to inevitable market hypothesis. This speculative nature, mixed with the shortage of intrinsic worth, resulted in vital monetary losses for followers. The introduction of fan tokens paradoxically abused the individuals the tokens have been meant to have interaction, contradicting the golf equipment’ mission to foster a supportive and steady fan group.

A Ethical Quandary

The ethical dilemma on the core of fan tokens is plain and has raised some moral questions. Golf equipment, absolutely conscious of the speculative nature of those tokens, nonetheless pursued them as a income stream, partnering with platforms like Chiliz. This exploitation of fan loyalty for monetary acquire undermines the golf equipment’ position as group stewards and erodes belief with their supporters.

“Fan tokens may quantity to little greater than golf equipment attempting to squeeze more money out of supporters by making up inconsequential engagement on-line polls,” mentioned Malcom Clarke, Chair of the UK Soccer Supporters’ Affiliation.

Bitcoin: A Beacon of Hope

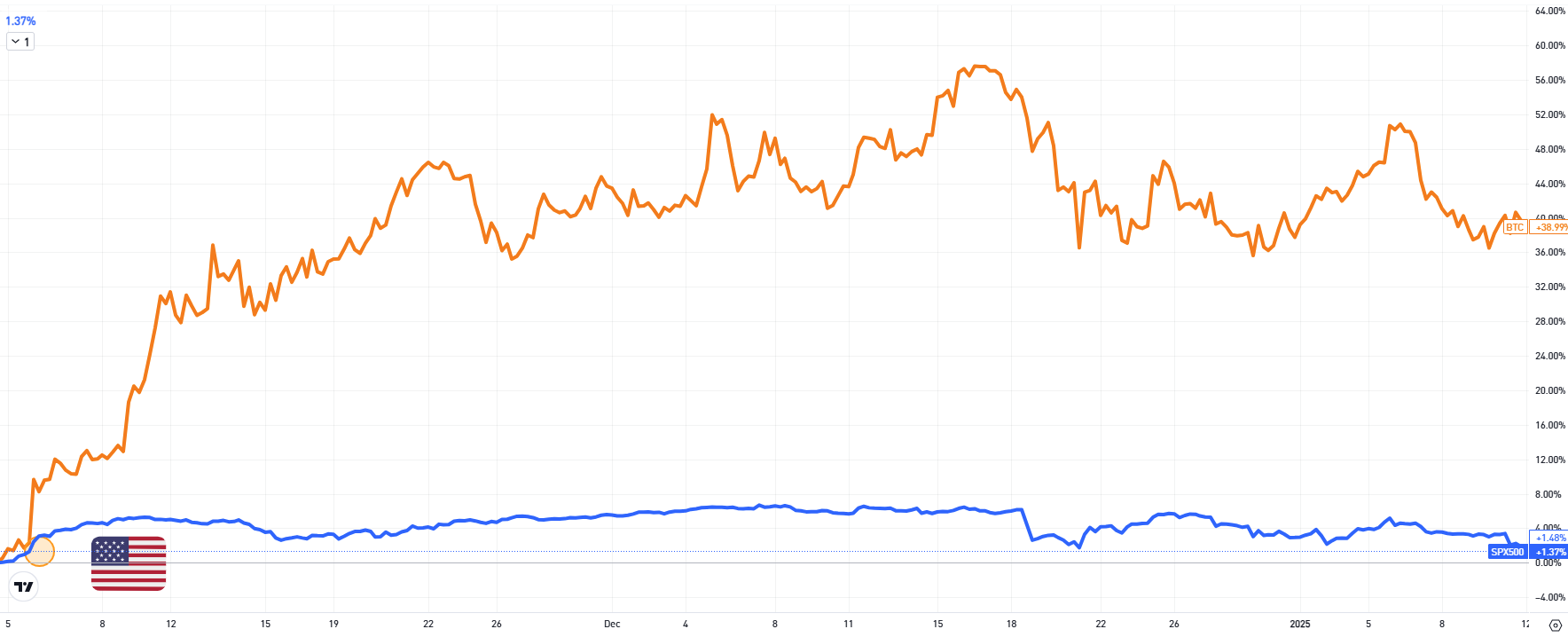

In distinction, Bitcoin and controlled monetary devices current a extra steady and moral different for sports activities finance. Bitcoin, with its confirmed 15-year monitor document of long-term value appreciation, offers a dependable basis for sports activities golf equipment’ monetary sustainability.

If Larry Fink (the world’s greatest asset supervisor) is appropriate, then Bitcoin is certainly larger than any sports activities membership, prompting the query: What’s your membership’s Bitcoin technique? By progressively transitioning to a Bitcoin customary, golf equipment can guarantee long-term monetary well being, foster real fan engagement, and construct a legacy that transcends the ephemeral beneficial properties from fan tokens.

JUST IN: BlackRock CEO Larry Fink says #Bitcoin “is larger than any authorities.” pic.twitter.com/Zz2JC0VQcG

— Bitcoin Journal (@BitcoinMagazine) January 12, 2024

A Roadmap to Adoption

The journey towards a Bitcoin-centric mannequin doesn’t should be abrupt. Golf equipment can begin by allocating a portion of their treasury to Bitcoin; exploring debt financing for buying Bitcoin; and alluring fan investments in alternate for a stake within the membership and its Bitcoin treasury.

These methods, alongside using conventional monetary devices, provide a path towards monetary stability and moral sports activities financing, in concord with UEFA’s Monetary Honest Play rules. This mannequin not solely advantages golf equipment and followers alike but additionally aligns with broader developments in the direction of monetary transparency and sustainability. In soccer, this has been completely exemplified by Peter McCormack’s Actual Bedford FC, which adopted Bitcoin as its core treasury asset in 2021, and has since demonstrated the feasibility and advantages of a Bitcoin-centric strategy.

And only recently the membership doubled down on its Bitcoin technique by promoting $4.5M value of fairness to the billionaire Winklesvoss brothers.

Constructing a Resilient Future

Whereas critics might spotlight Bitcoin’s volatility and regulatory challenges, these will not be insurmountable. Correct schooling, danger administration, and a gradual adoption technique can simply mitigate these considerations.

In actuality, adopting Bitcoin as a treasury asset can bolster golf equipment’ monetary resilience in instances of crew underperformance or macroeconomic downturns. For instance, having Bitcoin throughout the COVID disaster would have compensated for the lower in conventional business revenues that each membership skilled. Equally, having Bitcoin publicity can function a monetary buffer in instances of crew underperformance and decrease match revenues.

The Closing Whistle

The period of fan tokens, marked by exploitation and monetary instability, should finish. The way forward for sports activities financing lies in Bitcoin and established monetary devices, promising restored integrity in fan engagement and a steady, moral monetary basis for golf equipment. It is time to pivot away from short-lived speculative ventures in the direction of long-term worth creation. Let’s lead the cost towards a financially sustainable and unbiased sports activities trade.

The time to behave is now.

In late 2019, Juventus launched the world’s first blockchain-based fan token, promising a revolution in fan engagement. Quick ahead to right this moment, and each single fan token has skilled excessive volatility with costs principally plummeting. This isn’t only a monetary accident; it’s a basic design failure. As we navigate via the aftermath, a brand new horizon emerges: Bitcoin and controlled monetary devices aligning completely with Monetary Honest Play (FFP) rules for sustainable sports activities financing.

The Mirage of Fan Token Innovation

Fan tokens have been praised as revolutionary instruments for deepening fan engagement via voting rights and unique rewards. Nevertheless, their sensible affect has been disappointing. The attract of blockchain expertise, whereas novel, didn’t translate into significant utility. As an alternative of enhancing fan engagement, the tradability of fan tokens overshadowed their supposed function.

Not solely have all tokens failed to take care of their preliminary value, however their volatility has uncovered followers to monetary danger, turning a instrument for engagement right into a speculative gamble.

A Monetary Folly

The arbitrary pricing of fan tokens, with no underlying worth to justify their value, has led to inevitable market hypothesis. This speculative nature, mixed with the shortage of intrinsic worth, resulted in vital monetary losses for followers. The introduction of fan tokens paradoxically abused the individuals the tokens have been meant to have interaction, contradicting the golf equipment’ mission to foster a supportive and steady fan group.

A Ethical Quandary

The ethical dilemma on the core of fan tokens is plain and has raised some moral questions. Golf equipment, absolutely conscious of the speculative nature of those tokens, nonetheless pursued them as a income stream, partnering with platforms like Chiliz. This exploitation of fan loyalty for monetary acquire undermines the golf equipment’ position as group stewards and erodes belief with their supporters.

“Fan tokens may quantity to little greater than golf equipment attempting to squeeze more money out of supporters by making up inconsequential engagement on-line polls,” mentioned Malcom Clarke, Chair of the UK Soccer Supporters’ Affiliation.

Bitcoin: A Beacon of Hope

In distinction, Bitcoin and controlled monetary devices current a extra steady and moral different for sports activities finance. Bitcoin, with its confirmed 15-year monitor document of long-term value appreciation, offers a dependable basis for sports activities golf equipment’ monetary sustainability.

If Larry Fink (the world’s greatest asset supervisor) is appropriate, then Bitcoin is certainly larger than any sports activities membership, prompting the query: What’s your membership’s Bitcoin technique? By progressively transitioning to a Bitcoin customary, golf equipment can guarantee long-term monetary well being, foster real fan engagement, and construct a legacy that transcends the ephemeral beneficial properties from fan tokens.

JUST IN: BlackRock CEO Larry Fink says #Bitcoin “is larger than any authorities.” pic.twitter.com/Zz2JC0VQcG

— Bitcoin Journal (@BitcoinMagazine) January 12, 2024

A Roadmap to Adoption

The journey towards a Bitcoin-centric mannequin doesn’t should be abrupt. Golf equipment can begin by allocating a portion of their treasury to Bitcoin; exploring debt financing for buying Bitcoin; and alluring fan investments in alternate for a stake within the membership and its Bitcoin treasury.

These methods, alongside using conventional monetary devices, provide a path towards monetary stability and moral sports activities financing, in concord with UEFA’s Monetary Honest Play rules. This mannequin not solely advantages golf equipment and followers alike but additionally aligns with broader developments in the direction of monetary transparency and sustainability. In soccer, this has been completely exemplified by Peter McCormack’s Actual Bedford FC, which adopted Bitcoin as its core treasury asset in 2021, and has since demonstrated the feasibility and advantages of a Bitcoin-centric strategy.

And only recently the membership doubled down on its Bitcoin technique by promoting $4.5M value of fairness to the billionaire Winklesvoss brothers.

Constructing a Resilient Future

Whereas critics might spotlight Bitcoin’s volatility and regulatory challenges, these will not be insurmountable. Correct schooling, danger administration, and a gradual adoption technique can simply mitigate these considerations.

In actuality, adopting Bitcoin as a treasury asset can bolster golf equipment’ monetary resilience in instances of crew underperformance or macroeconomic downturns. For instance, having Bitcoin throughout the COVID disaster would have compensated for the lower in conventional business revenues that each membership skilled. Equally, having Bitcoin publicity can function a monetary buffer in instances of crew underperformance and decrease match revenues.

The Closing Whistle

The period of fan tokens, marked by exploitation and monetary instability, should finish. The way forward for sports activities financing lies in Bitcoin and established monetary devices, promising restored integrity in fan engagement and a steady, moral monetary basis for golf equipment. It is time to pivot away from short-lived speculative ventures in the direction of long-term worth creation. Let’s lead the cost towards a financially sustainable and unbiased sports activities trade.

The time to behave is now.