In a major growth for the cryptocurrency market, BlackRock’s iShares Bitcoin Belief has grow to be the most important fund devoted to Bitcoin, accumulating practically $20 billion in complete property since its US itemizing earlier this 12 months.

Bloomberg knowledge reveals that as of Tuesday, the exchange-traded fund held $19.68 billion price of Bitcoin, surpassing Grayscale Bitcoin Belief’s (GBTC) $19.65 billion place. Constancy Investments’ providing is the third-largest fund with $11.1 billion in property.

BlackRock’s iShares Bitcoin Belief Leads Inflows

The launch of the BlackRock and Constancy Bitcoin ETFs, alongside seven others, on January 11 marked a pivotal second for the crypto trade. Concurrently, the Grayscale automobile, working for over a decade, transitioned into an ETF.

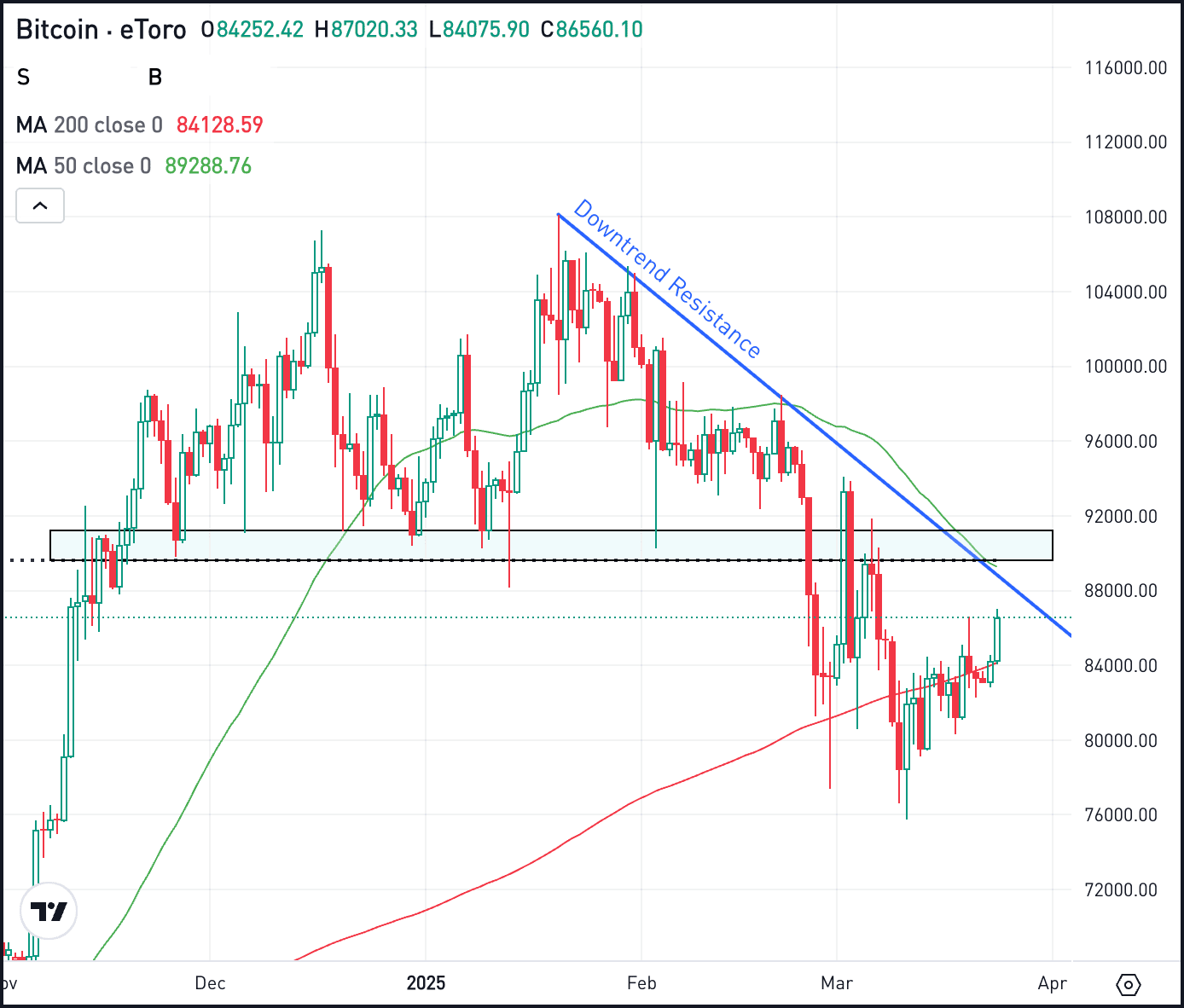

These developments considerably elevated Bitcoin’s accessibility for institutional and retail traders and triggered a rally on this planet’s largest cryptocurrency value, which soared to a report excessive of $73,700 on March 14.

Since its inception, the iShares Bitcoin Belief has attracted $16.5 billion in inflows, making it probably the most sought-after fund amongst traders. Conversely, the Grayscale fund skilled outflows of $17.7 billion throughout the identical interval.

A BlackRock spokesperson instructed Bloomberg that the agency is happy with the success of the iShares Bitcoin Belief. The spokesperson famous that traders want to entry Bitcoin by way of the “comfort and transparency” of an institutional-grade ETF. The corporate stays dedicated to educating traders and offering easy accessibility to Bitcoin.

Bitcoin ETFs Thrive Regardless of Volatility Issues

The Securities and Alternate Fee (SEC) reluctantly authorised the primary US spot-Bitcoin ETFs in January after a courtroom ruling 2023 prompted a reversal within the case introduced by Grayscale.

The transfer was important to deal with points the closed-ended Grayscale Bitcoin Belief confronted, the place shares sometimes traded at vital premiums or reductions to its web asset worth.

The group of Bitcoin funds, with a mixed complete of $58.5 billion in property thus far, represents probably the most profitable new classes of ETFs. Nonetheless, critics argue that the inherent volatility of digital property makes them unsuitable for widespread adoption, even inside ETFs.

Whereas some nations prohibit or ban investor entry to cryptocurrencies, main asset managers like Vanguard Group have explicitly said that they don’t have any plans to supply crypto-related merchandise. BlackRock and Vanguard stay the world’s two largest asset administration companies.

The introduction of ETFs has aided Bitcoin’s restoration, as its worth has quadrupled for the reason that starting of final 12 months.

Regardless of a slight dip of lower than 1%, with Bitcoin buying and selling at $67,600 on Wednesday, the continued success of the iShares Bitcoin Belief and the rising recognition of cryptocurrency-based ETFs proceed to form the panorama of digital asset investing.

Featured picture from Shutterstock, chart from TradingView.com