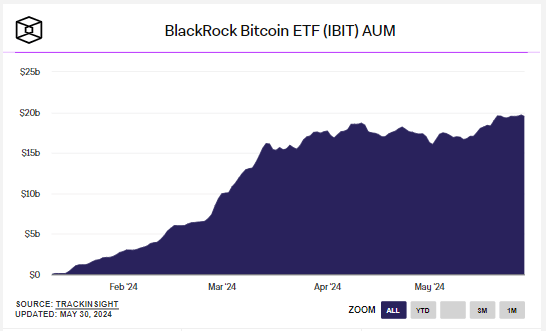

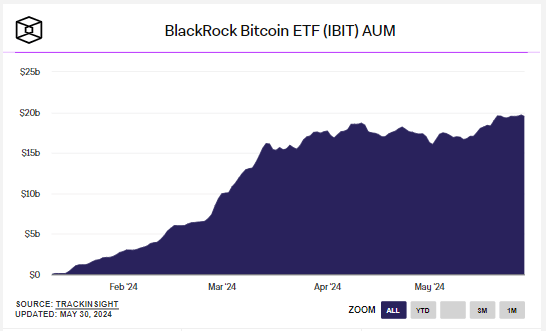

The newest information from Farside reveals slowing inflows into Bitcoin (BTC) exchange-traded funds (ETFs), totaling $28.3 million on Could 29. Six of the 11 ETF issuers skilled optimistic inflows, with BlackRock’s IBIT main the pack. BlackRock IBIT noticed a $24.6 million influx, bringing its whole internet influx to $16.5 billion. Constancy’s FBTC adopted with a $17.7 million influx, elevating its whole internet influx to $8.8 billion. In distinction, Grayscale’s GBTC skilled an outflow of $31.1 million, leading to a complete internet outflow of $17.8 billion. The general ETF market has now gathered a complete of $13.8 billion.

In keeping with The Block, BlackRock IBIT’s belongings underneath administration (AUM) have surged to $19.5 billion.

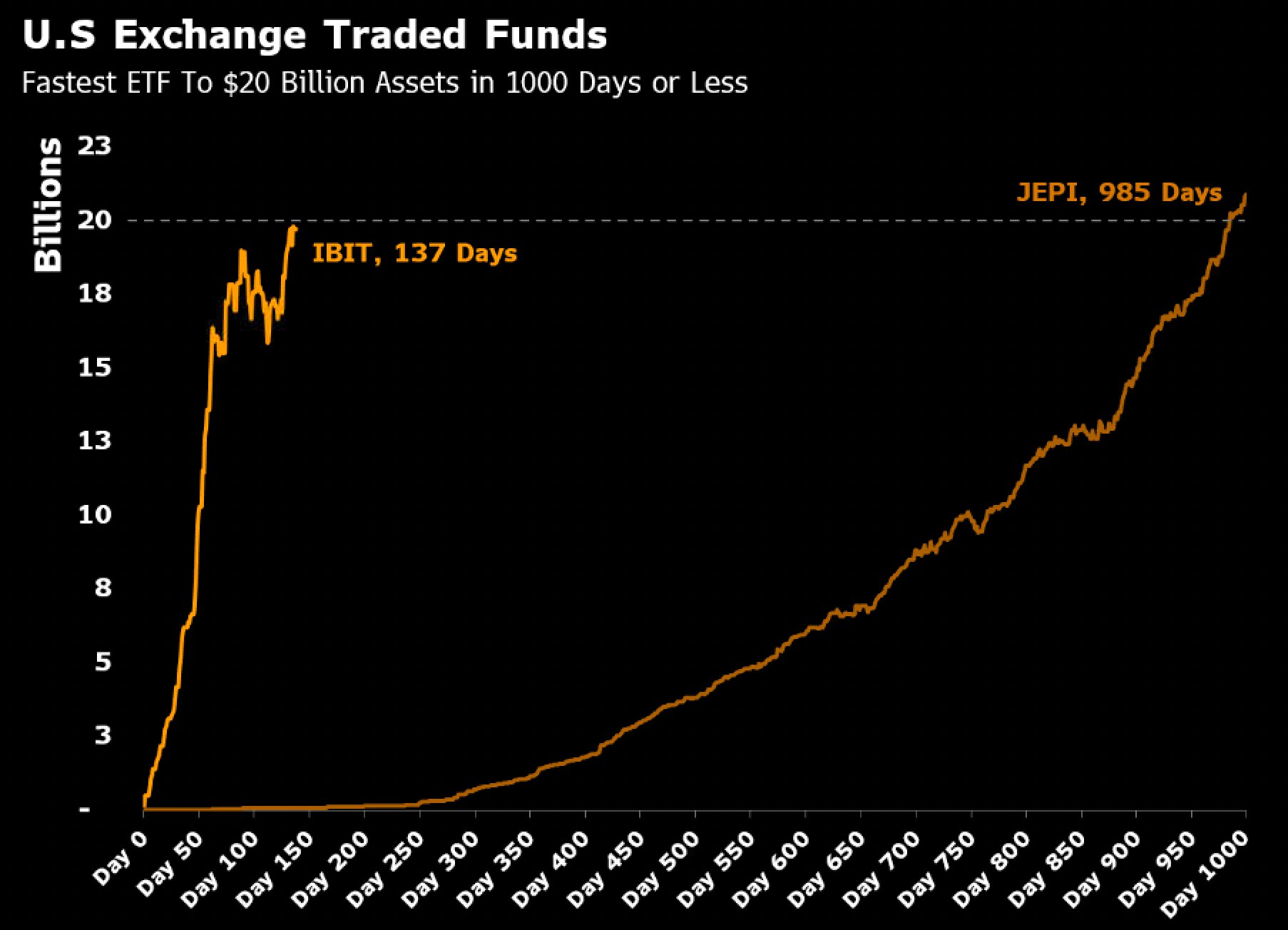

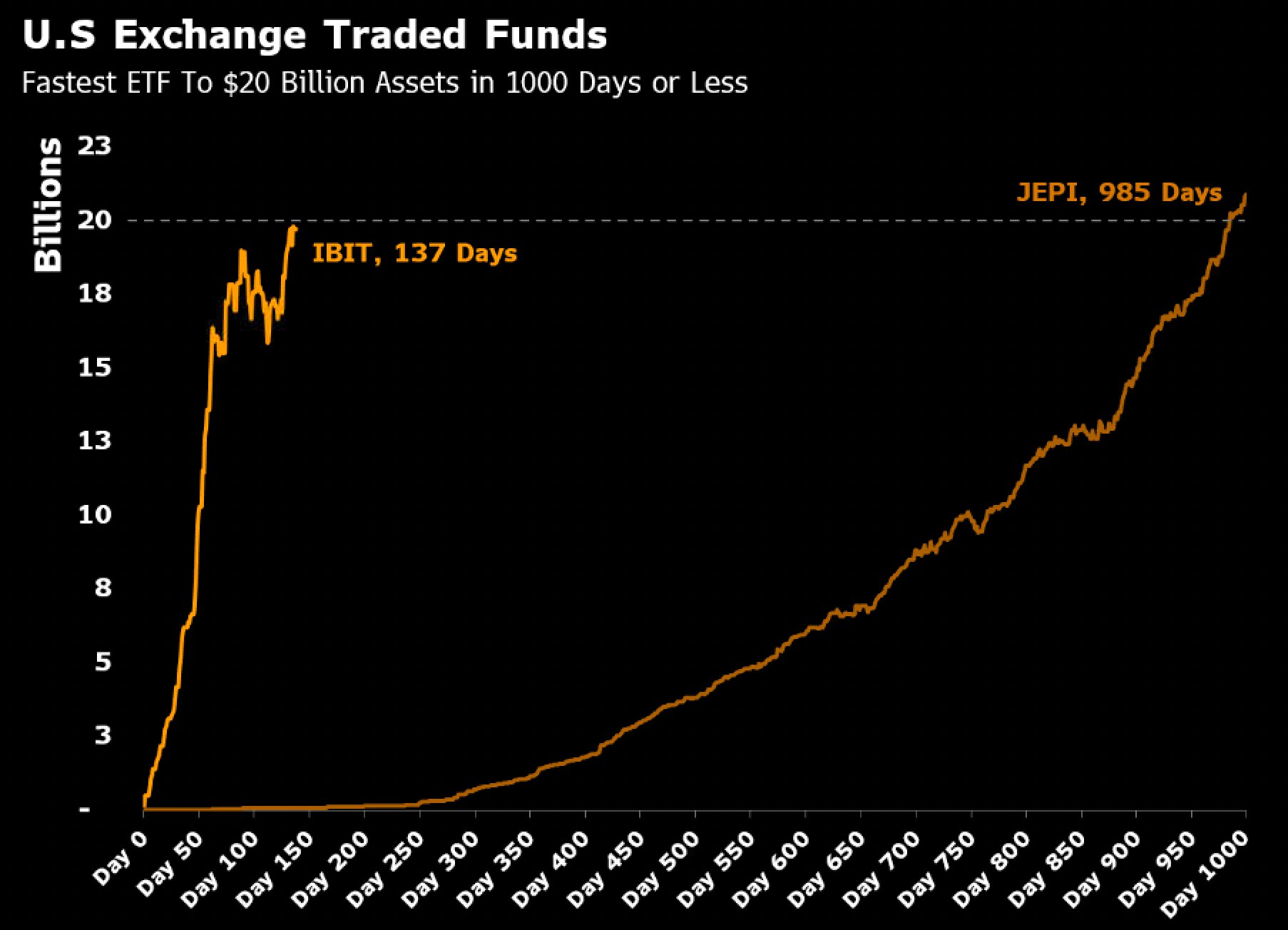

Senior Bloomberg ETF analyst Eric Balchunas highlighted the speedy progress of IBIT, noting its spectacular efficiency. He acknowledged:

“Extra context on simply how absurd $IBIT is, there’s solely been one ETF in historical past to succeed in $20b in belongings in underneath 1000 days. $JEPI, which did it in 985 days. $IBIT is a hair away at 137 days.”

The following milestone for BlackRock’s IBIT could possibly be surpassing the iShares Gold ETF (IAU), which presently holds roughly $29 billion in belongings underneath administration (AUM). Nate Geraci, president of the ETF Retailer, believes this milestone could possibly be achievable by the top of the 12 months. He acknowledged:

“After passing GBTC, the subsequent milestone to look at for the iShares Bitcoin ETF is monitoring down the iShares Gold ETF. IAU, launched in 2005, has practically $29 billion. It might be one thing if IBIT caught it earlier than year-end, as it’s presently nearing $20 billion.”