With President-elect Donald Trump’s latest dedication to utilizing Bitcoin as a strategic reserve asset for america, hypothesis relating to the timing and feasibility of this initiative has intensified throughout the crypto trade.

This proposal, first articulated in the course of the 2024 Nationwide Bitcoin Convention in Nashville earlier this 12 months by Trump and pro-crypto Senator Cynthia Lummis, has garnered vital consideration as main monetary gamers weigh in on its potential implications.

Race To Implement Strategic Bitcoin Reserve

Notably, BlackRock, the world’s largest asset supervisor and a number one issuer of cryptocurrency exchange-traded funds (ETFs), has reportedly expressed assist for establishing a strategic Bitcoin reserve.

As revealed by Trump’s earlier statements and Senator Lummis’ invoice, this initiative goals to handle the nation’s staggering nationwide debt, at present estimated at $36 trillion, by leveraging BTC’s distinctive attributes as a digital asset.

Dennis Porter, co-founder and CEO of the non-profit group Satoshi Motion Fund (SAF), confirmed BlackRock’s endorsement of the strategic Bitcoin reserve, whereas emphasizing that Trump’s administration is actively pursuing the creation of this reserve via an government order.

Porter has indicated that his discussions with US Senate workplaces reveal vital backing for this plan, stating, “Sport on, President Trump. The race is on.” He highlighted the state of affairs’s urgency, suggesting that Trump’s group is motivated to behave swiftly to implement the reserve earlier than any state can undertake related laws.

New BTC Laws Forward Of Trump’s Inauguration?

Porter additional famous that he’s racing to move the strategic Bitcoin reserve laws on the state degree, doubtlessly forward of any federal government order, underscored by his confidence that such legal guidelines might be enacted inside days of Trump assuming workplace.

Apparently, Trump’s proposal has discovered resonance outdoors the US, with Porter revealing that he has been invited to talk to members of Congress and parliament in two completely different nations, one in Europe and one other in Latin America, about establishing the same strategic Bitcoin reserve.

In parallel with these developments, BlackRock launched a report indicating a renewed optimism surrounding regulatory readability for Bitcoin and digital property, notably following the latest US elections.

The report means that Trump’s marketing campaign dedication to a strategic Bitcoin reserve, alongside the electoral success of pro-crypto politicians in each the Home and Senate, may create a positive macroeconomic setting for Bitcoin’s adoption.

Robbie Mitchnick, Head of Digital Belongings at BlackRock, highlighted that whereas Bitcoin’s long-term adoption will largely be pushed by its basic use case as a worldwide financial different, different components, equivalent to declining actual rates of interest, might also be catalysts for its elevated acceptance.

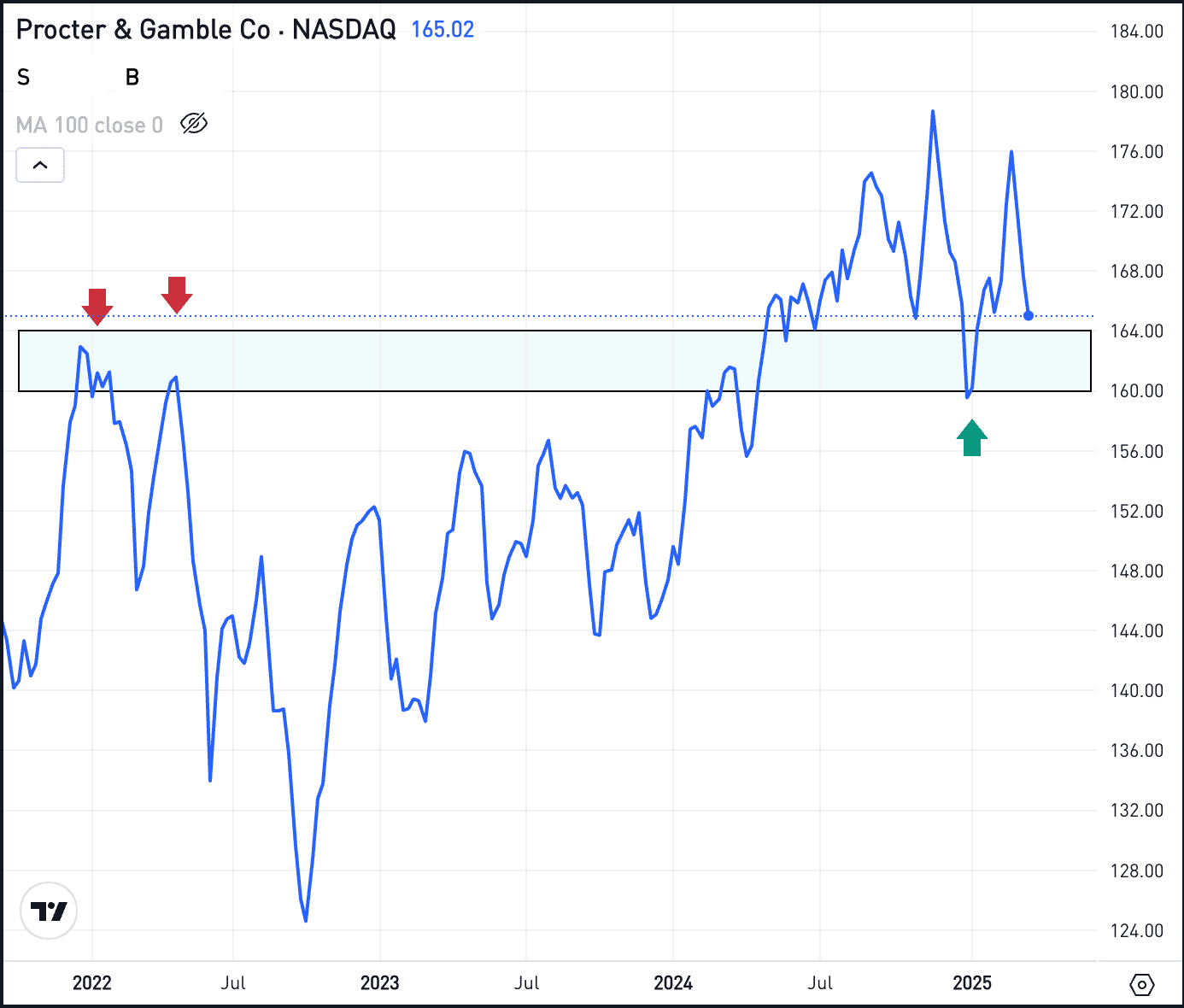

When writing, BTC was buying and selling at $92,330, approaching its all-time excessive of $93,300 reached throughout final week’s bullish pattern.

Featured picture from DALL-E, chart from TradingView.com