So, 2023 has been fairly epic for Bitcoin. It is like Bitcoin awakened and determined to flex its muscle tissue huge time. We’re speaking a large leap, over 140% in worth – that is large! It isn’t nearly topping conventional rivals like gold; it is also about leaving different cryptocurrencies within the rearview mirror. Let’s dive into the on-chain motion and the trade buzz, making an attempt to piece collectively clues to see what Bitcoin is perhaps as much as within the coming yr.

Bitcoin’s Blast from the Previous

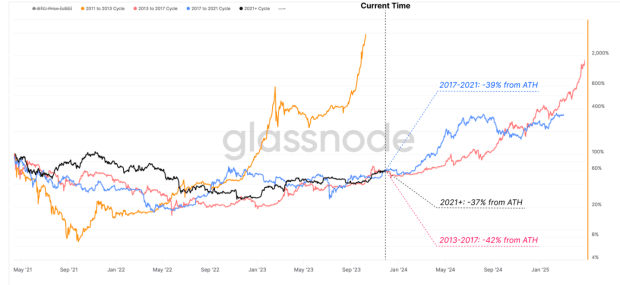

In accordance with Glassnode’s report, we’re seeing a déjà vu with Bitcoin cycles in 2015-2017 and 2018-2022 when it comes to how lengthy it is taking to bounce again and the drawdown for the reason that all-time excessive (ATH).

Within the present cycle, Bitcoin has seen a drawdown of about -37% from its ATH, which is fairly near the -42% in 2013-2017 and -39% in 2017-2021. Plus, for the reason that FTX lows in November 2022, Bitcoin costs are up a strong +140%, making it the strongest one-year return in comparison with the +119% in 2015-2018 and +128% in 2018-2022.

Alternate Exercise: Bitcoin’s Buying and selling Paradox

Regardless of 2023 being a banner yr for Bitcoin, the variety of transactions depositing funds to exchanges has surprisingly hit multi-year lows. However this is the kicker: Glassnode knowledge reveals that the on-chain quantity flowing out and in of exchanges has skyrocketed, leaping from $930 million to a staggering $3 billion – that is a large 220% enhance.

This discrepancy between fewer deposits but skyrocketing quantity makes us surprise: what’s driving the intensified trade exercise if not retail buyers? On one hand, the lower in deposit transactions would possibly recommend that buyers have gotten extra cautious about leaving their belongings on exchanges, presumably resulting from safety issues or a want for larger management over their funds. That is the place the potential shift in the direction of non-custodial exchanges like StealthEX comes into play. Given the FTX drama that is nonetheless on everybody’s thoughts, it is no shock that these platforms the place you may maintain your non-public keys are gaining popularity.

There is a critical uptick in on-chain quantity displaying that buying and selling and hypothesis are buzzing greater than ever. It appears that evidently whereas buyers is perhaps shying away from depositing their funds, they’re actively buying and selling and shifting giant sums of cash. This might be an indication of rising institutional curiosity, particularly as we see the typical measurement of deposits to exchanges nearing the earlier all-time excessive of $30k per deposit, in accordance with Glassnode.

Furthermore, the truth that trade deposits as a proportion of all transactions have dropped from round 26% in Could to only 10% at this time, but the decline is extra modest (round 20%) when adjusted for Inscriptions, provides one other layer to this narrative. Undeniably, we’re witnessing a dynamic shift within the blockchain sphere as novel transaction varieties emerge and new gamers seize their share of the limelight.

Quick-Time period Holders Cashing In

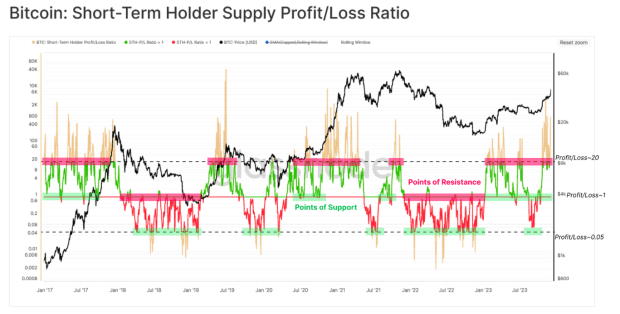

Quick-Time period Holders (STHs) have been making some sensible strikes currently, cashing in on their Bitcoin investments at simply the fitting time. Glassnode’s acquired the stats to show it – the STH-Provide Revenue/Loss Ratio has been hovering above ~1 since January. This implies these savvy merchants have been enjoying the ‘buy-the-dip’ sport fairly nicely, a traditional transfer in uptrends. Nevertheless, these STHs are shifting hefty quantities of cash to exchanges, and the hole between what they paid and what they’re promoting for is fairly sizable.

The primary week of December, when Bitcoin hit $44.2k, STHs jumped into motion, seizing the second to take earnings. It is like they noticed the wave coming and rode all of it the way in which to the shore, capitalizing on the demand liquidity. This exercise has put a little bit of a pause on Bitcoin’s upward climb, demonstrating STHs’ sway over crypto costs.

Wrapping It Up: Bitcoin and Past

So, there you might have it – Bitcoin’s 2023 story is a mixture of triumphs, challenges, and an entire lot of pleasure. Bitcoin, in its digital universe, by no means fails to maintain us intrigued with its roller-coaster journey of sturdy recoveries and declines that resonate with historic patterns, even bouncing again just lately regardless of just a few bumps on the highway. The play of STHs and the unpredictable ebbs and flows of trade actions knit collectively a posh, but intriguing narrative. No matter whether or not you are in it for the highs or the lows, or just out of sheer curiosity, observing Bitcoin’s journey is undoubtedly one to look at.

It is a visitor submit by Maria Carola. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.