The on-chain analytics agency Glassnode has defined how the buyers who purchased on the Bitcoin prime are exhibiting conviction, not capitulation.

3 To six Months Previous Bitcoin Consumers Have Been Holding Sturdy Not too long ago

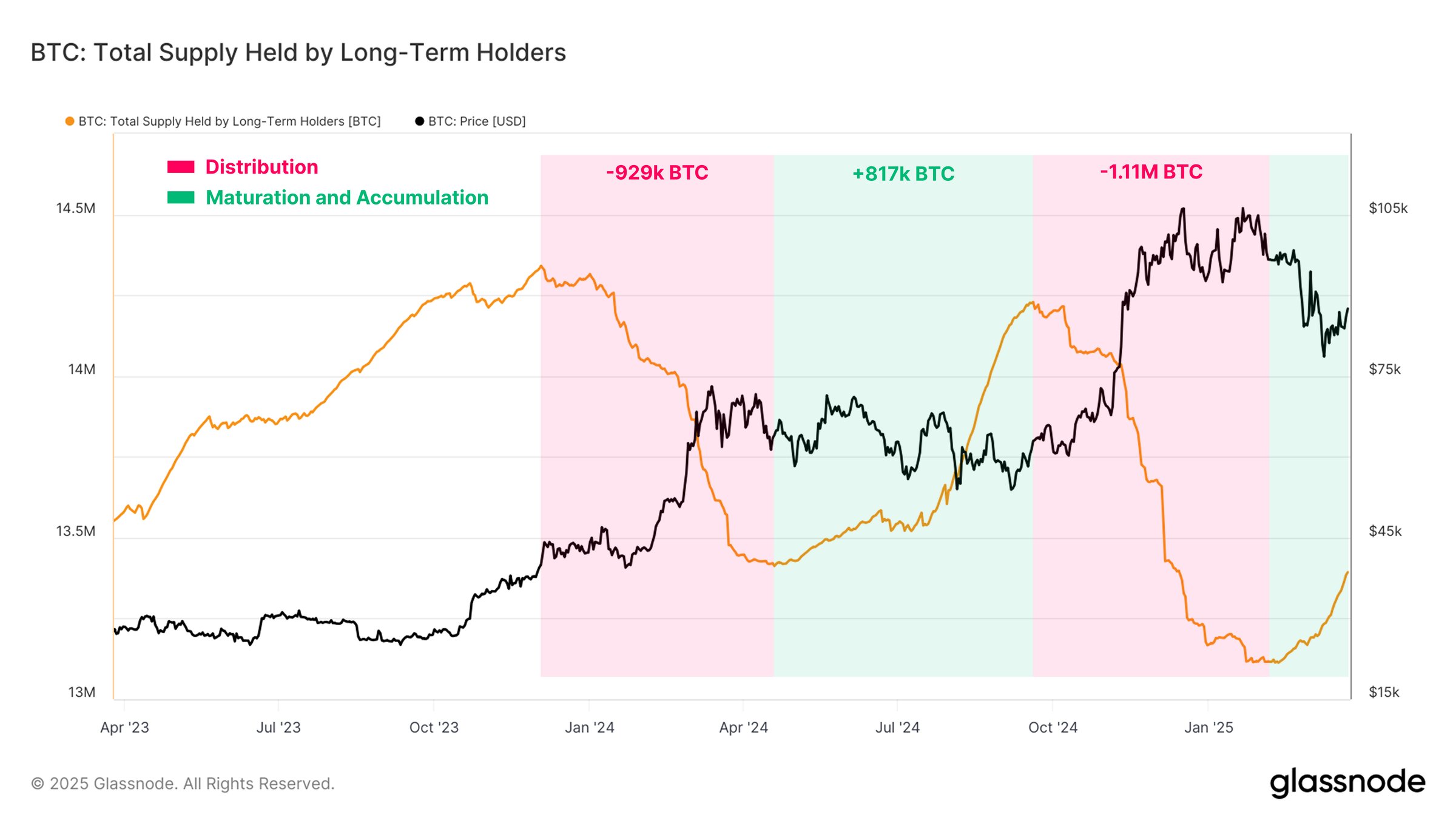

In a brand new publish on X, the on-chain analytics agency Glassnode has mentioned a few Bitcoin investor cohorts. Considered one of these teams is the “long-term holder” (LTH) cohort, which incorporates the BTC buyers who purchased their cash greater than 155 days in the past.

Statistically, the longer a holder retains their cash dormant, the much less probably they grow to be to maneuver the cash at any level. As such, the LTHs with their considerable holding time signify the resolute aspect of the market.

Although, whereas these buyers might be termed as ‘diamond arms,’ it’s not as in the event that they by no means take part in any promoting in any respect. The truth is, throughout two promoting waves within the present cycle alone, the group has performed a complete distribution of two million BTC.

The development within the provide held by the LTHs over the past couple of years | Supply: Glassnode on X

From the above graph, it’s seen that the primary LTH selloff was adopted by a interval of re-accumulation, which introduced the group’s provide again to virtually the identical degree as earlier than the distribution wave.

The second distribution section, which occurred between October 2024 and January 2025, can be equally being adopted by an accumulation wave, because the LTH provide has been rising over the last couple of months. “This cyclical steadiness could also be stabilizing value motion,” notes the analytics agency.

One thing to notice is that every time the LTH provide rises, it doesn’t signify any shopping for that’s occurring within the ‘now.’ Relatively, it exhibits that some accumulation occurred 155 days in the past and people cash have now been held lengthy sufficient to grow to be part of the cohort.

This five-month cutoff places the newest LTH acquisition level on the finish of November, which implies that the latest improve within the indicator correlates to purchasing that occurred through the BTC rally to costs past $90,000. Most of the November consumers ought to now be within the pink, however these buyers have continued to carry nonetheless, incomes their title as HODLers.

A section of buyers that must be below extra intense strain is the 3-month to 6-month group. This cohort represents the holders who’re transitioning into the LTHs. Many of those buyers would have purchased at or close to the worth all-time excessive (ATH), so that they might be notably underwater as we speak.

Curiously, these buyers have been showcasing sturdy conviction just lately, as the quantity of wealth held by them has solely been rising whereas the Bitcoin value continues to battle.

The Realized Cap of the three months to six months cohort | Supply: Glassnode on X

Naturally, the weak arms who received in through the Bitcoin prime would have already capitulated way back and by no means matured into the three months to six months vary, however it’s nonetheless important that those that are left aren’t shaken by the market volatility.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $84,300, down greater than 3% within the final seven days.

Appears like the worth of the coin has been transferring flat just lately | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.