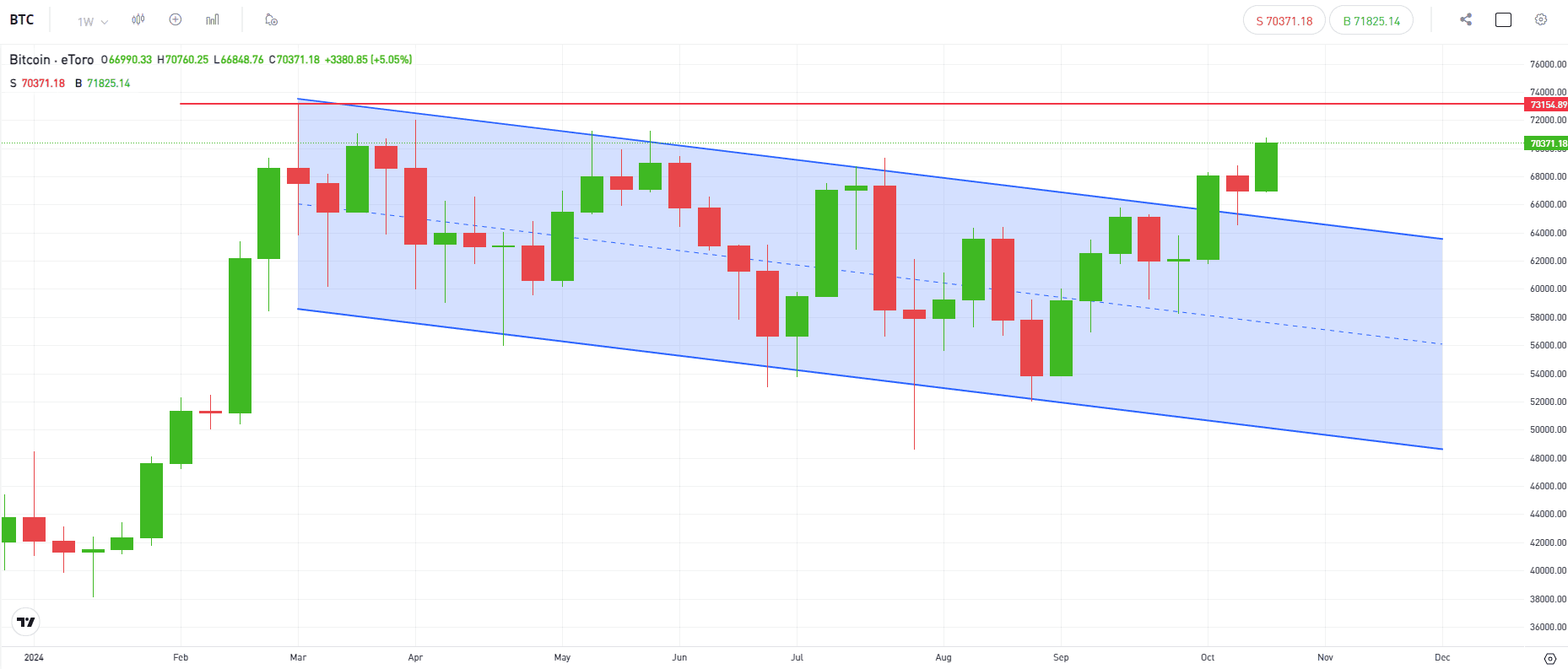

In the present day, Bitcoin (BTC) briefly traded above $69,000, coming near its all-time excessive (ATH) worth of $73,737 recorded earlier this 12 months in March.

Bitcoin ‘Bullish Setup’ Reminiscent Of 2020 Rally

After months of sideways value motion since March, BTC is repeatedly trying to succeed in a brand new ATH because the US presidential election attracts close to. The digital asset briefly touched $69,000 earlier than slipping to $68,674 on the time of writing.

Throughout an interview with CNBC, Matthew Sigel, Head of Digital Property Analysis at VanEck, stated:

Our guess is that this can be a very bullish setup for Bitcoin into the election. We noticed the very same sample in 2020 the place Bitcoin lagged with low volatility after which as soon as the winner was introduced, we had a excessive quantity rally as new consumers come into this market.

Sigel added that when the election outcomes are confirmed, Moody’s is predicted to downgrade US sovereign debt, which might catalyze a BTC rally within the fourth quarter of 2024.

Crypto analyst Michael van de Poppe additionally famous that regardless of Bitcoin’s comparatively subdued efficiency in October – a month historically robust for the asset – BTC is well-positioned to succeed in a brand new ATH quickly.

He pointed out that, regardless of latest Federal Reserve rate of interest cuts, charges stay excessive sufficient to favor risk-off belongings like US Treasury payments (T-bills), drawing liquidity away from riskier belongings.

The Dutch crypto analyst introduced consideration to the rising M2 cash provide, saying that the metric’s robust constructive correlation with BTC might recommend that the digital asset may be on the cusp of an enormous rally. He stated:

So long as the M2 provide will increase, bitcoin’s value goes to comply with… so it’s only a matter of time till bitcoin value goes to select up momentum.

Notably, van de Poppe additionally talked about {that a} potential Donald Trump presidency might spark optimism within the crypto sector, probably igniting a bull run for digital belongings within the months forward.

Trump Continues To Lead In Prediction Markets

Information from Polymarket – a decentralized prediction market platform – signifies that Trump is favored to win towards the Democratic candidate Kamala Harris.

At press time, Trump’s chance of profitable the election has surpassed 66%. As compared, Harris’ odds stand at about 34%.

A latest survey discovered that the affect of the crypto voting bloc on election outcomes is probably going understated. The survey discovered that near 16% of voters consider the candidate’s stance on cryptocurrencies will affect their voting alternative.

Whereas most within the crypto trade lean towards Trump resulting from his pro-crypto stance, Harris has been actively courting a few of his crypto-supporting base.

An analyst not too long ago opined {that a} Harris-led administration may arguably be higher than Joe Biden’s for the digital asset trade. BTC trades at $68,674 at press time, up 1.2% up to now 24 hours.

Featured Picture from Unsplash.com, Chart from TradingView.com