Bitcoin has cleared the $67,000 degree previously day as on-chain information exhibits the inhabitants of whales on the community has continued to develop.

Bitcoin Has Surged Alongside Enhance In Whale Rely

As defined by analyst Ali in a brand new submit on X, there was a correlation between the cryptocurrency’s worth and the whole variety of entities carrying a minimum of 1,000 BTC.

“Entity” refers to a cluster of addresses owned by the identical investor, as decided by superior heuristics achieved by the on-chain analytics agency Glassnode.

Entities carrying greater than 1,000 BTC are popularly known as “whales.” On the present asset trade fee, this decrease cutoff for the cohort converts to about $66.5 million.

These traders are large, to allow them to probably transfer round massive quantities shortly throughout the community, making them influential beings out there.

As such, the conduct of the whales might be value monitoring since it could find yourself reflecting on the sector as a complete. One strategy to monitor the actions of those massive entities is thru their whole rely.

The chart beneath exhibits the development within the whole variety of entities on the community that qualify as whales.

The worth of the metric appears to have been sharply going up in latest days | Supply: @ali_charts on X

As displayed within the above graph, the whole variety of Bitcoin entities carrying a stability of a minimum of 1,000 BTC has been capturing up not too long ago, suggesting that some shopping for has been occurring out there.

From the chart, it seems that uptrends within the metric have not too long ago coincided with surges within the asset’s worth. This may counsel that these humongous entities have been serving to drive these rallies.

Up to now, these whales haven’t taken to distribution but, as their quantity has solely gone increased. As such, the indicator could also be one to comply with within the coming days, as a turnaround in it may very well be a bearish signal for the worth.

The upper the rally, the extra probably it’s that a few of these giants will buckle and take their earnings. Nonetheless, if the variety of these entities continues to rise regardless, prefer it has to date, then it may counsel that the demand is absorbing any profit-taking.

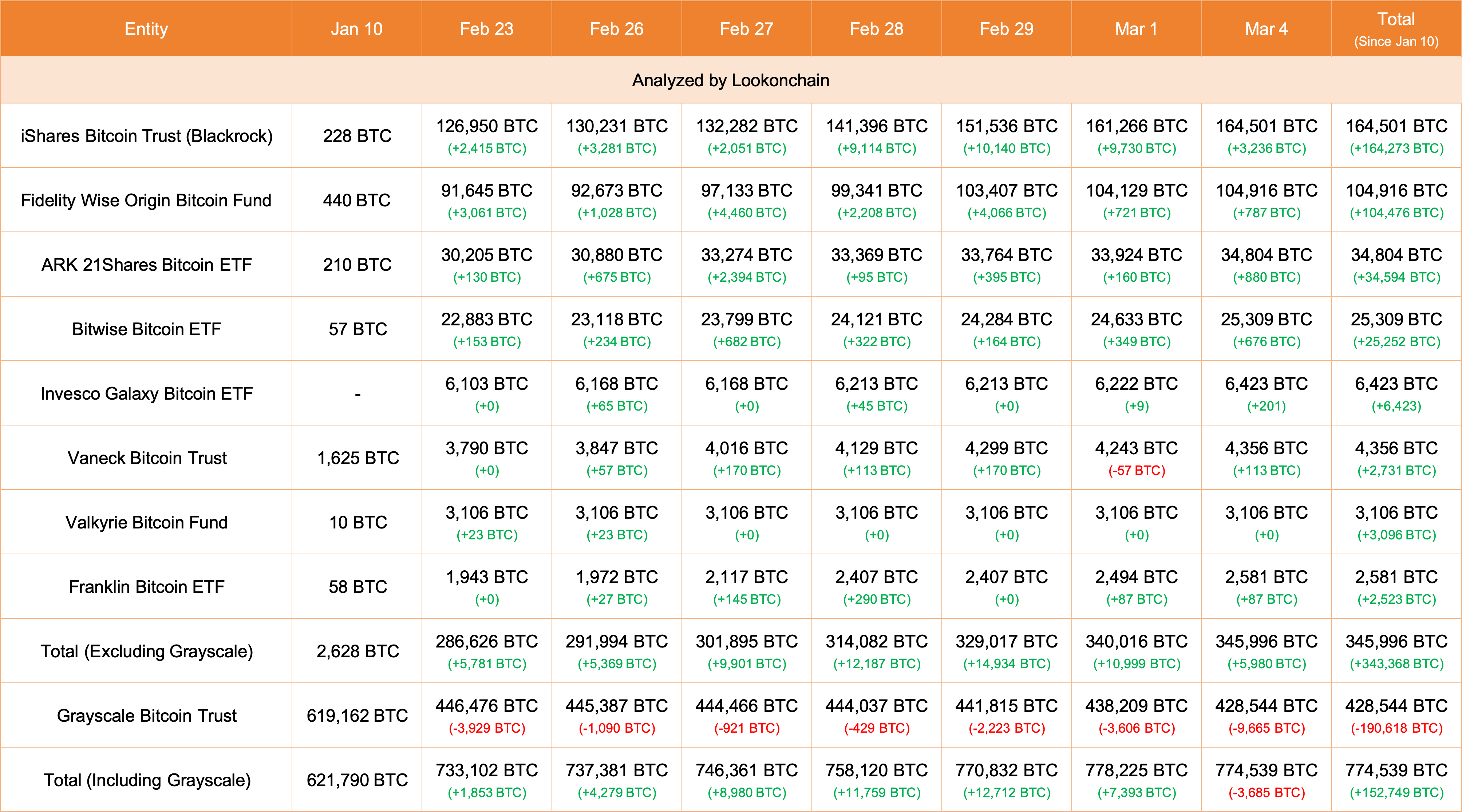

Talking of whales, the exchange-traded funds (ETFs) additionally rely as them, and it will seem that they’ve participated in web promoting at present, as smart-money tracker Lookonchain has identified in an X submit.

Appears to be like like all however one ETF has participated in promoting at present | Supply: @lookonchain on X

From the desk, it’s seen that the perpetrator is none apart from Grayscale Bitcoin Belief (GBTC), which has been always hemorrhaging BTC for the reason that ETFs first noticed approval.

The opposite ETFs participated in web shopping for like standard, however resulting from Grayscale’s promoting, the web change within the holdings of the ETFs has been adverse at 3,686 BTC previously day.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $67,000, up 25% over the previous week.

The worth of the asset has been sharply going up not too long ago | Supply: BTCUSD on TradingView

Featured picture from Vivek Kumar on Unsplash.com, Glassnode.com, chart from TradingView.com