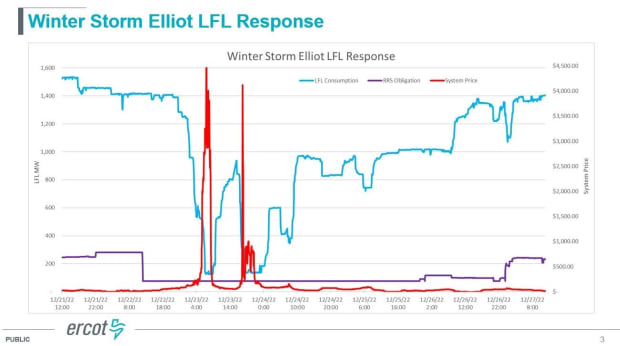

A number of headlines lately described a 25% drop in bitcoin community issue throughout Winter Storm Finn in January. Most attributed this drop to curtailment exercise in Texas. Whereas Texas does symbolize 17% of the worldwide bitcoin hashrate, ERCOT information reveals that a number of the curtailment exercise was a mix of upper costs and “good grid citizenship.” In ERCOT, and to a lesser extent in different ISOs, costs are the perfect proxy for grid stress. There are different proxies comparable to PRC (bodily responsive functionality) however costs are a greater measure for many conditions. For that motive, with a view to stop swings in costs and create tougher gird situations, an optimum atmosphere is one by which the value doesn’t swing wildly up and down. Nevertheless, value volatility is a frequent prevalence in ERCOT, as evidenced by Winter Storm Elliot in December 2022 (see graph under).

Bitcoin miners are the economically good customers of electrical energy. That isn’t to say that bitcoin miners will eat electrical energy in an altruistic approach, however quite that margins for bitcoin miners are uniquely delicate to the value of energy such that they’re economically incentivized to curtail consumption when energy costs exceed their breakeven threshold (present breakeven for many miners ranges between $100 and $200 per MWh). Which means they may eat electrical energy when costs are under their breakeven value and switch off when costs are above it. There are some operational and sensible exceptions to this, for instance, if miners have information middle colocation agreements that stipulate or assure uptime.

Texans ought to need bitcoin miners to be on anytime energy is plentiful as a result of their constant consumption incentivizes the buildout of extra era. And fewer counterintuitively, we naturally need bitcoin miners to curtail when costs are excessive and the grid is beneath stress.

That brings us to the January 2024 winter occasion of the week of January fifteenth. The headlines would have you ever assume that the Texas grid was once more burdened and that bitcoin miners curtailed consequently. The reality is far more nuanced. The common settlement value within the ERCOT wholesale energy market through the worst three days of the storm was $100.76 per MWh, and costs by no means exceeded $600 per MWh. For context costs max out at $5,000 per MWh. As indicated by wholesale costs, the grid weathered the storm fairly properly with ample reserves all through.

ERCOT did certainly situation a conservation alert, however that was extra of a precautionary message for energy customers who don’t monitor the facility value each second of every single day like bitcoin miners do.

We did see some financial curtailment, that means curbing energy utilization based mostly on value alerts, from miners for prolonged intervals, and a few shorter intervals when the costs exceeded $200 MWh. Nevertheless, this exercise was much less pronounced than in earlier winter occasions or summer season warmth waves as a result of era reserves have been extra plentiful throughout the grid. Some bitcoin miners probably curtailed for longer intervals as a gesture of fine “grid citizenship,” and to indicate their dedication to a steady grid, however that’s hardly quantifiable.

All of this proof signifies that the problem drop final week necessitates a extra nuanced clarification. A lot of it was a results of curtailment in Texas, however after evaluating ERCOT pricing information, it leads me to imagine {that a} materials portion of that curtailment got here from different ISOs in North America as properly. Briefly, everybody who has an opinion about bitcoin mining curtailment would do properly to observe ERCOT settlement and LMP costs. The information and the economics ought to type the spine of all future analyses.

It is a visitor put up by Lee Bratcher. Opinions expressed are totally their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.