Fast Take

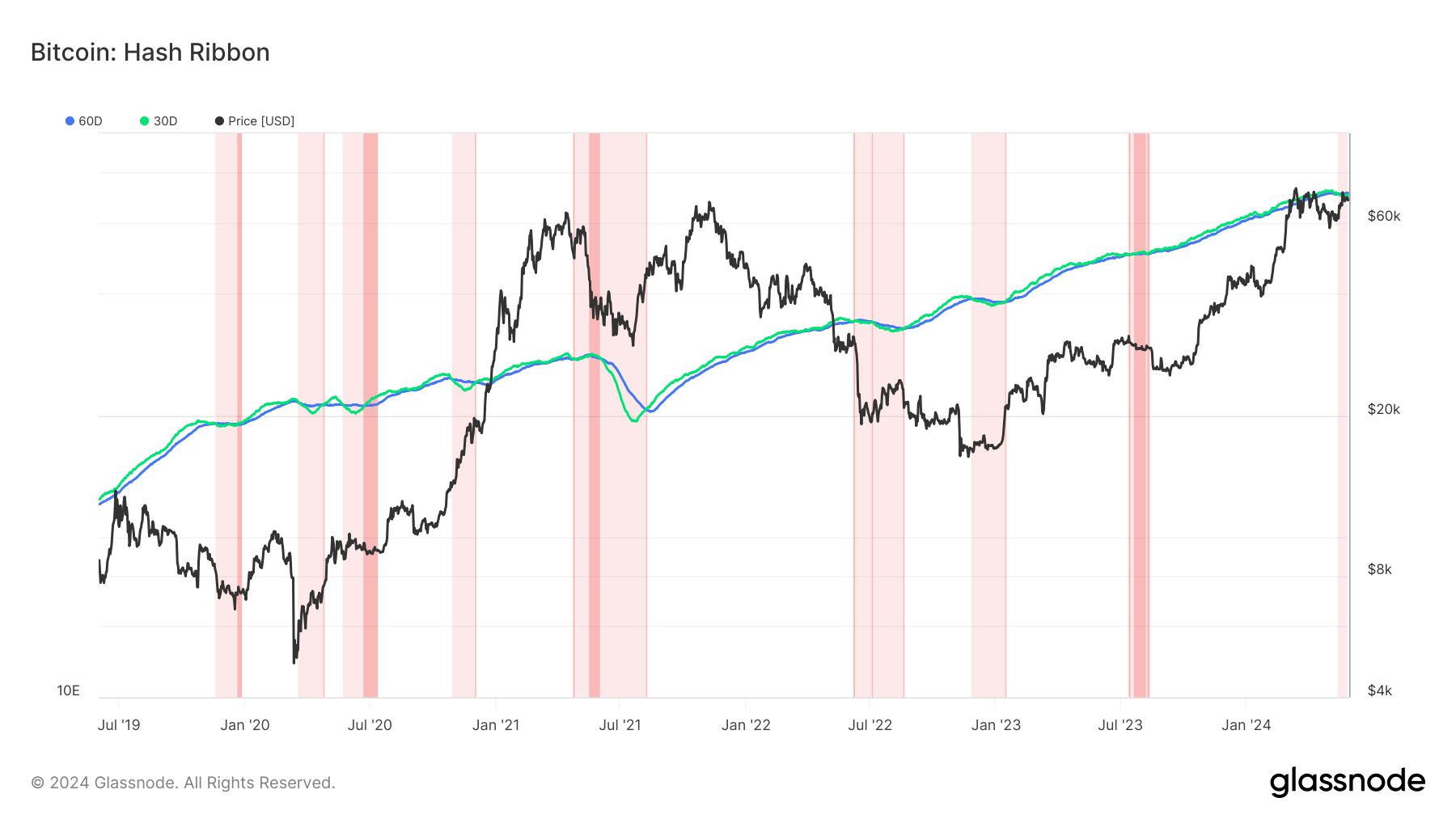

The Hash Ribbon chart by Glassnode is a market indicator that identifies potential bottoms in Bitcoin’s worth by analyzing miners’ habits. Particularly, it means that Bitcoin reaches a backside when miners capitulate, which means mining turns into unprofitable relative to the prices. The important thing sign from the Hash Ribbon happens when the 30-day shifting common (MA) of the hash charge crosses above the 60-day MA, transitioning from gentle purple to darkish purple areas on the indicator. When this crossover coincides with a change from damaging to constructive worth momentum (darkish purple to white), it traditionally signifies good shopping for alternatives.

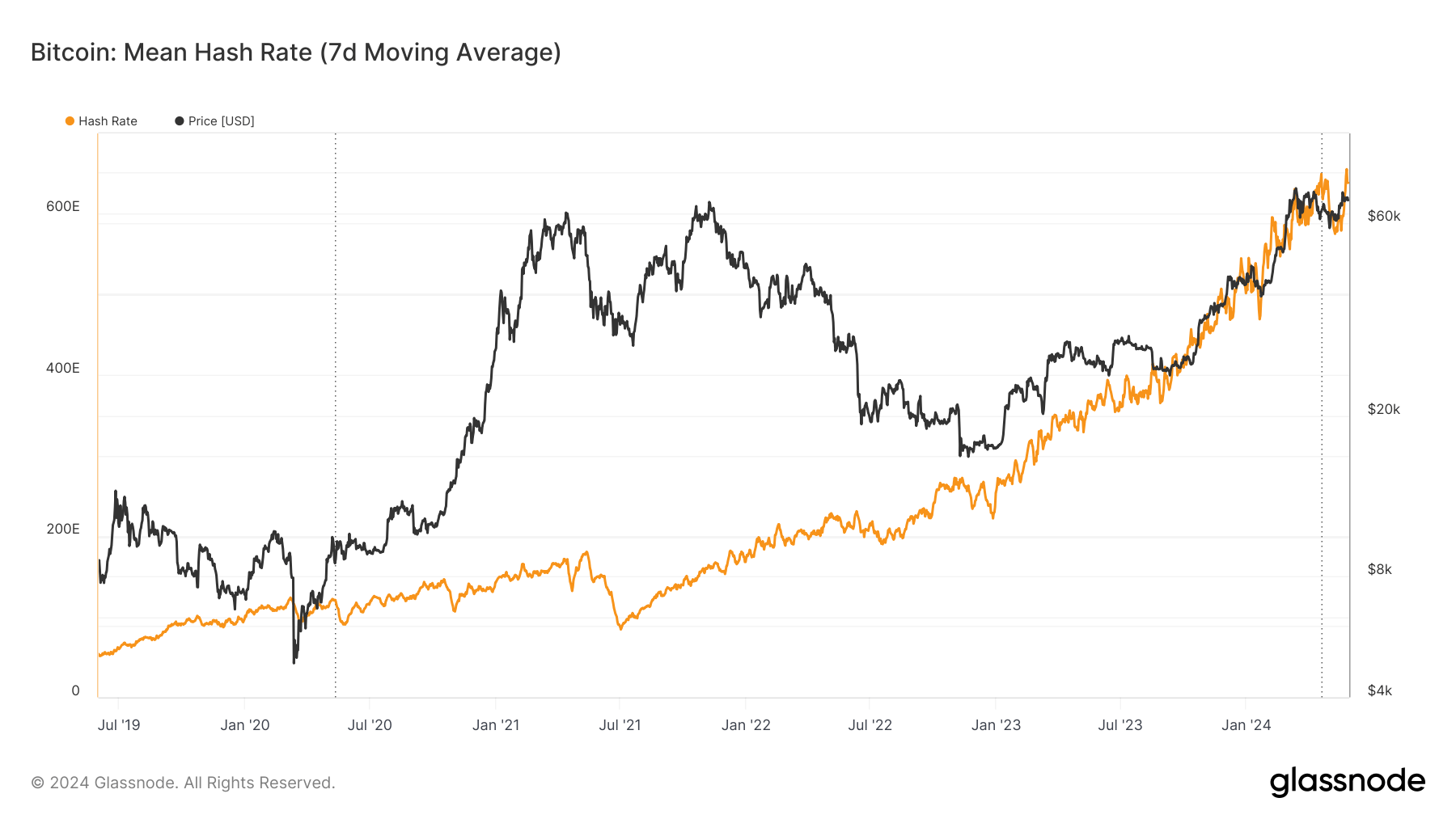

At present, CryptoSlate is monitoring a 14-day miner capitulation. To place this into perspective, the typical period of miner capitulations over the previous 5 years is roughly 41 days, equal to about three problem changes (every adjustment spans roughly 14 days or 2016 blocks). A chronic miner capitulation occurred in Might 2021 following China’s mining ban, which halved the worldwide hash charge and took months to get well.

Given the effectiveness of the Hash Ribbon in figuring out Bitcoin bottoms, the continued uneven worth motion could current a good shopping for alternative.

Begin Date

Period (days)

2019-11-20

31

2020-03-19

37

2020-05-25

29

2020-10-28

35

2021-05-19

81

2022-06-09

70

2022-11-27

49

2023-07-16

27

2024-05-14

14

Common

41.44

Supply: Glassnode

The publish Bitcoin miner capitulation: 14 days in, in comparison with 41-day common over the previous 5 years appeared first on CryptoSlate.