Fast Take

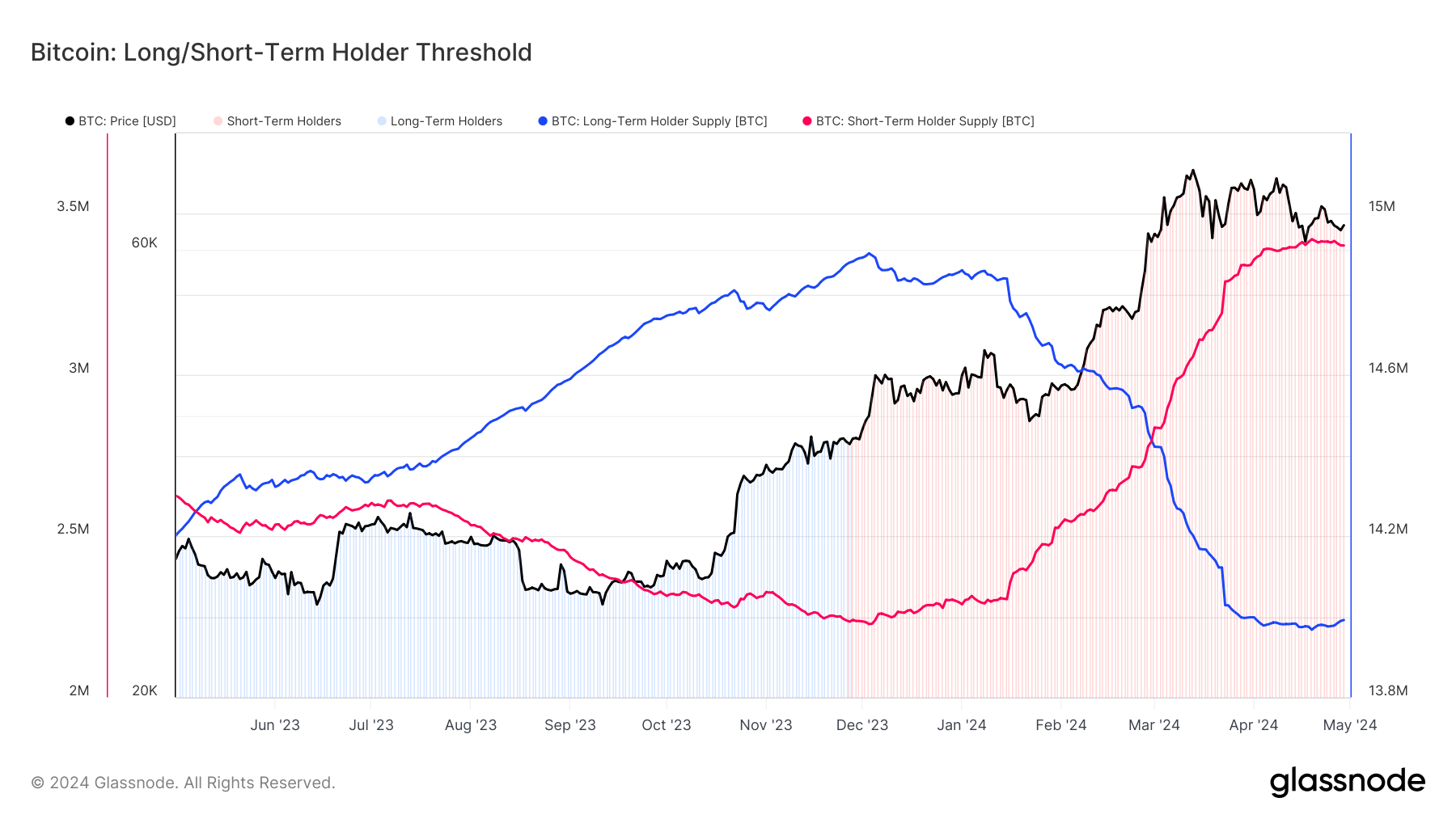

Whereas Bitcoin presently trades roughly 20% under its all-time excessive, the extra compelling narrative unfolds throughout the dynamic movement of cash between short-term holders (STHs) and long-term holders (LTHs)

LTHs, holding Bitcoin for over 155 days, usually accumulate throughout bear markets and distribute throughout bulls. Their provide peaked at 14.9 million BTC in December 2023 earlier than dropping to 13.9 million in April 2024. This 1 million BTC discount was pushed by the Grayscale Bitcoin Belief ETF (GBTC) promoting over 320,000 cash and LTHs taking income or losses on the remaining two-thirds.

Conversely, STHs, holding for underneath 155 days, have a tendency to purchase throughout bullish euphoria. Their provide surged from 2.2 million to three.4 million BTC, absorbing the LTH distribution plus an extra 200,000 cash.

A pivotal second looms on June 15, marking 155 days since Bitcoin’s ETF launch. We will count on LTH provide to climb till then as the brand new cohort of STH patrons transitions to LTH standing. Given the value the place it’s, it’s seemingly that STHs will exert promoting strain.