On-chain knowledge reveals the Bitcoin mining hashrate has not too long ago been closing in on a brand new all-time excessive (ATH). Right here’s what this might imply for BTC.

Bitcoin Hashrate Has Remained Excessive Regardless of Market Downturn

The “mining hashrate” refers to an indicator that retains monitor of the overall quantity of computing energy that the miners have at present linked to the Bitcoin community.

BTC is a blockchain that runs on a consensus mechanism known as the Proof-of-Work (PoW), so the miners use their computing energy for fixing sure mathematical puzzles.

At no level, nevertheless, does the overall hashrate work in tandem. As an alternative, the validators compete in opposition to one another to be the primary to resolve the identical drawback, utilizing their very own particular person energy. The reward for being the primary is the chance so as to add the following block to the community.

Whereas there is no such thing as a collective BTC energy, that doesn’t imply the overall hashrate has no penalties or usefulness. For starters, the extra the computing energy that’s linked to the community, the higher is BTC’s safety, provided that the brand new energy being added is sufficiently decentralized.

The indicator additionally serves as a manner of figuring out the sentiment among the many miners. When the worth of the metric rises, it means new miners are becoming a member of the community and/or outdated ones are increasing their services. Such a pattern suggests the miners consider BTC to be a worthwhile enterprise.

However, a decline within the hashrate implies a number of the validators have determined to unplug their mining rigs, probably as a result of they’re not capable of break even.

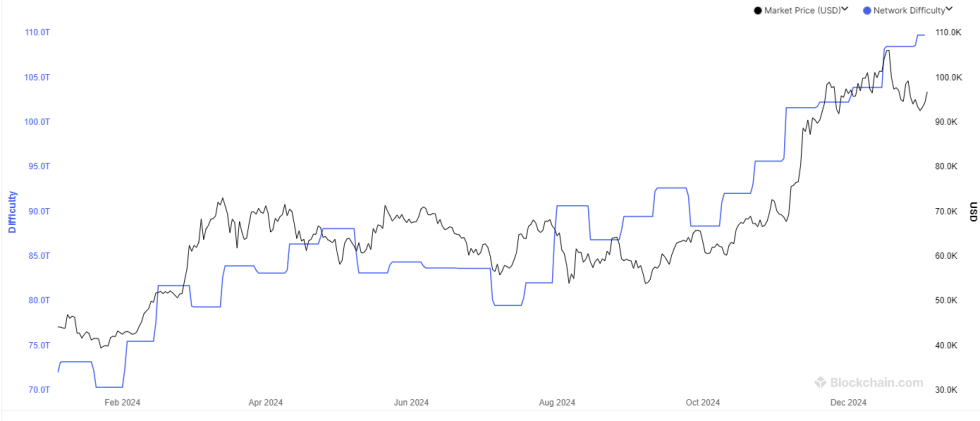

Now, here’s a chart from Blockchain.com that reveals the pattern within the Bitcoin hashrate over the previous 12 months:

The worth of the metric seems to have been following an upwards trajectory in current months | Supply: Blockchain.com

As is seen within the above graph, the Bitcoin mining hashrate set a brand new ATH again in mid-December, however the indicator then noticed a drawdown as BTC’s value itself fell. Miners obtain their rewards in BTC, so the value of the cryptocurrency could be a essential issue of their income.

Apparently, whereas BTC has been but to indicate any enough restoration, the indicator has reversed course and has arrived again close to the ATH. The truth that the miners aren’t able to rollback on their farms but would counsel they consider the community would find yourself paying off ultimately.

As talked about earlier than, the overall hashrate can have some actual penalties for the blockchain. One such result’s on the community’s problem, a characteristic that controls how arduous miners would discover their job.

The BTC community needs to limit how a lot block subsidy the miners obtain inside a given period of time, so every time the miners improve their computing energy, it responds by upping its problem simply sufficient to maintain the tempo of the miners the identical as earlier than.

On condition that the minining hashrate is near the ATH, it’s not shocking that the problem can also be sitting at a brand new file.

The pattern within the mining problem over the previous 12 months | Supply: Blockchain.com

BTC Worth

On the time of writing, Bitcoin is floating round $96,600, up 1% over the past seven days.

Appears to be like like the value of the coin has been following an upward trajectory not too long ago | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Blockchain.com, chart from TradingView.com