The crypto lending sector is experiencing a revival following the “crypto winter” that noticed the collapse of main gamers, because of the introduction of spot Bitcoin exchange-traded funds and the return of property to collectors from bankrupt corporations.

“What I’m seeing is that this market has come again roaring,” Mauricio Di Bartolomeo, co-founder of crypto lending agency Ledn, advised CoinDesk on the Consensus 2024 convention in Austin, Texas. “The market by no means actually left; it [just] acquired scared.”

Crypto lending capabilities equally to conventional banking. Clients deposit Bitcoin or different cryptocurrencies with corporations like Ledn, incomes curiosity or utilizing the crypto as collateral for loans. The curiosity paid to depositors is generated by lending their crypto to others at a better rate of interest.

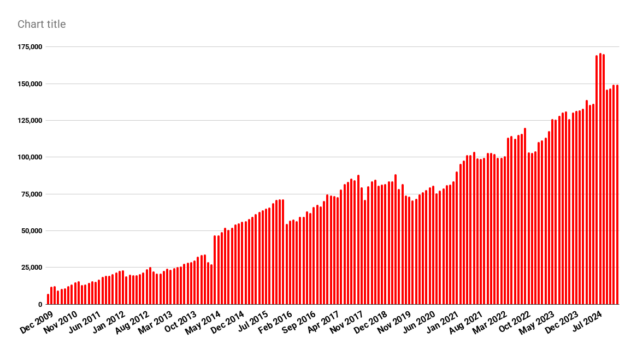

The sector collapsed in 2022 when crypto costs plummeted, resulting in bankruptcies of corporations like Celsius, BlockFi, and Genesis. Since then, the digital asset market has rebounded. The CoinDesk 20 Index has surged over 200% for the reason that finish of 2022. The rally gained momentum after BlackRock (NYSE:BLK) and different monetary giants efficiently utilized to create Bitcoin ETFs within the U.S. Di Bartolomeo attributes the renewed curiosity in crypto lending to the constructive outlook surrounding these funds.

“Bitcoin has gone up from $20,000 to $70,000 and has grow to be a focus within the U.S. political race,” he stated. “This elevated curiosity validates Bitcoin as an asset and collateral for lending.”

Ledn processed greater than $690 million in loans within the first quarter of this yr, its finest efficiency since its inception in 2018. Over 84% of those loans had been directed to institutional shoppers, pushed by the demand surge following the approval of Bitcoin ETFs in January. Ledn completely processes loans in Bitcoin, Ethereum, and two stablecoins: USDC and USDT.

The establishments concerned are primarily market makers from each Wall Road and crypto-native corporations. “These corporations function in each the ETF and spot markets,” Di Bartolomeo stated. “Some have made their names in crypto, others in conventional finance.”

One other issue driving the resurgence in crypto lending is the return of funds to customers from bankrupt corporations. Many customers, who had their funding thesis validated over time, are returning to the lending market. Di Bartolomeo defined that these “hardcore customers” are more likely to maintain onto their property and use the lending market to leverage them for borrowing and lending.

“What I’m seeing is plain proof that individuals wish to maintain their Bitcoin long-term and likewise wish to put it to use,” he stated. Conventional monetary establishments might not acknowledge digital property as collateral for loans, however corporations like Ledn bridge this hole for purchasers.

Surviving the crypto winter, Ledn remained dedicated to lending and borrowing fundamentals. “Ledn solely works with certified and vetted establishments, avoids asset and legal responsibility mismatches, and steers away from DeFi yield farming,” Di Bartolomeo defined. “If somebody lends us Bitcoin,we lend Bitcoin; if somebody lends us {dollars}, we lend {dollars}. There’s at all times a taker and at all times liquidity.”

He added that every one lending and borrowing actions are term-matched, guaranteeing liquidity for the property. “Individuals known as us boring, however we stated that is our approach: boring, gradual, and secure,” he famous.

Featured Picture: Freepik

Please See Disclaimer