The beneath is an excerpt from a latest version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

The First 5 Days

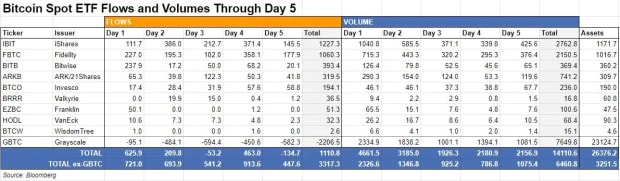

The Bitcoin spot ETF launch was one for the historical past books. By all accounts, it was the most important launch of an ETF product in historical past, beating out the earlier report set by the Proshares Bitcoin Technique ETF (BITO) launch in October 2021. First-day buying and selling quantity was large at $4.6 billion, and it has remained comparatively sturdy in comparison with typical post-launch declines of different merchandise. We may be assured within the quantity numbers, not like the inflows. After the primary two days of buying and selling, the market was left questioning about flows as a result of the information supplied by TradFi was delayed and incomplete. Consultants, comparable to Eric Balchunas of Bloomberg, mentioned it was regular to have delays in reporting of flows by as a lot as T+3 (three days after). Bitcoin isn’t used to such dangerous transparency.

Within the beneath desk, you possibly can see the GBTC outflows at the moment are over $2 billion, with the most important day being Day 3. Nonetheless, it’s extremely possible that almost all of Day 3’s flows was on account of buying and selling on Day 2, and likewise for Day 2 on Day 1, and so forth. We additionally can’t inform if all of the issuers are up-to-date on their knowledge. Is that every one their flows or are they not achieved counting? We merely don’t know.

Bitcoiners are supplementing gradual TradFi knowledge which might take days by monitoring flows on-chain. On Wednesday morning, James Van Straten of Cryptoslate reported that 18,400 bitcoin had been despatched from Grayscale to Coinbase’s Prime OTC desk proper at market open, following a sample of outflows on the 2 earlier buying and selling days of 9,000 bitcoin on January 16 and 4,000 bitcoin on January 12. The on-chain knowledge from intelligence agency Arkham is reliable, the issue is it doesn’t match the reported outflows. These three days of on-chain knowledge add as much as $1.3 billion value of bitcoin and the reported outflows had been solely $1.1 billion. Additionally, apparently there have been no transactions the morning on January 18, however they resumed this morning.

Supply: Arkham by way of @DylanLeClair_

Coinbase already custodies Grayscale’s bitcoin, so these are transfers from their custody account to the OTC desk, the place different ETF market makers can choose it up, limiting the impact on the spot worth.

GBTC Promoting Might Be Drawing to a Shut

Grayscale promoting was anticipated however we nonetheless don’t know the final word quantity that can find yourself being offered by the point the mud settles. Will 100% of their cash slowly come out, or maybe solely 10%? Persons are speculating the expense ratio of 1.5% versus the opposite ETFs averaging 0.25% would possibly trigger individuals to swap ETFs. If that’s the case, it will not translate into any web promoting. GBTC did decrease their charge after they transformed, from 2% all the way down to the brand new 1.5%. If GBTC holders are sitting on vital unrealized beneficial properties, they may select to not promote till the subsequent rally. Keep in mind, there are tax implications with swapping, additionally.

Many early sellers of GBTC are doing so for ideological causes. The low cost which fashioned in Feb 2021 took them unexpectedly and so they felt caught. The query is what number of bitcoin is that? GBTC nonetheless has over 550,000 bitcoin as of January 19, what number of of these nonetheless really feel caught? Why wouldn’t they’ve already swapped out within the first a number of buying and selling days? I feel it’s lower than individuals assume. Sure, all the bitcoin will come out ultimately in the event that they maintain the expense ratio that prime, however not in a single sustained motion. I feel the dumping can be unfold out over a number of massive rallies within the bull market. Promoting from GBTC would possibly already be slowing with the low cost to NAV dropping from 150 bps on day 1 to 47 bps on January 17.

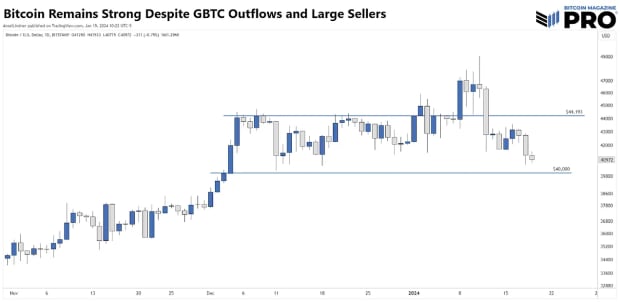

Bitcoin Value

Talking of worth, bitcoin has managed to carry help at $40,000 even with the huge outflows from GBTC and whale promoting. Once more, James Van Straten studies a whale who purchased at $48,000 in 2021’s bull market, who held via the huge drawdown and the FTX debacle, probably unloaded 100,000 BTC with an ask of $49,000. For context, all of the ETFs ex-GBTC are nonetheless beneath that at 79,000 BTC. This was not a sell-the-news occasion, it may have merely been a whale promoting after breaking even. That means the constant shopping for stress of the ETFs is simply delayed by every week or so.

We’re nonetheless within the vary relationship all the best way again to the start of December, however are threatening to fall beneath it proper now. My consideration stays on $40,000 and the $44,193 line we have been watching that complete time, created from the excessive day by day shut again on December 8.

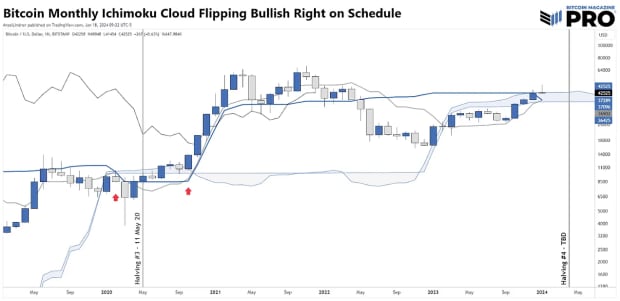

For these readers with stunning low time choice, the month-to-month Ichimoku cloud is flipping bullish. That is an especially bullish sign that solely occurs firstly of bull runs in bitcoin. It occurred final in October 2020 after virtually flipping previous to COVID in February 2020. Curiously, if it will have flipped in February, it will be at very almost the identical relation to the halving that we’re immediately. Previous to 2020, the one different time this has occurred was in June 2016, firstly of that large bull market, and one month previous to the July 2016 halving.

Large Shopping for Stress in Context

Utilizing the unfinished influx knowledge above, we will say that the typical day by day shopping for stress, together with GBTC promoting, has been greater than $200 million/day. Fascinating that Day 4 was the second highest, including some proof to the idea that purchasing stress would possibly stage out across the $250-300 million mark. To place that quantity in context, Microstrategy simply started a 4-month means of promoting $216 million in new shares to purchase extra bitcoin. The ETFs do this in a day. Tether can be continually shopping for bitcoin for his or her reserves. Lately, they reported including one other $380 million in bitcoin on the finish of 2023. Two out of the primary 5 days of the ETFs had been greater than that.

With all these sources of gigantic demand in thoughts, look once more on the month-to-month chart above, once more. There may be a technique for this market to go. Are you prepared?

If you happen to appreciated this put up, please give it a like and share on social media so we will unfold our message! Thanks!