Bitcoin‘s buying and selling quantity on centralized exchanges (CEXs) noticed a major spike in March, marking the very best recorded CEX quantity since Could 2021 — and the month isn’t over but. Monitoring buying and selling quantity on CEXs gives invaluable insights into market sentiment, liquidity, and the general well being of the crypto market.

From September 2023 to Mar. 24, 2024, Bitcoin’s buying and selling quantity on CEXs noticed an astronomical rise from $18.409 billion to $494.056 billion. This eightfold improve in quantity over simply seven months is especially noteworthy, contemplating Bitcoin’s value escalated from an in depth of $34,667 in September to over $73,000 in mid-March 2024. Regardless of a considerable correction, with Bitcoin consolidating at $67,000 by Mar. 23, buying and selling quantity continued its upward trajectory, indicating sturdy market participation and liquidity.

The distribution of this buying and selling quantity throughout varied exchanges reveals a stunning pattern, particularly contemplating the numerous position the US performs within the international crypto market. Regardless of internet hosting widespread spot Bitcoin ETFs and driving a lot of the market sentiment, a relatively small portion of CEX buying and selling quantity happens within the US. On Mar. 24, information confirmed that 52% of Bitcoin’s whole CEX buying and selling quantity was on Binance, aligning with the year-to-date common of above 50%. Following authorized challenges final fall, Binance noticed its BTC buying and selling quantity surge from $91.9 billion in October 2023 to $321.6 billion in March 2024, with the month but to shut.

In distinction, Coinbase accounted for less than 4.22% of the whole CEX buying and selling quantity, rating third total, whereas OKX held the second place with simply 6.41% of the whole BTC buying and selling quantity. This dominance of Binance, raking in a whole bunch of billions in BTC quantity, highlights its continued dominance within the CEX panorama, constantly accounting for half of the buying and selling quantity on centralized exchanges.

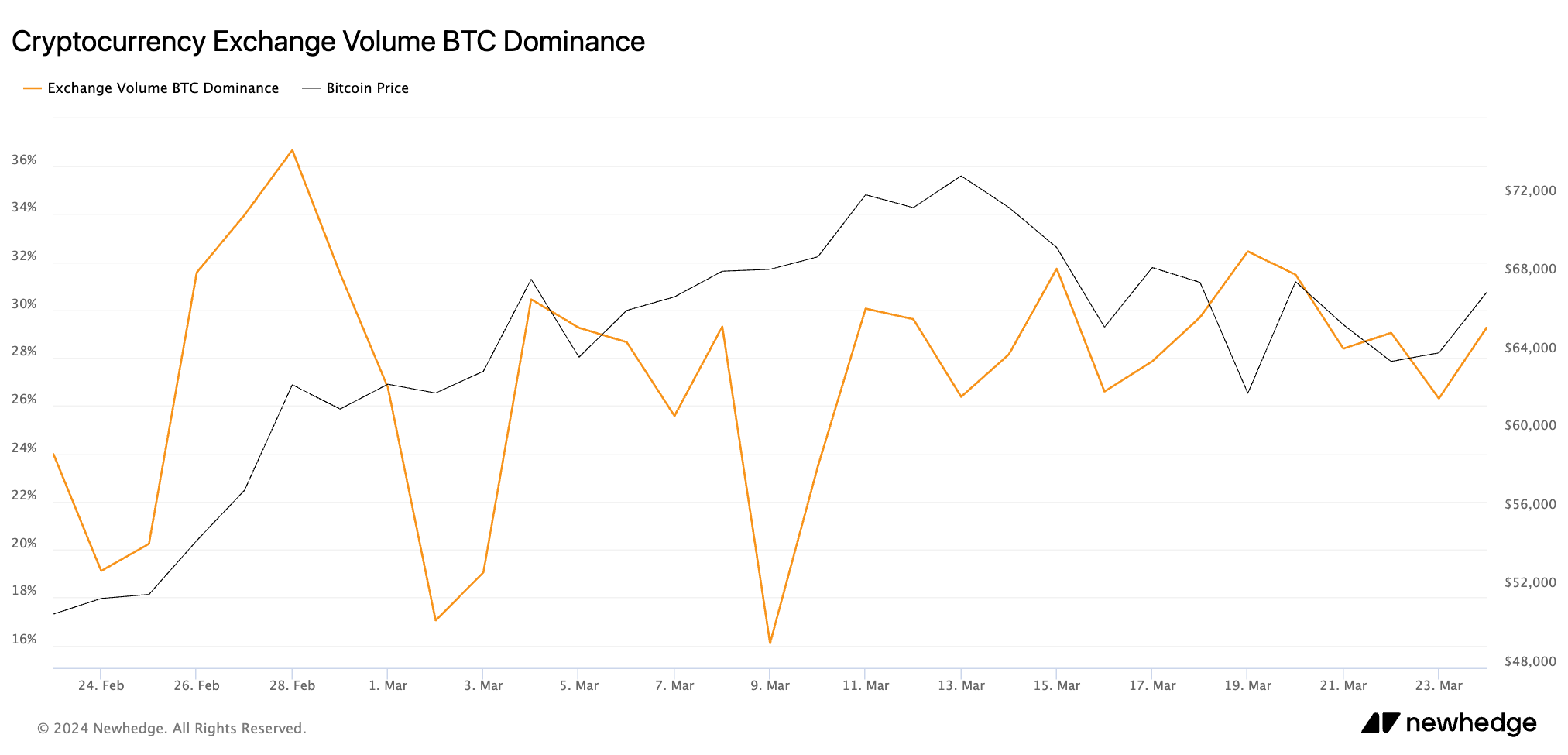

Binance’s place turns into much more pronounced when contemplating Bitcoin’s buying and selling quantity relative to the remainder of the market. As of Mar. 24, Bitcoin represented simply over 29% of the whole crypto buying and selling quantity on CEXs, in keeping with information from Newhedge. Regardless of the emergence of quite a few altcoins and the expansion of DeFi platforms, CEX volumes stay a crucial gauge of market sentiment and an integral element of the crypto market infrastructure.

The numerous value correction after Bitcoin’s peak in early March, coupled with the sustained improve in buying and selling quantity, suggests a market that, regardless of its inherent volatility, is shifting in the direction of higher resilience and stability over the long run. This means a maturing market panorama, the place elevated participation and liquidity contribute to a extra stabilized value atmosphere able to absorbing market shocks and fluctuations.

The put up Bitcoin CEX buying and selling quantity hits document excessive in March appeared first on CryptoSlate.