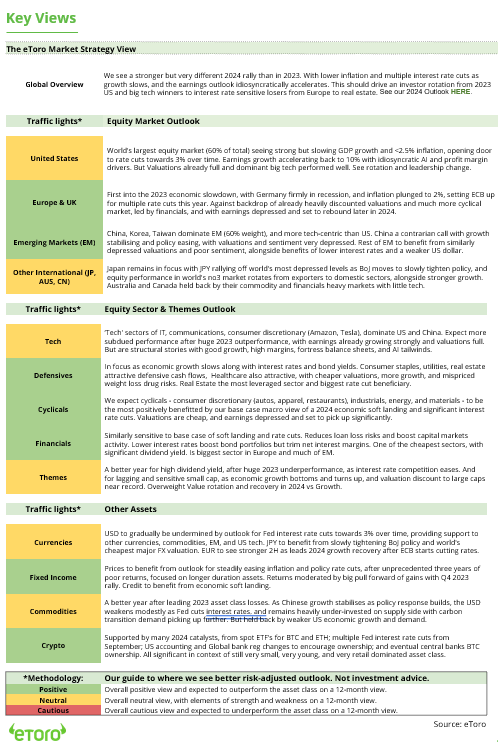

Decoding China’s Tech Surge

Buyers are re-evaluating the tech hole between China and the US, sparking a revaluation of Chinese language tech shares. The Grasp Seng Tech Index, monitoring giants like Alibaba, Tencent, and JD, has surged 31% year-to-date in native foreign money phrases. Right here we take a look at the explanations behind the surge.

AI Increase and Innovation: DeepSeek’s AI breakthrough is attracting international curiosity in China’s tech and AI sectors, particularly amongst corporations as soon as thought of undervalued. With Alibaba teaming up with Apple to combine AI options into the Chinese language iPhone and Tencent’s WeChat incorporating DeepSeek, demand for AI cloud computing is predicted to develop quickly. This accelerated progress in AI can be driving down prices.

Engaging Valuations and Development Potential: Regardless of some market volatility, long-term development prospects stay robust, with present valuations at solely 65% of their US counterparts. Whereas the perfect time to purchase was a yr in the past—when valuations had been deeply discounted, providing a a lot bigger margin of security earlier than the almost 60% rally—Chinese language tech shares nonetheless current alternatives. Earnings surprises and a shift of institutional investments into the sector are fueling momentum. Furthermore, whereas Beijing’s September coverage pivot helped scale back draw back dangers, innovation-driven tech breakthroughs are more likely to maintain the restoration higher than rebounds pushed purely by coverage shifts and market re-pricing.

Authorities Help and Renewed Confidence: Indicators of elevated authorities help for personal companies are additionally boosting sentiment. President Xi Jinping’s energetic engagement with prime executives from Alibaba, BYD, and Tencent underscores efforts to revive confidence within the tech sector after years of regulatory crackdowns.

Regardless of the bullish outlook, buyers should think about potential dangers: First, whereas China has signaled help for personal enterprise, previous crackdowns stay contemporary in investor reminiscence. Second, export controls on superior chips and AI-related know-how may decelerate China’s progress. Third, ongoing tensions with the US and Europe may affect overseas funding flows.

Bottomline: China’s tech resurgence is now not only a policy-driven rebound however a shift fueled by innovation, rising AI competitiveness, and powerful authorities help. With valuations nonetheless under US ranges and institutional flows rising, Chinese language tech shares proceed to current compelling opportunities- although buyers should stay conscious of regulatory and geopolitical dangers.

Development vs. valuation: Is Nvidia value its value?

Sector Rotation Pressures Tech Shares: Because the starting of the yr, tech shares have been among the many largest losers within the S&P 500. With a modest 0.9% decline, the sector lags behind the broader market. Solely Client Discretionary shares have carried out worse at -3.4%. In the meantime, Power, Well being Care, and Communications Providers are the winners, gaining between 5% and 6%.

Nvidia Earnings on Wednesday After Market Shut: Analysts count on EPS development of 61.2% to $0.79 and $38.1 billion in income. Buyers ought to look ahead to any indicators of weakening demand and the way easily the transition to Blackwell chips unfolds, as these may drive the following efficiency leap and development cycle.

Provide Chain and Tariffs as a Danger: Nvidia depends closely on TSMC, which may change into a weak spot if Trump imposes new tariffs. China additionally stays a threat, as commerce conflicts and export restrictions may additional restrict market entry.

Excessive Valuation, however Distinctive Profitability: Nvidia trades at a ahead P/E of 34.2, above trade friends, however its LTM EBIT margin of 62.7% underscores its superior profitability. Nvidia is not only a development inventory—it’s a extremely environment friendly revenue machine.

Third Breakout Try Doable: Nvidia has narrowed the hole to its document excessive to 10%. Since November, the inventory has confronted two failed breakouts at $149 (see chart). The uptrend stays intact, making a 3rd try doable. Help ranges at $100.84 and $90.58 may present a cushion in case of promoting strain.

Bottomline: Nvidia has rapidly recovered from DeepSeek-related losses, however the important thing query stays: What’s subsequent? Wednesday’s earnings report will present not simply an replace on Nvidia, but additionally insights into the place we stand within the AI cycle. With its excessive valuation, potential dangers are in focus. To remain aggressive, Nvidia should diversify its provide chain and reassess its China technique. Buyers are searching for clear solutions.

Supply: eToro, TradingView

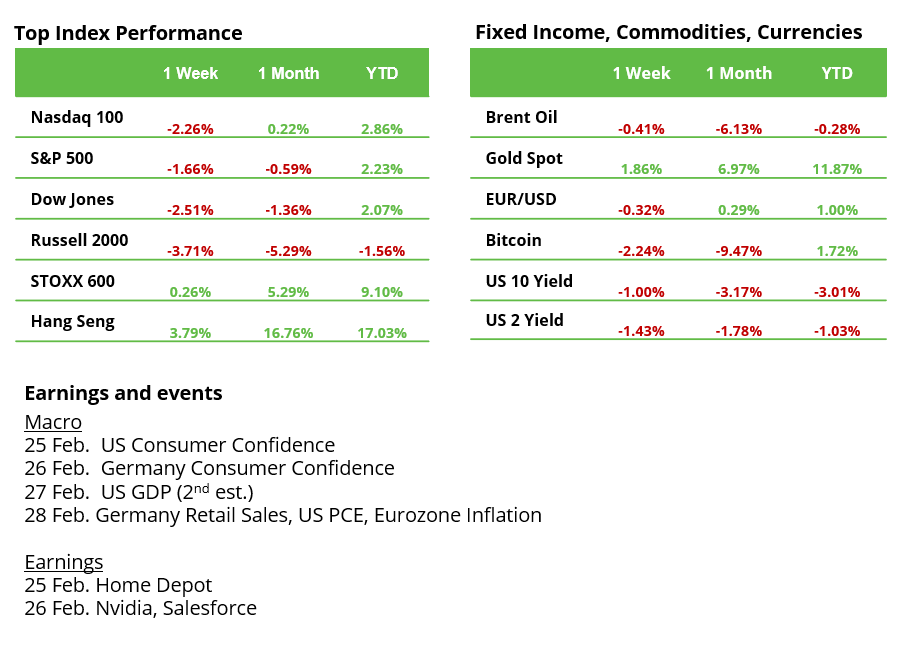

Weekly Efficiency and Calendar

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any explicit recipient’s funding targets or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.