A crypto analyst, Elja on X, predicts that Ethereum (ETH) will attain a staggering $15,000 by 2025 primarily based on technical evaluation. The analyst argues that the present bearish sentiment within the crypto market is “momentary.”

Furthermore, Elja notes that the second most dear coin by market cap follows the same fractal sample that fueled its earlier main worth rally in 2021.

Is Ethereum Prepared To Rip Regardless of The Present Consolidation?

Sharing a display seize of the present ETH worth motion, Elja says most individuals in crypto are “short-sighted” and solely give attention to instant worth actions. Within the analyst’s evaluation, merchants ought to take a look at the long-term to know the general worth sample.

To this point, Ethereum, like Bitcoin (BTC), stays below stress and struggling to interrupt above instant resistance ranges. Trying on the improvement within the every day chart, ETH is again at a crucial assist stage of round $2,200. Notably, the coin is down 20% from January 2024 highs of about $2,700.

ETH is below stress, at the least within the quick to medium time period. As it’s, the coin follows the technical candlestick association seen in Bitcoin.

The altcoin downtrend seems to have been triggered by occasions following the approval of spot Bitcoin ETFs by america Securities and Change Fee (SEC). As an illustration, Bitcoin fell from round $47,000 to under $40,000 this week, weighing down altcoins, together with Ethereum.

On-chain information exhibits that Grayscale Investments has been unloading hundreds of cash behind Grayscale Bitcoin Belief (GBTC). Subsequently, there was a sell-off in Bitcoin and throughout the altcoin scene. The scenario has been made worse for Ethereum following america SEC’s resolution to postpone the approval of spot Ethereum ETFs.

Whereas these developments have negatively impacted sentiment, Elja believes they won’t derail Ethereum’s long-term development trajectory. Particularly, the analyst notes that ETH is consolidating, a “wholesome signal.”

ETH To $15,000: Will Basic And Technical Components Assist?

Elja added that when crypto costs consolidate, it might counsel that whales are accumulating their place. As soon as this ends, ETH costs might development greater. From the analyst’s chart, the coin will break above $5,000 to $15,000 within the coming periods.

When making this prediction, the analyst in contrast the Ethereum worth motion to the fractal sample that propelled ETH from round $200 to $4,800 in 15 months from 2019 to 2021. Extrapolating from previous worth motion, Elja believes Ethereum is on the same path. Based mostly on evaluation, the coin will probably break above November 2021 peaks.

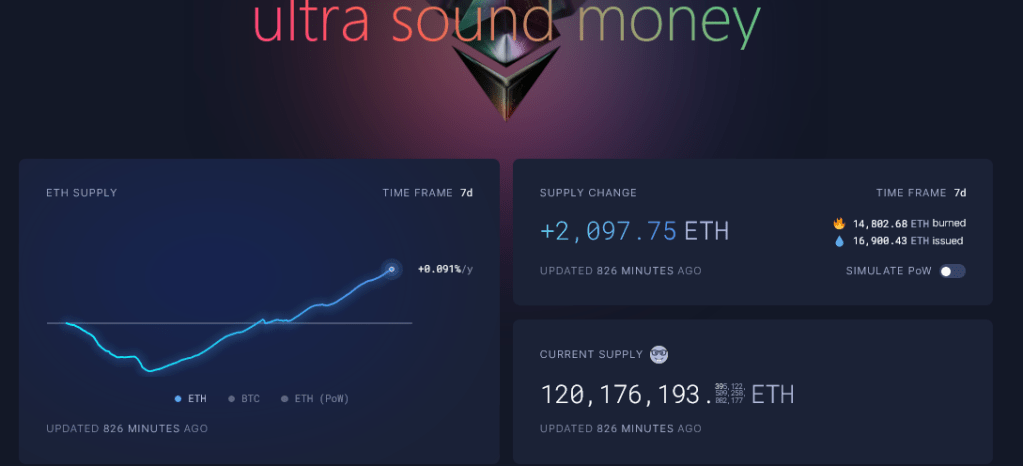

Past technical elements, ETH supporters cite the lowering issuance fee. In keeping with Ultrasound Cash information, the community has been burning hundreds of ETH, lowering provide. Moreover, Larry Fink, the CEO of BlackRock, believes Ethereum would be the selection community for tokenizing real-world property (RWAs) within the years forward.

Characteristic picture from Canva, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site totally at your individual danger.